- Understanding Cash App Stock Trading

- Setting Up Your Account for Stock Trading

- Navigating the Cash App Trading Interface

- Placing a Stock Order: How To Sell Stock On Cash App

- Cash App Stock Trading Fees and Costs

- Security and Risk Management

- Tax Implications of Stock Trading

- Customer Support and Resources

- Last Word

- FAQ Compilation

How to sell stock on Cash App is a question many investors are asking, and for good reason! Cash App has become a popular platform for buying and selling stocks, offering a user-friendly interface and a range of features that make investing accessible. This guide will walk you through the process of selling your stocks on Cash App, from setting up your account to navigating the trading platform and understanding the associated fees and risks.

Whether you’re a seasoned investor or just starting out, this guide will provide you with the information you need to confidently sell your stocks on Cash App. We’ll cover everything from the basics of stock trading to advanced strategies for managing your portfolio, ensuring you have the knowledge and tools to make informed decisions.

Understanding Cash App Stock Trading

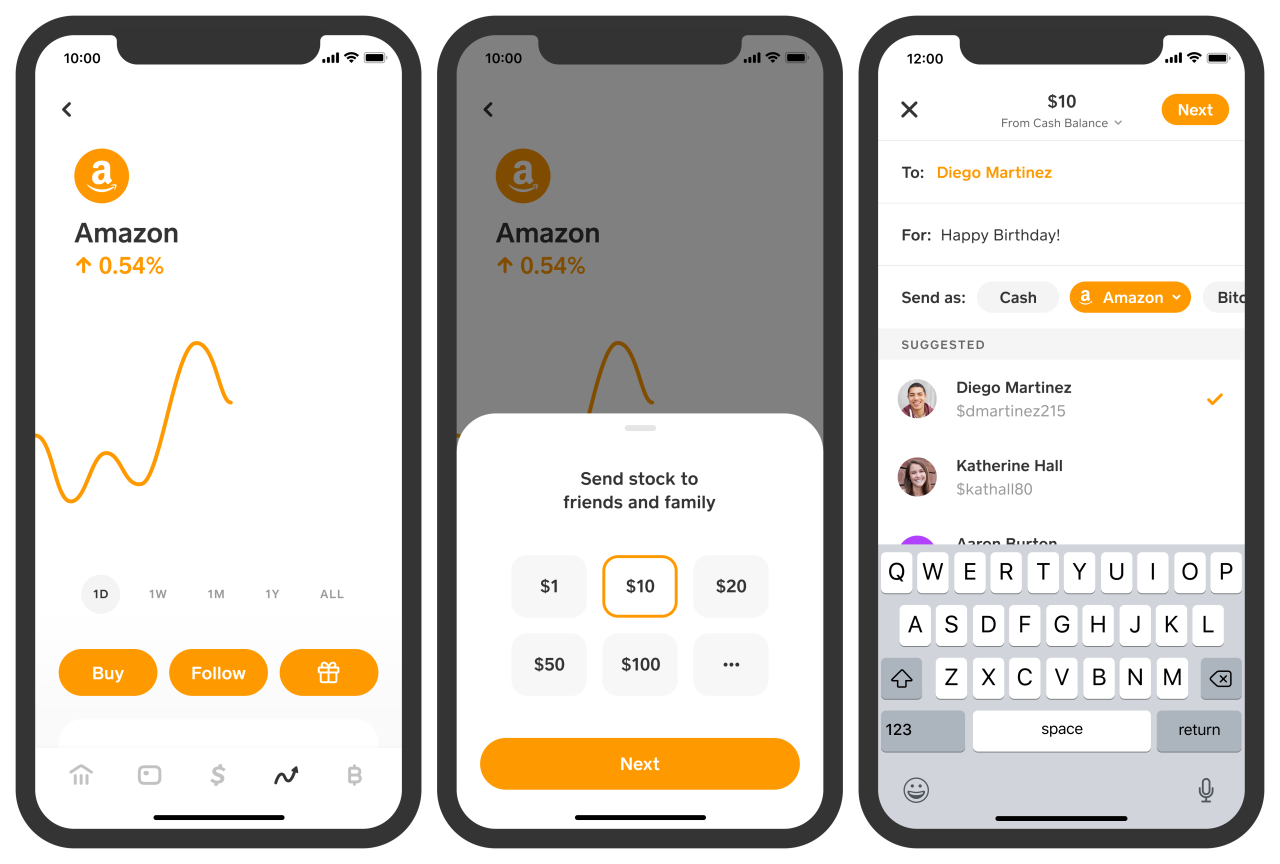

Cash App, known for its peer-to-peer payment capabilities, has expanded its offerings to include stock trading. This feature allows users to buy and sell fractional shares of publicly traded companies directly through the app. Let’s delve into the details of Cash App’s stock trading platform.

Buying and Selling Stocks on Cash App

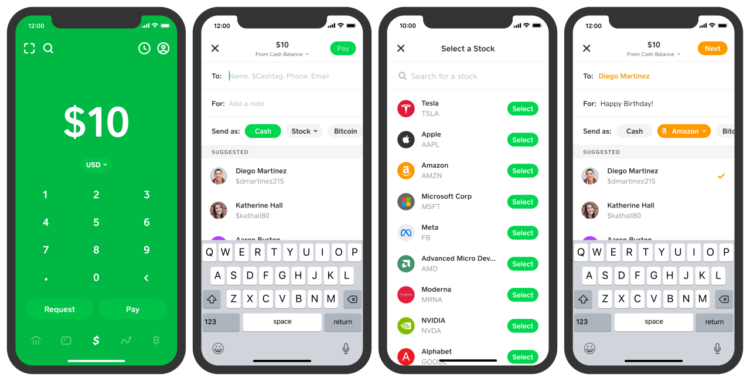

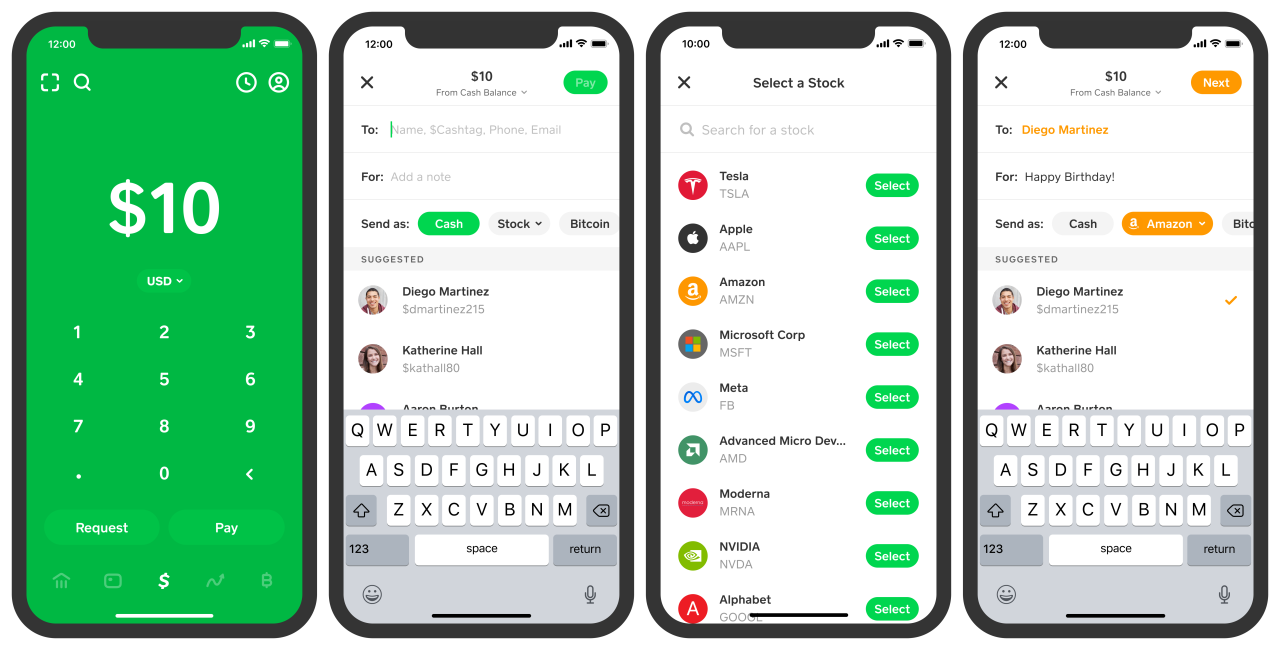

Cash App’s stock trading platform is designed for ease of use. Buying and selling stocks on Cash App involves a straightforward process:

- Search for a Stock: You can search for a specific stock using its ticker symbol or company name. For example, you can search for “AAPL” to find Apple Inc. or “TSLA” to find Tesla, Inc.

- Place an Order: Once you’ve found the stock you want, you can place an order by entering the number of shares you want to buy or sell and the price you’re willing to pay or receive.

- Confirm and Submit: Review your order details, including the total cost, and confirm the purchase or sale.

Features and Functionalities

Cash App’s stock trading platform offers several features:

- Fractional Shares: You can buy fractions of shares, allowing you to invest in companies even if you don’t have a lot of money to invest.

- Real-time Quotes: The app provides real-time stock quotes, giving you up-to-date information on stock prices.

- Investment Insights: Cash App offers investment insights and news updates to help you make informed trading decisions.

- Portfolio Tracking: You can track your portfolio performance and see how your investments are doing over time.

- Limit Orders: This allows you to set a specific price you’re willing to buy or sell a stock, helping you manage risk.

- Market Orders: This allows you to buy or sell a stock at the current market price.

Comparison with Robinhood

Cash App and Robinhood are both popular platforms for stock trading, but they have some key differences:

- Fees: Both Cash App and Robinhood offer commission-free stock trading, but Cash App charges a fee for instant deposits, while Robinhood does not.

- Investment Options: Cash App offers a more limited selection of investment options compared to Robinhood, which includes options trading, cryptocurrencies, and more.

- Research Tools: Robinhood provides more comprehensive research tools and analysis, while Cash App focuses on a simpler and more streamlined trading experience.

Setting Up Your Account for Stock Trading

To start buying and selling stocks on Cash App, you need to enable stock trading within your account. This involves a few simple steps, and Cash App provides a user-friendly interface to make the process straightforward.

Enabling Stock Trading

Enabling stock trading on Cash App is a simple process that involves navigating to the trading section within the app. Here’s how:

- Open the Cash App: Launch the Cash App on your mobile device.

- Tap on the “Investing” tab: Look for the tab labeled “Investing” at the bottom of your screen. This will open the stock trading section.

- Verify your identity: If you haven’t already, Cash App will prompt you to verify your identity by providing your full name, date of birth, and Social Security number. This step is essential for compliance with regulations and helps ensure the security of your account.

- Agree to the terms and conditions: After verifying your identity, Cash App will present you with its terms and conditions for stock trading. Carefully review these terms and agree to them to proceed.

- Start trading: Once you’ve completed these steps, you’ll be able to start trading stocks on Cash App.

Securing Your Account

Protecting your Cash App account from unauthorized access is crucial, especially when you’re trading stocks.

- Enable two-factor authentication: Two-factor authentication (2FA) adds an extra layer of security to your account. When you log in, you’ll receive a code on your phone, which you’ll need to enter along with your password. This prevents anyone else from accessing your account even if they know your password.

- Use a strong password: Choose a password that’s at least 12 characters long and includes a mix of uppercase and lowercase letters, numbers, and symbols. Avoid using easily guessable information like your name or birthday.

- Avoid public Wi-Fi for sensitive transactions: When making trades or accessing your account, use a secure Wi-Fi network or your mobile data connection. Public Wi-Fi networks can be vulnerable to security breaches, putting your account at risk.

Requirements for Opening a Cash App Trading Account

To open a Cash App trading account, you need to meet certain requirements.

- Be at least 18 years old: You must be of legal age to trade stocks in the United States.

- Have a valid Social Security number: You’ll need to provide your Social Security number for identity verification purposes.

- Have a U.S. bank account: You’ll need a U.S. bank account to fund your Cash App trading account and withdraw your earnings.

- Agree to Cash App’s terms and conditions: You must agree to Cash App’s terms and conditions for stock trading, which Artikel the rules and responsibilities involved.

Navigating the Cash App Trading Interface

The Cash App trading interface is designed to be user-friendly, allowing you to buy and sell stocks with ease. Once you’ve set up your account for stock trading, you can navigate the interface to find and trade the stocks you’re interested in.

Searching for Stocks

You can search for stocks on Cash App using the search bar located at the top of the trading screen. Simply type in the ticker symbol or the company name of the stock you want to find. For example, to find Apple stock, you would type in “AAPL” or “Apple.”

Types of Stock Orders

Cash App offers three main types of stock orders:

- Market Orders: These orders are executed at the best available price at the moment you place the order. Market orders are typically used for quick trades, but they may not always get you the exact price you want.

- Limit Orders: These orders allow you to specify the maximum price you’re willing to pay for a stock (buy order) or the minimum price you’re willing to sell a stock for (sell order). Limit orders can help you get a better price than market orders, but there’s no guarantee your order will be executed.

- Stop-Loss Orders: These orders are used to limit your potential losses on a stock trade. A stop-loss order automatically sells your stock if the price falls below a certain level that you set. Stop-loss orders can help protect your profits or prevent further losses if the stock price drops significantly.

Information Displayed on the Stock Trading Screen

When you view a stock on Cash App, the trading screen will display a variety of information, including:

- Stock Symbol: The unique identifier for the stock, such as “AAPL” for Apple.

- Current Price: The price at which the stock is currently being traded.

- Day Change: The percentage change in the stock’s price compared to the previous day’s closing price.

- Volume: The number of shares traded in the stock during the current trading day.

- Chart: A visual representation of the stock’s price history, typically displayed as a line graph or candlestick chart.

- Buy/Sell Buttons: Buttons that allow you to place buy or sell orders for the stock.

Placing a Stock Order: How To Sell Stock On Cash App

Once you’ve set up your Cash App account for stock trading, you’re ready to start placing orders. You can buy or sell stocks directly through the app’s intuitive interface. Let’s delve into the process and explore the different order types available to you.

Placing a Buy or Sell Order

To place a buy or sell order, you’ll need to know the ticker symbol of the stock you want to trade and the quantity you wish to purchase or sell. The ticker symbol is a unique abbreviation for a particular company’s stock, such as “AAPL” for Apple Inc.

To place a buy or sell order, navigate to the “Investing” tab within the Cash App, search for the ticker symbol of the stock you’re interested in, and then tap on the stock to view its details.

Once you’re on the stock’s detail page, you’ll see a “Buy” or “Sell” button. Tap on the button to place your order. You’ll be prompted to enter the quantity of shares you want to buy or sell. You can also set the price you’re willing to pay or sell for.

Setting the Order Price and Quantity

When placing an order, you have the option to set the price you want to pay or sell for. You can choose to buy or sell at the current market price, which is the price the stock is trading at right now, or you can set a limit order. A limit order allows you to specify the maximum price you’re willing to pay for a stock or the minimum price you’re willing to sell it for.

If you’re placing a buy order, you’re setting a limit price, and if you’re placing a sell order, you’re setting a limit price.

The quantity of shares you want to buy or sell is also a key factor in your order. You can enter the number of shares you want to trade directly into the app.

Different Order Types

Cash App offers several order types to suit your trading needs. Understanding these types can help you execute your trades effectively.

Here are some of the common order types:

- Market Order: A market order is an order to buy or sell a stock at the best available price at the time the order is placed. This is the default order type and is typically used when you want to execute your trade quickly.

- Limit Order: A limit order is an order to buy or sell a stock at a specific price or better. This type of order is used when you want to ensure you don’t pay more than a certain price for a stock or sell it for less than a certain price.

- Stop-Loss Order: A stop-loss order is an order to sell a stock if its price falls below a certain level. This order type helps to limit your losses on a stock if its price starts to decline.

- Stop-Limit Order: A stop-limit order is a combination of a stop order and a limit order. This type of order will trigger a limit order when the stock price reaches a certain level. This order type is often used to protect your profits or limit your losses.

Cash App Stock Trading Fees and Costs

Cash App is known for its user-friendly interface and accessibility, but understanding its fees and costs is crucial for making informed investment decisions. While it offers commission-free trades, there are other costs to consider, such as inactivity fees and fractional share pricing.

Commission-Free Trades

Cash App doesn’t charge commissions for buying or selling stocks. This means you won’t pay a percentage of your trade value as a fee. This can be a significant advantage compared to traditional brokerage firms that often charge commissions, especially for smaller trades.

Fractional Shares

Fractional shares allow you to buy portions of a stock, even if you don’t have enough money to buy a whole share. Cash App charges a small fee for fractional shares, which is typically a few cents per share. This can be beneficial for investors with limited capital who want to diversify their portfolios.

Inactivity Fees

Cash App charges an inactivity fee of $1 per month if you don’t buy or sell any stocks for 12 months. This fee is applied to your Cash App Investing account and can be avoided by engaging in at least one trade per year.

Comparison with Other Platforms

Cash App’s fee structure is generally competitive with other commission-free trading platforms. While some platforms may offer slightly lower fractional share fees or have no inactivity fees, Cash App’s simplicity and accessibility make it a popular choice for many investors.

Security and Risk Management

Cash App takes security seriously, employing robust measures to protect your investments and personal information. While stock trading offers potential rewards, it also comes with inherent risks. Understanding these risks and implementing effective risk management strategies is crucial for maximizing your returns and minimizing potential losses.

Security Measures

Cash App implements various security measures to protect your account and transactions:

- Two-Factor Authentication (2FA): This adds an extra layer of security by requiring a unique code from your phone or email in addition to your password when logging in.

- Biometric Authentication: Cash App allows you to use fingerprint or facial recognition to access your account, further enhancing security.

- Encryption: All data transmitted between your device and Cash App servers is encrypted, protecting your sensitive information from unauthorized access.

- Fraud Detection: Cash App employs sophisticated algorithms to monitor transactions and detect potential fraudulent activity, alerting you to suspicious behavior.

While these measures are in place, it’s essential to take personal responsibility for protecting your account:

- Strong Passwords: Use strong, unique passwords for your Cash App account and avoid sharing them with anyone.

- Regular Password Updates: Change your password periodically to minimize the risk of unauthorized access.

- Beware of Phishing Scams: Be cautious of emails or messages requesting personal information or asking you to click on suspicious links.

Risk Management Strategies, How to sell stock on cash app

Investing in stocks carries inherent risks, including:

- Market Volatility: Stock prices can fluctuate significantly due to various factors, such as economic conditions, company performance, and investor sentiment. This volatility can lead to losses if you sell your stocks at a lower price than you purchased them.

- Company-Specific Risks: Each company faces unique risks, such as competition, regulatory changes, and product failures. These risks can negatively impact the stock price and lead to losses.

- Counterparty Risk: There’s a risk that the broker-dealer facilitating your trades might default or become insolvent, potentially resulting in the loss of your investments.

Here are some strategies to mitigate these risks:

- Diversification: Invest in a range of different stocks across various sectors and industries to reduce the impact of any single investment’s performance on your overall portfolio.

- Long-Term Perspective: Avoid short-term trading and focus on long-term investments. This helps to weather market fluctuations and allows you to benefit from the potential for growth over time.

- Dollar-Cost Averaging: Invest a fixed amount of money at regular intervals, regardless of the stock price. This strategy helps to average out your purchase price and reduces the impact of market volatility.

- Limit Orders: Use limit orders to specify the maximum price you’re willing to pay for a stock or the minimum price you’re willing to sell it for. This helps to control your potential losses.

- Stop-Loss Orders: Set a stop-loss order to automatically sell your stock if it reaches a predetermined price. This can help to limit your losses if the stock price falls significantly.

Risk Tolerance

Risk tolerance refers to your ability and willingness to accept potential losses in pursuit of higher returns. Your risk tolerance depends on several factors, including your financial situation, investment goals, and time horizon.

- Conservative Investors: Prefer low-risk investments with lower potential returns, such as bonds or low-volatility stocks.

- Moderate Investors: Balance risk and reward, seeking investments with moderate potential returns and a reasonable level of risk.

- Aggressive Investors: Have a higher tolerance for risk and seek investments with potentially higher returns but also higher risk.

It’s crucial to assess your risk tolerance and choose investments that align with your comfort level.

Tax Implications of Stock Trading

You’ll need to report your stock trading activity on your taxes, and it’s important to understand the tax implications to avoid surprises come tax season. This section covers the basics of stock trading taxes, including how to track your transactions and the different types of capital gains taxes.

Capital Gains Taxes

Capital gains taxes are levied on the profit you make when you sell an asset, such as stock, for a higher price than you paid for it. The amount of capital gains tax you owe depends on how long you held the asset and your income level.

- Short-Term Capital Gains: These gains are realized on assets held for less than a year. They are taxed at your ordinary income tax rate, which can be as high as 37%.

- Long-Term Capital Gains: These gains are realized on assets held for more than a year. They are taxed at preferential rates, which are generally lower than your ordinary income tax rate. The long-term capital gains tax rates for 2023 are:

- 0% for taxpayers in the 10% or 12% income tax brackets

- 15% for taxpayers in the 22%, 24%, 32%, and 35% income tax brackets

- 20% for taxpayers in the highest income tax bracket (37%)

Tracking Your Stock Transactions

Keeping accurate records of your stock trades is crucial for tax purposes. You’ll need to track information like the purchase date, purchase price, sale date, and sale price for each transaction. This information will be used to calculate your capital gains or losses.

- Cash App’s Activity Tab: Cash App provides a detailed activity tab that includes all your stock transactions. You can download a statement from this tab, which will include all the necessary information for your tax filings.

- Third-Party Software: You can use third-party software like TurboTax or Mint to track your stock transactions. These programs can automatically import your transaction history from Cash App and other brokerage accounts.

- Spreadsheet: You can create a simple spreadsheet to manually track your stock transactions. This method requires more effort, but it can be a good option for those who prefer to keep their records organized.

Wash Sales

A wash sale occurs when you sell a stock at a loss and then repurchase the same stock (or a substantially similar stock) within 30 days before or after the sale. The IRS disallows the loss deduction on a wash sale, meaning you cannot deduct the loss on your taxes. This rule is designed to prevent investors from artificially creating losses to offset capital gains.

To avoid a wash sale, you should wait at least 31 days before repurchasing the same stock after selling it at a loss.

Customer Support and Resources

While Cash App aims to provide a smooth and user-friendly stock trading experience, you may encounter questions or need assistance. Cash App offers various customer support channels and resources to help you navigate the process effectively.

Customer Support Channels

Cash App provides multiple ways to reach their customer support team.

- In-app support: The easiest way to get help is through the Cash App mobile app. Navigate to the “Support” section, and you’ll find options to contact customer support through various methods.

- Help Center: Cash App has a comprehensive Help Center with articles and FAQs covering a wide range of topics, including stock trading. You can access it directly from the Cash App website or app.

- Social media: Cash App is active on various social media platforms, including Twitter and Facebook. You can reach out to them through their official accounts for general inquiries or assistance.

- Email: For more detailed inquiries, you can send an email to Cash App’s customer support team. You can find their email address on their website or Help Center.

Educational Resources

Cash App provides a variety of educational resources to help you learn about stock trading and make informed decisions.

- Cash App Investing Blog: This blog features articles and insights on various investment topics, including stock market trends, investment strategies, and financial literacy.

- Stock Trading Tutorials: Cash App offers interactive tutorials and guides within the app that walk you through the basics of stock trading, placing orders, and managing your portfolio.

- External Resources: Cash App encourages users to explore additional educational resources from reputable financial institutions, such as the Securities and Exchange Commission (SEC) and FINRA.

Seeking Professional Financial Advice

While Cash App offers resources and tools to help you navigate stock trading, it’s crucial to remember that investing involves risk.

- Consult a financial advisor: If you’re new to investing or have complex financial goals, it’s highly recommended to seek professional financial advice from a certified financial planner (CFP) or other qualified financial advisor.

- Tailored guidance: A financial advisor can help you create a personalized investment plan based on your financial situation, risk tolerance, and long-term goals. They can also provide guidance on asset allocation, diversification, and tax implications.

Last Word

Selling stocks on Cash App can be a straightforward process, but it’s essential to understand the nuances of the platform and the risks involved. By following the steps Artikeld in this guide, you can confidently navigate the trading process and manage your investments effectively. Remember, it’s always a good idea to consult with a financial advisor to personalize your investment strategy and ensure it aligns with your financial goals.

FAQ Compilation

Can I sell fractional shares on Cash App?

Yes, Cash App allows you to sell fractional shares, meaning you can buy and sell portions of a stock rather than buying whole shares. This is a great option for investors who want to diversify their portfolio without investing a large amount of money.

How do I withdraw funds after selling my stocks?

Once you’ve sold your stocks, the proceeds will be credited to your Cash App balance. You can then withdraw these funds to your linked bank account or use them to buy other investments.

What are the tax implications of selling stocks on Cash App?

You’ll need to report your stock sales on your tax return. The tax implications depend on the length of time you held the stock and whether you made a profit or loss. It’s best to consult with a tax professional for personalized advice.

What happens if I sell my stock before it reaches the price I want?

You can set a limit order to sell your stock at a specific price. If the price of the stock doesn’t reach your limit before the order expires, it won’t be executed. You can also use a stop-loss order to sell your stock if it falls below a certain price, which can help mitigate losses.