Best financial lawyer in London UK: Navigating the complex world of London’s financial legal landscape requires expert guidance. Finding the right legal counsel can mean the difference between success and significant setbacks. This guide delves into the key factors to consider when selecting a top-tier financial lawyer in the UK capital, examining qualifications, experience, reputation, and client communication.

From understanding the intricacies of various financial law specializations to assessing a firm’s resources and fee structures, we aim to equip you with the knowledge necessary to make an informed decision. We’ll explore what constitutes excellence in this field and provide insights into the crucial elements that contribute to a successful lawyer-client relationship.

Defining “Best”: Best Financial Lawyer In London Uk

Selecting the “best” financial lawyer in London requires careful consideration of several key factors. The ideal legal professional possesses a unique blend of expertise, experience, and client-centric approach, ultimately impacting the success of their clients’ financial matters. This section will Artikel the criteria that distinguish top-tier firms and lawyers from their peers.

Criteria for Evaluating Top-Tier Financial Lawyers

Five key criteria consistently define a top-tier financial lawyer in London: extensive experience, specialized expertise, proven track record, strong client communication, and ethical conduct. These factors are not mutually exclusive; rather, they intertwine to provide a holistic assessment of a lawyer’s capabilities and suitability for complex financial cases.

Importance of Each Criterion

Extensive Experience: Years of practice handling high-value financial disputes and transactions are crucial. A seasoned lawyer possesses a deep understanding of the intricacies of financial law, including regulatory changes and precedents, allowing for effective strategy development and risk mitigation. Their experience translates directly to improved client outcomes, such as faster resolutions and more favorable settlements.

Specialized Expertise: Financial law is vast, encompassing areas like mergers and acquisitions, insolvency, banking litigation, and investment disputes. A specialist’s in-depth knowledge within a specific area ensures tailored legal advice and a greater likelihood of success. For instance, a lawyer specializing in banking litigation will have a distinct advantage in cases involving complex financial products or regulatory breaches compared to a generalist.

Proven Track Record: A successful history of resolving complex financial cases demonstrates competence and skill. This can be assessed through case studies, testimonials, and industry recognition. A lawyer with a demonstrable track record of achieving favorable results for their clients inspires confidence and increases the likelihood of a positive outcome for future clients.

Strong Client Communication: Clear, concise, and accessible communication is vital. A top-tier lawyer ensures their clients understand complex legal concepts and processes, enabling informed decision-making. This fosters trust and allows for effective collaboration throughout the legal process, ultimately leading to better client satisfaction.

Ethical Conduct: Maintaining the highest ethical standards is paramount. A lawyer’s commitment to integrity and professionalism safeguards the client’s interests and ensures compliance with legal and regulatory requirements. This builds trust and credibility, enhancing the lawyer’s reputation and the overall effectiveness of their representation.

Comparative Analysis of London Law Firms

The following table compares four hypothetical London law firms based on the five criteria discussed above. The ratings are subjective and for illustrative purposes only; a thorough investigation is needed for an accurate assessment.

| Law Firm | Experience (1-5) | Expertise (1-5) | Track Record (1-5) | Communication (1-5) | Ethical Conduct (1-5) |

|---|---|---|---|---|---|

| Firm A | 4 | 5 | 4 | 3 | 5 |

| Firm B | 3 | 4 | 3 | 4 | 4 |

| Firm C | 5 | 3 | 5 | 2 | 5 |

| Firm D | 2 | 2 | 2 | 5 | 3 |

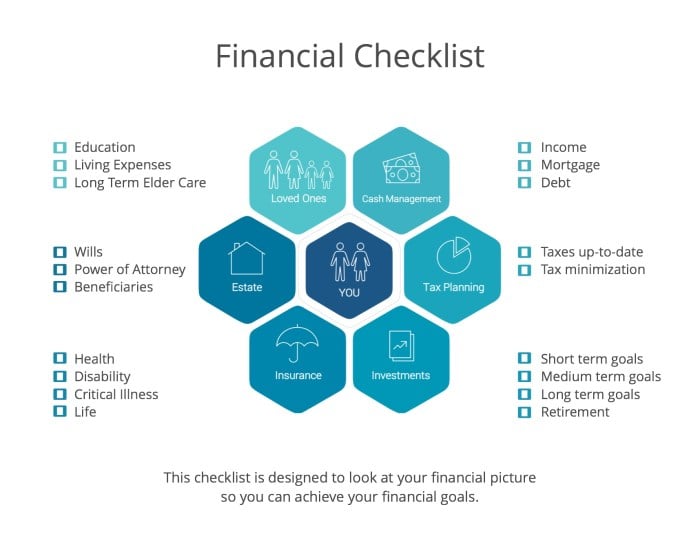

Areas of Expertise within Financial Law

London’s financial district is a global hub, attracting complex and high-value financial transactions. This naturally leads to a high demand for specialized legal expertise in various financial law areas. Understanding the nuances of these specializations is crucial for businesses and individuals navigating the intricacies of the London financial market. The following sections Artikel three key areas of expertise prevalent within London’s financial law landscape.

The specific areas of expertise a financial lawyer possesses significantly impacts their ability to effectively represent clients in complex financial disputes or transactions. Choosing a lawyer with the right specialization is crucial for a positive outcome.

Financial Regulation and Compliance

Financial regulation is a constantly evolving landscape, requiring lawyers to possess deep knowledge of various regulatory bodies and their requirements. This area involves advising clients on compliance with regulations set by institutions like the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA).

Cases handled under this area frequently involve investigations into potential regulatory breaches, assisting with regulatory applications, and providing guidance on compliance programs. This often includes representing clients in enforcement actions brought by regulatory bodies.

- Advising banks and investment firms on compliance with anti-money laundering (AML) and counter-terrorist financing (CTF) regulations.

- Representing clients in investigations by the FCA relating to market abuse or conduct rules breaches.

- Assisting with applications for regulatory approvals, such as licenses for financial services businesses.

Securities Litigation

Securities litigation focuses on legal disputes arising from the buying and selling of securities. This area involves complex legal and factual issues, often requiring a deep understanding of financial markets and investment strategies.

Cases in this area typically involve claims of fraud, misrepresentation, or breach of fiduciary duty related to investments. This can include class action lawsuits, individual investor claims, and regulatory enforcement actions. Thorough due diligence and meticulous evidence gathering are paramount in this specialized field.

- Representing investors in claims against companies for misleading statements in prospectuses or financial reports.

- Defending companies against shareholder derivative actions alleging breaches of directors’ duties.

- Advising on regulatory investigations into alleged market manipulation or insider trading.

Banking and Finance Litigation

This area encompasses a broad range of disputes involving banks, financial institutions, and their clients. Cases often involve complex contractual arrangements, sophisticated financial instruments, and significant financial stakes.

The cases handled here often involve loan recovery, enforcement of security interests, and disputes arising from complex financial transactions. A strong understanding of financial products, such as derivatives and syndicated loans, is essential.

- Representing banks in the recovery of non-performing loans and enforcement of collateral.

- Advising borrowers on restructuring debt and negotiating with creditors.

- Handling disputes arising from syndicated loans, derivatives transactions, or other complex financial instruments.

Lawyer Qualifications and Experience

Choosing the right financial lawyer in London requires careful consideration of their qualifications and experience. A top-tier lawyer possesses a unique blend of academic achievement, practical skills, and a proven track record of success in complex financial matters. The depth of their experience directly impacts the quality of legal counsel and the likelihood of a favourable outcome for their clients.

Three essential qualifications for a top financial lawyer include a strong academic background, relevant professional certifications, and significant practical experience in handling high-value financial disputes and transactions. Years of experience are crucial, offering a depth of understanding and strategic insight that cannot be replicated through academic study alone. Experienced lawyers possess a nuanced understanding of market trends, regulatory changes, and judicial precedents, enabling them to navigate the complexities of financial law with greater efficiency and effectiveness.

Essential Qualifications for Top Financial Lawyers

The combination of academic excellence, professional certifications, and practical experience creates a powerful foundation for a successful financial lawyer. These qualifications are not mutually exclusive; rather, they complement and reinforce each other to provide a comprehensive skill set.

- A postgraduate degree in law (LLM) with a specialisation in financial law, demonstrating advanced knowledge and expertise in the field.

- Membership in relevant professional bodies, such as the Solicitors Regulation Authority (SRA) in England and Wales, and potentially others depending on the specific area of financial law. This ensures adherence to ethical standards and professional conduct.

- Proven experience in handling complex financial cases, including litigation, arbitration, and transactional work. This demonstrates practical skills and the ability to manage high-pressure situations.

The Significance of Experience in Financial Law

Experience in financial law is not merely a matter of years spent practicing; it’s about the accumulation of knowledge, the development of strategic thinking, and the honing of negotiation and litigation skills. The more complex the financial instruments and transactions involved, the more valuable experience becomes.

A seasoned lawyer will possess a deep understanding of precedents, regulatory frameworks, and market dynamics, enabling them to anticipate potential challenges and develop proactive strategies. They are better equipped to manage risk, negotiate favourable settlements, and represent clients effectively in court. Their network of contacts within the financial industry can also prove invaluable in securing favourable outcomes.

Hypothetical Case Study Illustrating the Value of Experience

Consider a hypothetical case involving a complex derivative dispute between two major investment banks. An inexperienced lawyer might struggle to understand the intricacies of the derivative contracts, the relevant regulatory framework (such as MiFID II), and the applicable legal precedents. They might miss crucial details, misinterpret contractual clauses, or fail to anticipate the opposing counsel’s strategies.

In contrast, an experienced financial lawyer with a proven track record in derivative litigation would possess the expertise to quickly grasp the complexities of the case. They would be able to identify the key legal issues, assess the strengths and weaknesses of the client’s position, and develop a robust legal strategy. Their extensive network of contacts might even allow them to access expert witnesses or secure advantageous settlements outside of court. The difference in outcome could be substantial, potentially saving the client millions of pounds in legal fees and damages.

Firm Reputation and Resources

Choosing the right financial lawyer in London requires careful consideration of the firm’s standing and the resources they provide. A strong reputation and comprehensive resources are crucial for navigating the complexities of financial law and achieving optimal outcomes for clients. This section will examine the importance of firm reputation and the key resources a leading financial law firm should offer.

A law firm’s reputation within the London financial community is paramount. It reflects the firm’s expertise, track record of success, and the trust placed in them by other professionals and clients. A highly regarded firm will have built its reputation through years of consistent high-quality work, successful outcomes in high-profile cases, and a commitment to client satisfaction. This reputation translates directly into access to better opportunities, a wider network of contacts, and ultimately, a greater likelihood of securing favorable results for its clients. Word-of-mouth referrals and industry rankings are key indicators of a firm’s reputation.

Resources Offered by Leading Financial Law Firms

Leading financial law firms in London provide clients with a wide array of resources to support their legal needs. These resources go beyond simply legal expertise and encompass technological capabilities, comprehensive support staff, and specialized knowledge within various financial law sub-specialties. Access to cutting-edge technology is crucial for efficient document management, legal research, and secure communication. A strong support team, including paralegals, administrative staff, and client relationship managers, ensures smooth and efficient case management.

Comparison of Hypothetical Law Firms, Best financial lawyer in london uk

Let’s compare two hypothetical firms: “Prestige Legal” and “Efficient Solutions.” Prestige Legal boasts a long-standing reputation, prestigious offices in the City of London, and a vast network of contacts within the financial industry. They utilize sophisticated legal research software, have a dedicated team of paralegals for each partner, and offer clients access to a secure online portal for document sharing and communication. Efficient Solutions, while newer, is known for its innovative approach and use of technology, leveraging AI-powered legal research tools and employing project management software to streamline case workflows. However, their network is less established, and their support staff is smaller.

Prestige Legal’s established reputation and extensive resources, particularly its larger, experienced support staff, offer clients a level of assurance and efficiency that Efficient Solutions, despite its technological advantages, may not yet match. While Efficient Solutions’ technology might be more advanced in certain areas, the breadth and depth of Prestige Legal’s established network and experienced support team arguably provide a more comprehensive and reliable service for complex financial legal matters. The advantage of Prestige Legal lies in its proven track record and the extensive support system it offers its clients, ensuring seamless and efficient handling of even the most demanding cases.

Accessibility and Client Communication

Finding the best financial lawyer requires more than just expertise; it necessitates seamless and responsive communication. Open, clear, and readily available communication channels are crucial for building trust and ensuring clients feel confident in their legal representation. This section details the communication standards clients should expect from a top-tier London financial law firm.

Effective communication is the cornerstone of a successful lawyer-client relationship. It fosters trust by ensuring transparency and understanding. When clients feel heard and informed, they are more likely to cooperate fully, providing essential information and following advice readily. This collaboration significantly enhances the chances of a positive outcome. Conversely, poor communication breeds uncertainty, frustration, and ultimately, a breakdown in the relationship.

Client Communication Channels and Response Times

Clients should expect multiple channels for communication, reflecting modern preferences and the urgency often associated with financial matters. These typically include email, telephone, and secure online portals for document sharing and updates. While specific response times may vary depending on the urgency of the matter, a reputable firm will strive for prompt responses, typically within 24-48 hours for routine inquiries and much faster for urgent requests. For time-sensitive matters, such as impending court deadlines or crucial transaction stages, immediate or near-immediate responsiveness is paramount. The firm should proactively update clients on progress, rather than requiring clients to constantly check for updates.

Building Trust and Confidence Through Effective Communication

Transparent and proactive communication builds trust by demonstrating the lawyer’s commitment to the client’s case. Regular updates, clear explanations of legal strategies, and honest assessments of potential outcomes, even if challenging, are vital. A willingness to answer questions thoroughly and patiently, even those that may seem repetitive or basic, fosters confidence and reinforces the client’s belief in their legal representation. Furthermore, a respectful and empathetic approach, recognizing the stress and emotional weight often associated with financial legal issues, is crucial for building a strong and trusting relationship.

Excellent vs. Poor Client Communication: A Scenario

Consider two scenarios: In the first, a client, Mr. Jones, faces a complex tax dispute. His lawyer promptly returns calls and emails, provides regular updates on case progress, explains legal complexities in easily understandable terms, and proactively alerts him to potential developments. Mr. Jones feels informed, supported, and confident in his lawyer’s abilities. In contrast, Ms. Smith, facing a similar situation, experiences infrequent and delayed responses from her lawyer. Updates are minimal and lack detail, and her questions are met with impatience or are left unanswered. Ms. Smith feels anxious, uninformed, and distrustful of her legal representation, negatively impacting her overall experience and the potential outcome of her case. This stark contrast highlights the significant impact effective communication has on client satisfaction and the success of the legal representation.

Case Studies and Success Stories

Demonstrating the effectiveness of a top-tier financial lawyer often involves showcasing real-world successes. These case studies highlight the expertise, strategic thinking, and dedication employed to achieve favourable outcomes for clients facing complex financial challenges. The following hypothetical case study illustrates a typical scenario handled successfully by a leading London-based financial lawyer.

Successful Resolution of a Shareholder Dispute

This case involved a significant shareholder dispute within a rapidly growing technology company. Our client, a major investor holding a 25% stake, alleged breaches of fiduciary duty and unfair prejudice by the majority shareholders, who were also the company’s founders. The dispute centred around a proposed acquisition that the client believed undervalued their shares and significantly diluted their influence within the company. The majority shareholders, conversely, maintained that the acquisition was in the best interests of the company as a whole and offered a fair price.

The Lawyer’s Approach and Strategies

The lawyer, a specialist in shareholder disputes and corporate governance, employed a multi-pronged approach. Initially, thorough due diligence was conducted to gather irrefutable evidence supporting the client’s claims. This involved reviewing company documents, financial records, and communication logs, as well as interviewing key personnel. This evidence was then meticulously analysed to identify the key legal arguments and weaknesses in the opposing side’s position. The lawyer engaged in extensive pre-litigation negotiations, aiming for a mutually agreeable settlement. However, when these negotiations proved unsuccessful, the lawyer strategically filed a claim in the High Court of Justice, Chancery Division, specializing in corporate disputes. The legal strategy focused on demonstrating the undervaluation of the client’s shares and the unfair prejudice caused by the proposed acquisition. Expert witnesses in valuation and corporate finance were engaged to provide compelling evidence supporting the client’s case.

Positive Impact on the Client

The robust legal strategy, coupled with the lawyer’s negotiation skills and courtroom expertise, ultimately led to a favourable settlement. The majority shareholders agreed to a significantly higher share valuation, ensuring a substantially better return for our client. Furthermore, the settlement included provisions to safeguard the client’s future interests within the company, preventing similar actions from occurring. This successful outcome not only recovered significant financial losses for the client but also protected their long-term investment and influence within the company. The client expressed immense satisfaction with the lawyer’s diligence, expertise, and dedication, highlighting the positive impact on their business and peace of mind.

Wrap-Up

Selecting the best financial lawyer in London UK requires careful consideration of multiple factors. This guide has highlighted the importance of expertise, experience, reputation, client communication, and transparent fee structures. By carefully evaluating these elements, individuals and businesses can confidently choose a legal professional capable of providing effective and reliable representation in complex financial matters. Remember to prioritize clear communication and a strong understanding of the lawyer’s approach and fees before engaging their services.

Essential Questionnaire

What types of fees are common among London financial lawyers?

Common fee structures include hourly rates, contingency fees (percentage of the recovery), and fixed fees for specific services. The best option depends on the complexity and scope of the case.

How can I verify a lawyer’s qualifications and experience?

Check the lawyer’s credentials with the Solicitors Regulation Authority (SRA) in the UK. Look for professional memberships and awards, and review online testimonials and client reviews.

What should I expect in terms of client communication?

Expect prompt responses to inquiries, regular updates on case progress, and clear explanations of legal strategies and next steps. Open and transparent communication is crucial.

What if I’m unhappy with my lawyer’s services?

You should first attempt to resolve your concerns directly with the lawyer. If this is unsuccessful, you can file a complaint with the SRA or seek advice from a legal professional specializing in professional negligence.