Consumer law attorneys near me are your legal allies when facing unfair business practices, defective products, or debt collection issues. They stand as your shield, protecting your rights and fighting for your best interests.

Navigating the complex world of consumer law can be daunting, but with the right legal guidance, you can reclaim your power and hold businesses accountable. From understanding your rights to negotiating settlements, a skilled consumer law attorney can empower you to achieve a favorable outcome.

Understanding Consumer Law: Consumer Law Attorneys Near Me

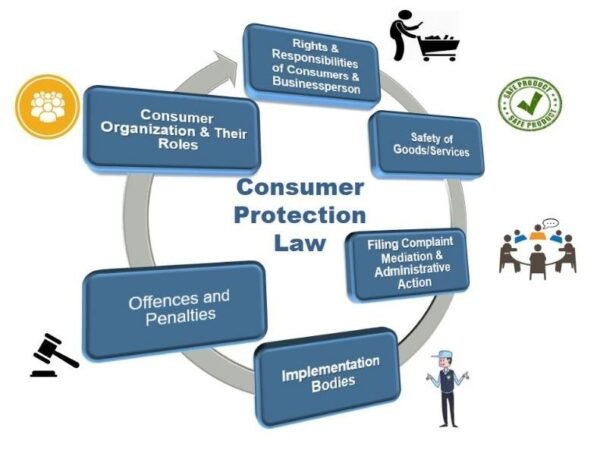

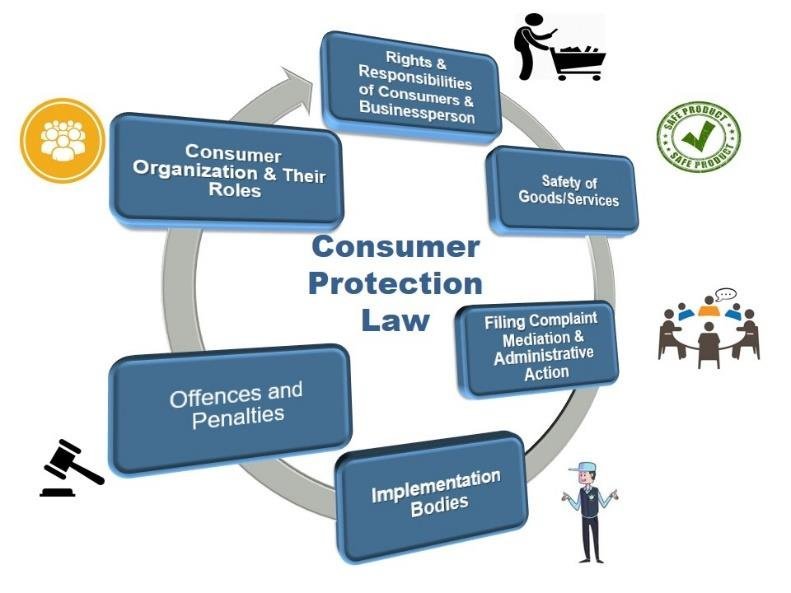

Consumer law is a complex and ever-evolving area of law that aims to protect consumers from unfair or deceptive business practices. It establishes a framework of rights and responsibilities that govern the interactions between consumers and businesses.

Core Principles of Consumer Law

The core principles of consumer law are designed to ensure fairness and transparency in the marketplace. These principles include:

- Protection from Unfair or Deceptive Practices: Consumer law prohibits businesses from engaging in deceptive advertising, false claims, or other unfair practices that mislead consumers. For example, a business cannot advertise a product as having certain features or benefits if it does not actually possess those features.

- Right to Information: Consumers have the right to receive accurate and complete information about products and services before making a purchase. This includes information about pricing, warranties, and potential risks.

- Right to Safety: Consumer law requires businesses to produce and sell safe products. This includes ensuring that products meet safety standards and are free from defects that could cause harm.

- Right to Remedy: Consumers have the right to seek redress for defective products or services, or for unfair or deceptive business practices. This may include a refund, replacement, or other forms of compensation.

Types of Consumer Protection Laws

Consumer protection laws encompass a wide range of areas, including:

- Product Safety: These laws regulate the safety of consumer products, setting standards for design, manufacturing, and labeling. The Consumer Product Safety Commission (CPSC) is responsible for enforcing product safety laws in the United States.

- Unfair Business Practices: These laws prohibit businesses from engaging in unfair or deceptive acts or practices that harm consumers. For example, laws against bait-and-switch advertising or telemarketing fraud fall under this category.

- Debt Collection: These laws regulate the practices of debt collectors and protect consumers from abusive or harassing collection tactics. The Fair Debt Collection Practices Act (FDCPA) is a key federal law that governs debt collection.

- Credit Reporting: These laws protect consumers’ credit information and ensure that credit reporting agencies maintain accurate and up-to-date records. The Fair Credit Reporting Act (FCRA) is a federal law that governs credit reporting.

- Privacy: These laws protect consumers’ personal information and limit how businesses can collect, use, and disclose that information. For example, the California Consumer Privacy Act (CCPA) provides consumers with certain rights regarding their personal data.

Examples of Common Consumer Rights

Consumers have a variety of rights under consumer protection laws. Some common examples include:

- Right to Cancel Contracts: Consumers often have the right to cancel certain contracts, such as door-to-door sales or contracts for home improvement services, within a specified period of time.

- Right to a Refund: Consumers have the right to a refund for defective products or services, or for products or services that do not meet the terms of the contract.

- Right to File a Complaint: Consumers have the right to file a complaint with government agencies or consumer protection organizations if they believe their rights have been violated.

- Right to Negotiate: Consumers have the right to negotiate with businesses over the terms of a contract or to dispute a charge.

Enforcement of Consumer Rights

Consumer rights are enforced through a combination of government agencies, consumer protection organizations, and private lawsuits.

- Government Agencies: Agencies such as the Federal Trade Commission (FTC), the Consumer Financial Protection Bureau (CFPB), and the Department of Justice (DOJ) investigate and prosecute violations of consumer protection laws.

- Consumer Protection Organizations: Organizations such as the Better Business Bureau (BBB) and the National Consumer League (NCL) provide information and resources to consumers and advocate for their rights.

- Private Lawsuits: Consumers can file private lawsuits against businesses that violate their rights. This can include class action lawsuits, where a group of consumers sue a business together.

Common Consumer Law Issues

Navigating the complexities of consumer law can be challenging, but understanding your rights is essential. Many common issues arise in consumer transactions, ranging from defective products to misleading advertising.

Defective Products

Consumers are entitled to safe and functional products. When a product fails to meet these standards, it can result in financial losses, physical harm, or both.

- Product Liability: Manufacturers and sellers are held responsible for defective products that cause harm. This responsibility can extend to design flaws, manufacturing defects, or inadequate warnings.

- Lemon Laws: These laws provide consumers with recourse when they purchase a new car with recurring defects. They may allow consumers to return the vehicle for a full refund or replacement.

- Examples: A recent case involved a consumer who purchased a new refrigerator that repeatedly malfunctioned. The manufacturer refused to repair or replace the appliance, so the consumer filed a claim under the state’s lemon law. The consumer successfully obtained a full refund and was able to purchase a new refrigerator from a different manufacturer.

Deceptive Advertising

Misleading or deceptive advertising practices can trick consumers into making purchases they would not otherwise make.

- False or Misleading Claims: Businesses cannot make false or misleading statements about their products or services. This includes claims about quality, price, features, or benefits.

- Bait-and-Switch Tactics: Businesses cannot advertise a product at a low price to attract customers and then switch them to a more expensive product.

- Examples: A consumer saw an advertisement for a “free” cell phone with a new service plan. Upon visiting the store, the consumer learned that the “free” phone came with a long-term contract and high monthly fees. The consumer filed a complaint with the Federal Trade Commission (FTC), which found that the advertisement was deceptive and ordered the company to stop using it.

Unfair Debt Collection Practices

Debt collection agencies must adhere to specific regulations when collecting debts.

- Harassment and Abuse: Debt collectors cannot harass or abuse consumers, such as by making repeated calls at inconvenient hours or using threats or intimidation.

- False Statements: Debt collectors cannot make false statements about the debt, such as claiming that a legal action is pending when it is not.

- Examples: A consumer was contacted by a debt collector who threatened to sue them if they did not pay the debt immediately. The debt collector also made false statements about the amount of the debt and the consequences of non-payment. The consumer filed a complaint with the Consumer Financial Protection Bureau (CFPB), which investigated the matter and found that the debt collector had violated the Fair Debt Collection Practices Act (FDCPA). The CFPB ordered the debt collector to stop contacting the consumer and to pay a fine.

Consequences of Violating Consumer Protection Laws

Businesses that violate consumer protection laws face a range of consequences.

- Civil Penalties: Consumers can sue businesses for damages resulting from violations of consumer protection laws.

- Criminal Penalties: In some cases, businesses may face criminal charges for violating consumer protection laws.

- Regulatory Action: Government agencies, such as the FTC and the CFPB, can take action against businesses that violate consumer protection laws. This may include fines, cease-and-desist orders, and other sanctions.

- Reputational Damage: Violating consumer protection laws can damage a business’s reputation and lead to a loss of customer trust.

Finding the Right Attorney

Navigating consumer law issues can be complex and overwhelming. Finding a qualified and experienced consumer law attorney is crucial for protecting your rights and maximizing your chances of a successful outcome. The right attorney will provide expert guidance, advocate for your interests, and help you understand your legal options.

Choosing a Consumer Law Attorney, Consumer law attorneys near me

When selecting a consumer law attorney, it’s essential to consider several key factors. This guide Artikels the steps to take to ensure you find the right attorney for your situation.

Experience and Expertise

Experience is a significant factor in choosing a consumer law attorney. Seek an attorney who specializes in consumer law and has a proven track record of success in handling cases similar to yours.

- Look for attorneys with experience in specific areas of consumer law, such as debt collection, unfair trade practices, or product liability.

- Check the attorney’s website or online profiles to review their case history and areas of expertise.

- Inquire about the attorney’s experience in handling cases in your jurisdiction, as laws and procedures can vary from state to state.

Reputation and Client Reviews

An attorney’s reputation is a valuable indicator of their competence and integrity. Look for attorneys with a positive reputation among their peers and clients.

- Check online reviews on websites like Avvo, Martindale-Hubbell, and Google Reviews to see what past clients have to say about their experience with the attorney.

- Inquire about the attorney’s professional affiliations and memberships, such as the National Association of Consumer Advocates (NACA), which demonstrate their commitment to consumer protection.

- Ask for referrals from trusted sources, such as friends, family, or other professionals who have experience with consumer law attorneys.

Communication Skills and Accessibility

Effective communication is vital in any legal matter. Choose an attorney who is responsive, clear, and easy to understand.

- During your initial consultation, pay attention to the attorney’s communication style. Do they listen attentively? Are they clear and concise in their explanations? Do they answer your questions thoroughly?

- Inquire about the attorney’s communication methods and availability. Do they offer multiple ways to contact them, such as phone, email, and online platforms?

- Ask about the attorney’s fees and billing practices to ensure transparency and avoid unexpected costs.

Questions to Ask Potential Attorneys

To ensure you find the right attorney, prepare a list of questions to ask during your initial consultations. This will help you gather the information you need to make an informed decision.

- What is your experience handling cases similar to mine?

- What is your success rate in these types of cases?

- What are your fees and billing practices?

- How will you keep me informed about the progress of my case?

- How long have you been practicing consumer law?

- Are you familiar with the laws in my jurisdiction?

- Can you provide me with references from past clients?

- What is your approach to resolving consumer law disputes?

- What are the potential outcomes of my case?

The Role of a Consumer Law Attorney

Consumer law attorneys specialize in protecting the rights of consumers who have been wronged by businesses or other entities. They understand the complex laws that govern consumer transactions and can help you navigate the legal system to get the justice you deserve.

Services Offered by Consumer Law Attorneys

Consumer law attorneys offer a wide range of services to help consumers resolve legal issues. These services include:

- Legal Advice: Consumer law attorneys can provide you with legal advice on your rights and obligations as a consumer. They can help you understand the laws that apply to your situation and explain your options for resolving the issue.

- Negotiation: Consumer law attorneys can negotiate with businesses on your behalf to try to reach a fair settlement. They have the experience and knowledge to effectively advocate for your interests and achieve the best possible outcome.

- Representation in Court: If a settlement cannot be reached, consumer law attorneys can represent you in court. They will prepare your case, argue your claims, and fight for your rights in front of a judge or jury.

Hiring a Consumer Law Attorney

Hiring a consumer law attorney can be a valuable investment, especially if you are facing a complex legal issue. Here are some key considerations when hiring an attorney:

- Experience: Look for an attorney who has experience handling cases similar to yours. You can ask potential attorneys about their experience and track record of success.

- Fees: Consumer law attorneys typically charge fees on an hourly basis or on a contingency basis. This means that they will only get paid if they are successful in your case. It is important to discuss the attorney’s fees upfront to ensure that you understand the costs involved.

- Communication: It is essential to choose an attorney who communicates effectively and keeps you informed throughout the process. You should feel comfortable asking questions and receiving clear and concise answers.

Communicating Effectively with a Consumer Law Attorney

Effective communication is key to a successful attorney-client relationship. Here are some tips for communicating effectively with your consumer law attorney:

- Be Clear and Concise: When describing your situation, be clear and concise in your explanations. Avoid jargon or technical terms that your attorney may not understand.

- Provide All Relevant Information: Be sure to provide your attorney with all relevant information, including documentation, contracts, and any other supporting evidence. This will help your attorney build a strong case on your behalf.

- Ask Questions: Don’t be afraid to ask questions. Your attorney is there to help you understand the legal process and your rights. The more questions you ask, the better equipped you will be to make informed decisions about your case.

Protecting Yourself as a Consumer

In today’s complex marketplace, it’s more important than ever for consumers to be proactive in safeguarding their rights and interests. Understanding your rights and responsibilities as a consumer is crucial for navigating the often-uncertain terrain of consumer transactions. By taking steps to protect yourself, you can minimize the risk of being taken advantage of and ensure a fair and equitable experience.

Practical Tips for Consumer Protection

Protecting yourself as a consumer involves being informed, vigilant, and assertive. Here are some practical tips to help you avoid common consumer law issues:

- Read and Understand Contracts: Before signing any agreement, take the time to carefully read and understand all the terms and conditions. Pay close attention to clauses related to warranties, returns, refunds, and dispute resolution. If you’re unsure about anything, don’t hesitate to ask for clarification.

- Keep Detailed Records: Maintain a record of all your purchases, including receipts, invoices, and correspondence. This documentation can be invaluable if you need to file a complaint or seek legal recourse later.

- Be Aware of Scams: Be wary of unsolicited offers, high-pressure sales tactics, and deals that seem too good to be true. Research businesses and products before making any commitments.

- Shop Around: Compare prices and terms from different businesses before making a purchase. Don’t be afraid to negotiate for better deals or ask for discounts.

- Understand Your Rights: Familiarize yourself with your consumer rights under federal and state laws. This knowledge will empower you to advocate for yourself and hold businesses accountable.

- Use Credit Cards Wisely: Credit cards can provide valuable consumer protection, but it’s important to use them responsibly. Monitor your statements, pay your bills on time, and keep your credit utilization low.

- Be Cautious Online: Be mindful of online scams, phishing attempts, and identity theft. Protect your personal information, use strong passwords, and be cautious about sharing sensitive data online.

Common Consumer Rights and Legal Remedies

Consumers have a range of legal rights that protect them from unfair or deceptive business practices. Here’s a table outlining some common consumer rights and the corresponding legal remedies available:

| Consumer Right | Legal Remedy |

|---|---|

| Right to a Safe Product | Product liability lawsuits, recall actions, consumer protection agency complaints |

| Right to Accurate Information | False advertising claims, consumer protection agency complaints |

| Right to Fair Credit Practices | Fair Credit Reporting Act claims, consumer protection agency complaints |

| Right to a Fair Debt Collection Process | Fair Debt Collection Practices Act claims, consumer protection agency complaints |

| Right to a Refund or Exchange | State consumer protection laws, breach of contract claims |

| Right to Privacy | Data breach lawsuits, privacy violation claims |

Leveraging Technology and Online Resources

The internet provides a wealth of resources for consumers seeking information and advocacy. Here are some ways to leverage technology to protect your rights:

- Online Consumer Protection Agencies: Websites like the Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB) offer valuable information, resources, and complaint filing options.

- Consumer Reviews and Forums: Online platforms like Yelp, Trustpilot, and Reddit allow consumers to share experiences and warn others about problematic businesses.

- Social Media Advocacy: Use social media to raise awareness about consumer issues and hold businesses accountable for their actions.

- Online Legal Resources: Websites like Nolo and LegalZoom offer legal information and resources, including templates for consumer complaints and legal documents.

Local Resources for Consumers

Navigating the complexities of consumer law can be daunting, but you don’t have to go it alone. Your local community offers a wealth of resources designed to empower consumers and protect their rights. From government agencies to non-profit organizations, these resources provide valuable information, legal assistance, and advocacy support.

Local Government Agencies

Local government agencies play a crucial role in consumer protection. They enforce consumer laws, investigate complaints, and provide guidance on consumer rights.

- Consumer Affairs Offices: These offices handle consumer complaints, mediate disputes, and provide information on consumer rights and local laws. For example, the [Name of City/County] Consumer Affairs Office offers a range of services, including complaint resolution, mediation, and consumer education workshops.

- District Attorney’s Offices: Some district attorney’s offices have dedicated consumer protection units that investigate and prosecute cases of consumer fraud and unfair business practices. For instance, the [Name of County] District Attorney’s Office has a Consumer Protection Unit that handles cases involving identity theft, telemarketing fraud, and other consumer scams.

- Department of Weights and Measures: This agency ensures accuracy in weights and measures, protecting consumers from being shortchanged. They inspect businesses that use scales and other measuring devices to ensure fairness in transactions.

Local Consumer Advocacy Groups

Local consumer advocacy groups work tirelessly to protect consumer rights and promote fair business practices. They provide information, education, and support to consumers facing legal challenges or unfair treatment.

- [Name of Local Consumer Advocacy Group]: This organization advocates for consumer rights and provides legal assistance to consumers facing unfair business practices. They offer free legal consultations, representation in small claims court, and educational workshops on consumer rights.

- [Name of Local Community Action Agency]: These agencies often have programs that provide legal assistance and advocacy to low-income consumers. They may offer free legal consultations, representation in consumer-related cases, and consumer education workshops.

Local Consumer Law Attorneys

Finding a qualified consumer law attorney is crucial for navigating complex legal issues. A local attorney will have a deep understanding of local laws and regulations and can provide tailored advice and representation.

- [Name of Local Bar Association]: Local bar associations maintain directories of attorneys practicing in specific areas, including consumer law. You can search their website or contact them directly to find a qualified attorney.

- Online Legal Directories: Websites like Avvo and FindLaw allow you to search for attorneys by location, area of expertise, and client reviews. These directories provide valuable information about attorneys’ experience, qualifications, and client satisfaction.

- Referrals: Ask friends, family, or other trusted professionals for referrals to reputable consumer law attorneys in your area.

Ultimate Conclusion

Empowering consumers with knowledge and legal representation is at the heart of consumer law. By understanding your rights and seeking professional assistance when needed, you can navigate the marketplace with confidence and protect yourself from exploitation. Remember, you are not alone in this journey, and a dedicated consumer law attorney is ready to fight for your rights and help you achieve justice.

Quick FAQs

What types of cases do consumer law attorneys handle?

Consumer law attorneys handle a wide range of cases, including product liability, deceptive advertising, unfair debt collection practices, and violations of consumer protection laws.

How much does it cost to hire a consumer law attorney?

The cost of hiring a consumer law attorney can vary depending on the complexity of the case and the attorney’s experience. Some attorneys charge an hourly rate, while others may work on a contingency fee basis, meaning they only get paid if they win your case.

How do I find a reputable consumer law attorney near me?

You can find reputable consumer law attorneys near you by asking for referrals from friends, family, or other professionals. You can also search online directories or contact your local bar association.

What should I ask a potential consumer law attorney during a consultation?

When meeting with a potential consumer law attorney, ask about their experience handling cases similar to yours, their fees, and their communication style. You should also ask if they are willing to answer your questions and provide you with clear and concise information.