Car insurance average cost: It’s a question on everyone’s mind, especially when you’re trying to budget for your ride. Whether you’re a seasoned driver or just getting your license, understanding how much car insurance costs is crucial. It’s like figuring out the price of your favorite pizza, but instead of pepperoni and cheese, you’re talking about liability, collision, and comprehensive coverage. And just like with pizza, there are different toppings that can make the price go up or down, like your driving record, the type of car you drive, and even where you live.

This guide will break down the key factors that influence car insurance premiums, explore average costs across the US, and give you some insider tips on how to save money. Think of it as a cheat sheet for navigating the world of car insurance. Buckle up, because we’re about to dive into the nitty-gritty.

Understanding Car Insurance Costs

Car insurance is a necessity for most drivers, but figuring out how much you’ll pay can feel like a mystery. Don’t worry, we’re here to break down the factors that influence your premiums and help you understand the different types of coverage.

Factors Affecting Car Insurance Premiums

Understanding what factors influence your car insurance premiums can help you make informed decisions to potentially lower your costs. Here are some of the key factors:

- Your Driving History: Your driving record is a major factor in determining your insurance premiums. A clean driving record with no accidents or traffic violations will generally result in lower rates. On the other hand, accidents, speeding tickets, or DUI convictions can significantly increase your premiums.

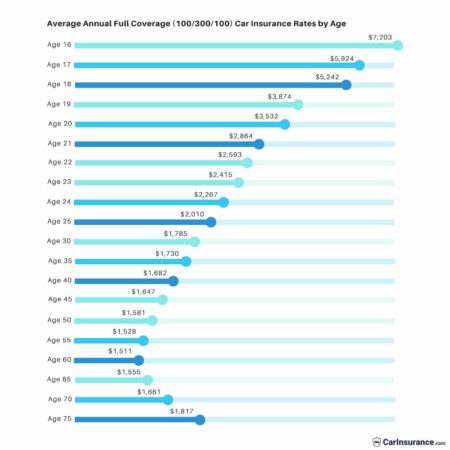

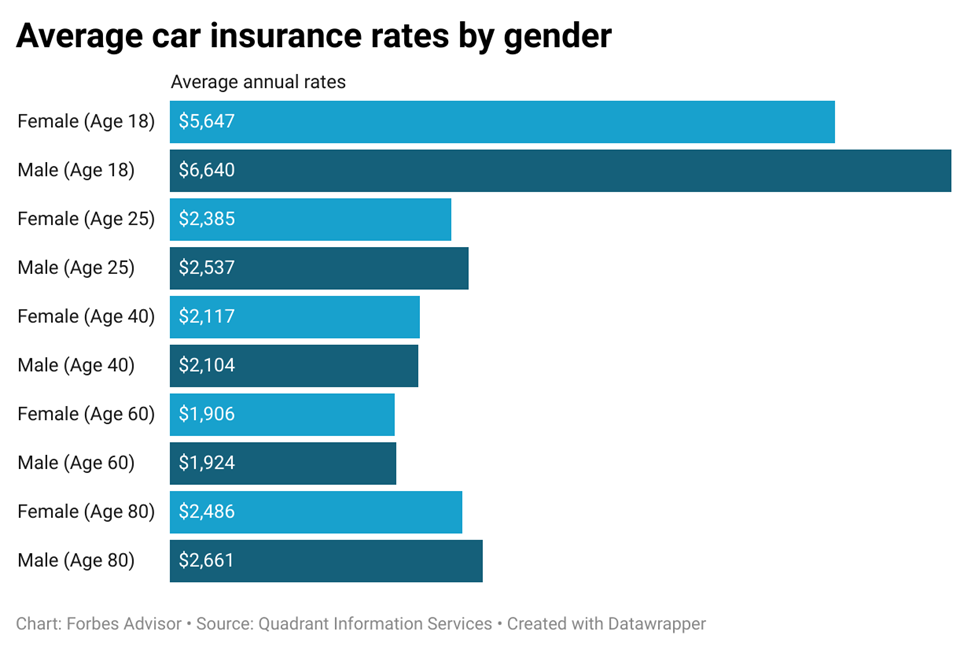

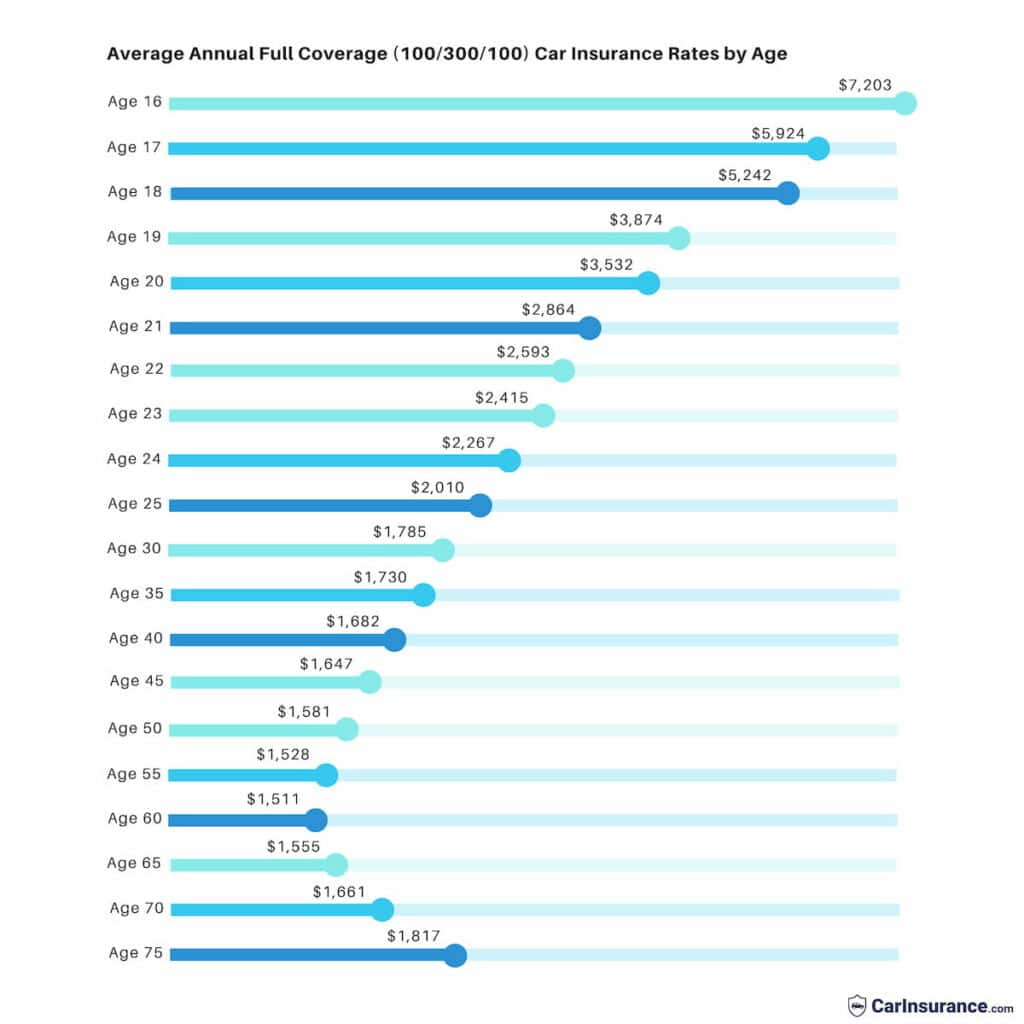

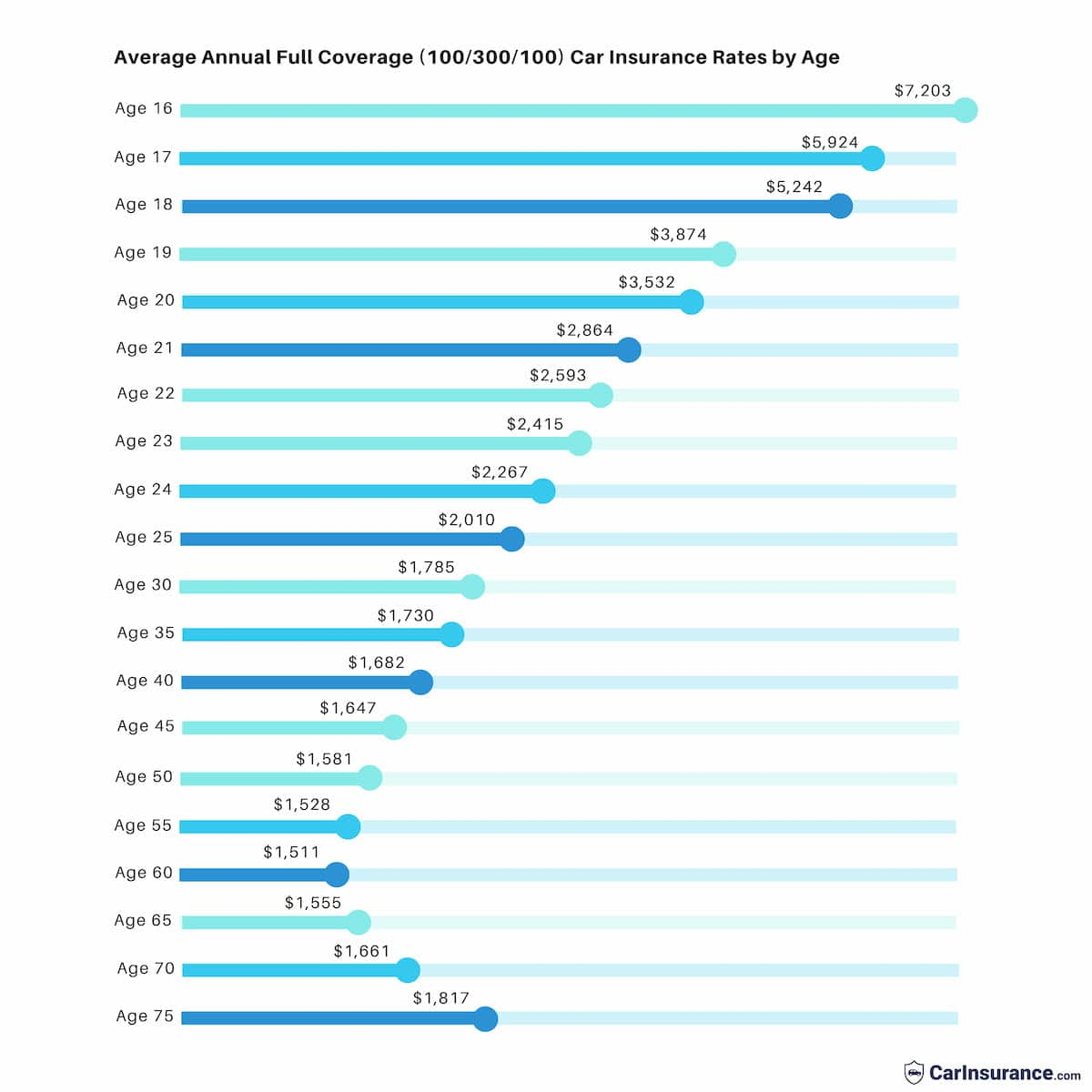

- Your Age: Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This higher risk translates to higher insurance premiums. As you gain experience and age, your premiums typically decrease.

- Your Location: The area where you live can significantly impact your car insurance costs. Urban areas with higher population density and traffic volume tend to have higher rates due to increased risk of accidents.

- Your Vehicle: The type of vehicle you drive plays a crucial role in determining your premiums. Luxury cars, high-performance vehicles, and newer models generally have higher insurance costs due to their higher repair and replacement expenses.

- Your Credit Score: In many states, insurance companies use your credit score as a factor in determining your premiums. A good credit score can help you qualify for lower rates.

Types of Car Insurance Coverage

There are several types of car insurance coverage available, and understanding the differences is essential for making informed decisions about your insurance needs. Here are three common types:

- Liability Coverage: This type of coverage protects you financially if you cause an accident that injures someone or damages their property. Liability coverage is usually required by law, and it typically includes two types:

- Bodily Injury Liability: Covers medical expenses, lost wages, and other damages for injuries caused to others in an accident.

- Property Damage Liability: Covers damage to other people’s property, such as their vehicle or belongings, if you are at fault in an accident.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects you against damage to your vehicle from non-collision events, such as theft, vandalism, fire, or natural disasters.

Average Car Insurance Costs Across the US

The cost of car insurance varies significantly across the United States, influenced by a range of factors like location, driving record, vehicle type, and more. Understanding these variations can help you make informed decisions about your insurance needs and potentially save money.

Average Car Insurance Premiums by State

The average annual car insurance premium across the US can vary significantly depending on the state you reside in. Here’s a table showcasing the average, minimum, and maximum annual premiums by state, providing a snapshot of the cost landscape:

| State | Average Premium | Minimum Premium | Maximum Premium |

|---|---|---|---|

| Alabama | $1,472 | $500 | $3,000 |

| Alaska | $2,128 | $700 | $4,500 |

| Arizona | $1,548 | $550 | $3,200 |

| Arkansas | $1,384 | $450 | $2,800 |

| California | $2,088 | $750 | $4,200 |

| Colorado | $1,624 | $600 | $3,400 |

| Connecticut | $1,872 | $650 | $3,800 |

| Delaware | $1,512 | $525 | $3,100 |

| Florida | $2,352 | $800 | $4,800 |

| Georgia | $1,440 | $475 | $2,900 |

| Hawaii | $2,520 | $850 | $5,200 |

| Idaho | $1,320 | $425 | $2,700 |

| Illinois | $1,728 | $625 | $3,600 |

| Indiana | $1,488 | $510 | $3,050 |

| Iowa | $1,296 | $400 | $2,600 |

| Kansas | $1,344 | $450 | $2,850 |

| Kentucky | $1,560 | $550 | $3,250 |

| Louisiana | $1,776 | $625 | $3,700 |

| Maine | $1,680 | $600 | $3,500 |

| Maryland | $1,920 | $675 | $4,000 |

| Massachusetts | $2,016 | $700 | $4,250 |

| Michigan | $1,848 | $650 | $3,850 |

| Minnesota | $1,536 | $525 | $3,150 |

| Mississippi | $1,392 | $460 | $2,950 |

| Missouri | $1,408 | $475 | $2,950 |

| Montana | $1,248 | $400 | $2,500 |

| Nebraska | $1,312 | $425 | $2,750 |

| Nevada | $1,824 | $650 | $3,800 |

| New Hampshire | $1,584 | $550 | $3,300 |

| New Jersey | $2,112 | $750 | $4,400 |

| New Mexico | $1,608 | $575 | $3,350 |

| New York | $2,208 | $775 | $4,600 |

| North Carolina | $1,424 | $475 | $2,900 |

| North Dakota | $1,216 | $375 | $2,400 |

| Ohio | $1,656 | $575 | $3,450 |

| Oklahoma | $1,368 | $450 | $2,850 |

| Oregon | $1,740 | $600 | $3,600 |

| Pennsylvania | $1,704 | $600 | $3,550 |

| Rhode Island | $1,896 | $675 | $3,900 |

| South Carolina | $1,500 | $525 | $3,100 |

| South Dakota | $1,280 | $400 | $2,650 |

| Tennessee | $1,464 | $500 | $3,000 |

| Texas | $1,632 | $575 | $3,400 |

| Utah | $1,496 | $510 | $3,050 |

| Vermont | $1,760 | $625 | $3,650 |

| Virginia | $1,696 | $600 | $3,550 |

| Washington | $1,904 | $675 | $3,950 |

| West Virginia | $1,432 | $480 | $2,950 |

| Wisconsin | $1,576 | $550 | $3,250 |

| Wyoming | $1,264 | $400 | $2,550 |

Note: These figures are estimates based on industry data and may vary depending on individual factors.

Average Car Insurance Costs for Different Vehicle Types

The type of vehicle you drive also plays a role in determining your insurance costs. Generally, higher-value vehicles and those with higher performance capabilities tend to have higher premiums due to increased repair costs and potential risk.

For example, a luxury sedan like a BMW 5 Series will likely have a higher insurance premium compared to a basic sedan like a Honda Civic.

Here’s a general overview of average insurance costs for different vehicle types:

- Sedans: Typically, sedans have moderate insurance costs, falling somewhere in the middle range.

- SUVs: SUVs tend to have slightly higher premiums compared to sedans, due to their larger size and potential for higher repair costs.

- Trucks: Trucks, especially heavy-duty trucks, often have the highest insurance premiums due to their size, power, and potential for higher repair costs.

- Sports Cars: Sports cars, known for their performance and speed, often have the highest insurance premiums due to their increased risk factors.

Impact of Urban vs. Rural Locations on Average Costs

The location where you live can significantly impact your car insurance costs. Urban areas generally have higher insurance premiums compared to rural areas. This difference is mainly due to factors like:

- Higher Risk of Accidents: Urban areas have denser populations and higher traffic volume, leading to a greater likelihood of accidents.

- Increased Theft Rates: Urban areas often experience higher rates of vehicle theft, which can lead to increased insurance costs.

- Higher Repair Costs: Urban areas typically have higher repair costs for vehicles due to factors like higher labor costs and the availability of specialized repair facilities.

Factors Affecting Individual Premiums

While the average car insurance costs can provide a general idea, your individual premiums are influenced by a variety of factors. These factors are unique to you and your driving habits, and they can significantly impact the amount you pay for car insurance.

Driving History

Your driving history is a major factor in determining your car insurance premiums. Insurance companies assess your risk based on your past driving behavior, specifically looking at accidents and traffic violations.

- Accidents: If you’ve been involved in accidents, especially those where you were at fault, your premiums will likely increase. The severity of the accident and the number of claims you’ve filed will also affect the increase. For example, a minor fender bender might lead to a smaller increase compared to a serious accident with injuries.

- Traffic Violations: Traffic violations, such as speeding tickets, reckless driving, or driving under the influence (DUI), can also raise your premiums. These violations indicate a higher risk of future accidents, making you a less desirable customer for insurance companies.

Credit Score

It might seem surprising, but your credit score can impact your car insurance rates. Insurance companies use credit scores as a proxy for risk assessment, assuming that individuals with good credit are more financially responsible and less likely to file claims.

- Credit Score and Risk: Insurance companies have found a correlation between credit score and driving behavior. People with lower credit scores tend to be associated with higher claims frequency and severity. This is not always the case, but it is a statistical trend that insurance companies use to assess risk.

- Credit Score Impact: If you have a lower credit score, you might face higher car insurance premiums. However, it’s important to note that this is not the only factor considered. Other factors, such as your driving history, age, and vehicle type, also play a role.

Safety Features and Technology

Modern vehicles are equipped with advanced safety features and technology that can help prevent accidents and reduce their severity. Insurance companies recognize this and often offer discounts to drivers who have these features in their cars.

- Safety Features: Features like anti-lock brakes (ABS), electronic stability control (ESC), airbags, and daytime running lights can reduce the risk of accidents and injuries. Insurance companies often provide discounts for vehicles equipped with these safety features.

- Advanced Technology: Some newer cars have advanced technology, such as lane departure warning, blind spot monitoring, and adaptive cruise control. These technologies can help drivers avoid accidents and reduce their severity. Insurance companies are increasingly offering discounts for vehicles with these features.

Saving Money on Car Insurance

Car insurance is a necessity, but it can be a significant expense. Luckily, there are several ways to save money on your premiums. From exploring discounts to improving your driving habits, you can make a real difference in your wallet.

Discounts

Many car insurance companies offer discounts to policyholders. These discounts can be based on a variety of factors, such as your driving record, the type of car you drive, and even your occupation.

Here are some common car insurance discounts:

- Good student discount: If you’re a good student with a high GPA, you may be eligible for a discount.

- Safe driver discount: This is a common discount for drivers with a clean driving record.

- Multi-car discount: If you insure multiple vehicles with the same company, you can often get a discount on each policy.

- Multi-policy discount: If you bundle your car insurance with other types of insurance, such as homeowners or renters insurance, you can save money on your premiums.

- Loyalty discount: Some insurance companies offer discounts to customers who have been with them for a certain amount of time.

- Anti-theft device discount: If your car has anti-theft devices, such as an alarm system or GPS tracking, you may be eligible for a discount.

Bundling

Bundling your car insurance with other types of insurance, like homeowners or renters insurance, can save you money. This is because insurance companies often offer discounts to customers who bundle their policies.

Negotiating

Don’t be afraid to negotiate your car insurance premiums. Many insurance companies are willing to work with you to find a rate that fits your budget. Be prepared to discuss your driving record, your car’s safety features, and any other factors that might affect your premium.

Comparing Insurance Providers, Car insurance average cost

It’s essential to compare quotes from multiple insurance providers before you choose a policy. This will help you find the best rate for your needs.

Here are some tips for comparing insurance providers:

- Use an online comparison tool: There are many websites that allow you to compare quotes from different insurance companies.

- Contact insurance providers directly: You can also get quotes by contacting insurance companies directly. Be sure to ask about any discounts you may be eligible for.

- Read reviews: Before you choose an insurance provider, read reviews from other customers. This will give you an idea of the company’s reputation and customer service.

Improving Driving Habits

Improving your driving habits can also help you save money on car insurance. By driving safely and avoiding accidents, you can reduce your risk and lower your premiums.

Here are some tips for improving your driving habits:

- Obey the speed limit: Speeding is one of the leading causes of accidents. By obeying the speed limit, you can reduce your risk of getting into an accident.

- Avoid distractions: Distracted driving is another major cause of accidents. Put away your phone and avoid other distractions while you’re driving.

- Be aware of your surroundings: Pay attention to your surroundings and be prepared to react to unexpected situations.

- Maintain your car: Regular car maintenance can help prevent accidents. Make sure your car is in good working order and that all of its safety features are functioning properly.

Understanding Insurance Coverage Options

Choosing the right car insurance coverage is like picking the right outfit for a big event: you want to be protected but not overdressed. Different types of coverage offer different levels of protection, and understanding them is key to finding the right fit for your needs and budget.

Liability Coverage

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It’s typically the most important type of coverage, as it can help cover the costs of medical bills, lost wages, and property repairs for the other party involved.

Liability coverage is divided into two parts: bodily injury liability and property damage liability.

- Bodily injury liability covers medical expenses, lost wages, and pain and suffering for injuries caused to others in an accident.

- Property damage liability covers damages to another person’s vehicle or property.

The amount of liability coverage you need depends on your individual circumstances and the laws in your state. Most states have minimum liability coverage requirements, but you may want to consider purchasing higher limits to protect yourself from potentially devastating financial losses.

Ultimate Conclusion

Navigating the world of car insurance can feel like trying to decipher a secret code, but it doesn’t have to be a headache. By understanding the factors that affect your premiums, comparing different insurance providers, and implementing some smart strategies, you can find the best coverage at a price that fits your budget. So, go ahead and do your research, ask questions, and don’t be afraid to negotiate. Remember, you’re in the driver’s seat when it comes to your car insurance.

User Queries: Car Insurance Average Cost

What is the cheapest car insurance?

The cheapest car insurance depends on individual factors like your driving history, location, and the car you drive. It’s best to compare quotes from different insurers to find the most affordable option for you.

How often should I review my car insurance?

It’s a good idea to review your car insurance at least once a year, or even more frequently if your circumstances change, like getting a new car or moving to a different location.

What is the difference between liability and collision coverage?

Liability coverage protects you financially if you cause an accident, while collision coverage covers damage to your own vehicle in an accident, regardless of who is at fault.