-

Hypothecary Nature of Maritime Law: A Comprehensive Exploration

- Greetings, Readers!

- Section 1: The Maritime Lien

- Subsection 1.1: Types of Maritime Liens

- Subsection 1.2: Priority of Maritime Liens

- Section 2: The Maritime Mortgage

- Subsection 2.1: Rights and Responsibilities of Maritime Mortgagees

- Subsection 2.2: Registration and Enforcement of Maritime Mortgages

- Section 3: The Bottomry Bond

- Subsection 3.1: Characteristics of Bottomry Bonds

- Subsection 3.2: Uses and Regulation of Bottomry Bonds

- Table: Maritime Liens, Mortgages, and Bottomry Bonds

- Conclusion

-

FAQ about Hypothecary Nature of Maritime Law

- What is the hypothecary nature of maritime law?

- What types of claims have priority under this law?

- What is the purpose of this principle?

- How does the hypothecary nature protect maritime liens?

- Can maritime liens be extinguished?

- What is the difference between a maritime lien and a mortgage?

- How is the priority of maritime liens determined?

- What happens if multiple maritime liens are registered against a vessel?

- Can a vessel be sold to satisfy maritime liens?

- What is the benefit of registering a maritime mortgage?

Hypothecary Nature of Maritime Law: A Comprehensive Exploration

Greetings, Readers!

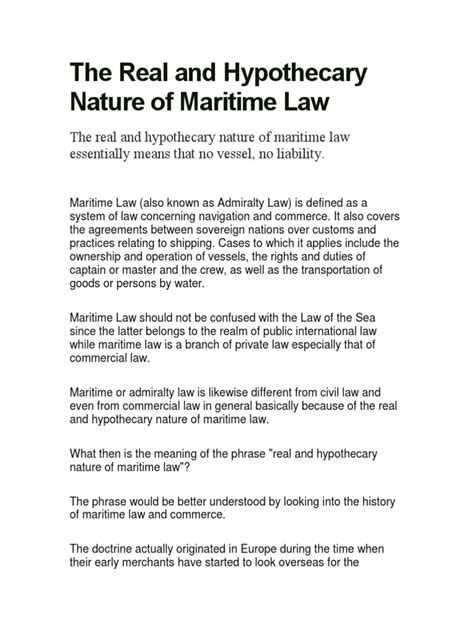

Welcome to this in-depth exploration of the hypothecary nature of maritime law. In the realm of maritime affairs, the law takes on a unique character, shaped by the ever-changing tides and the boundless expanse of the oceans. As we delve into this fascinating subject, we’ll shed light on the intricate legal framework that governs maritime commerce and unravel the complexities that make this field so captivating.

Section 1: The Maritime Lien

In the maritime context, a lien serves as a powerful tool for securing debts or obligations. Unlike ordinary liens, which attach to specific assets, a maritime lien grants a creditor a claim against the vessel itself. This hypothecary nature of maritime law empowers creditors to hold the vessel liable, even if the owner changes hands.

Subsection 1.1: Types of Maritime Liens

The maritime lien is a versatile instrument, encompassing various types:

- Contractual Liens: Arise from agreements between parties, such as a charter party or a contract of carriage.

- Statutory Liens: Conferred by law, such as liens for salvage services or seaman’s wages.

- Equitable Liens: Recognized in equity courts, based on principles of fairness and unjust enrichment.

Subsection 1.2: Priority of Maritime Liens

When multiple liens exist against a vessel, a hierarchy determines their priority. First-in-time liens generally take precedence, but maritime law also recognizes certain liens as having inherent superiority, such as seaman’s wages and salvage liens.

Section 2: The Maritime Mortgage

A mortgage, in the maritime context, represents a specialized type of security interest in a vessel. Like a traditional mortgage, it grants a lender a claim against the vessel as collateral for a loan. However, the hypothecary nature of maritime law allows a maritime mortgage to remain valid even if the vessel undergoes repairs or alterations.

Subsection 2.1: Rights and Responsibilities of Maritime Mortgagees

Mortgagees in maritime law enjoy certain rights and obligations:

- Right to Foreclosure: If the mortgagor defaults on their loan, the mortgagee can foreclose and seize the vessel.

- Duty to Maintain the Vessel: The mortgagor is obligated to maintain the vessel in good condition, preserving its value for the mortgagee.

- Right to Transfer: Maritime mortgages are transferable, allowing mortgagees to assign their interest to other parties.

Subsection 2.2: Registration and Enforcement of Maritime Mortgages

Maritime mortgages must be registered with the appropriate maritime authority to provide public notice and protect the mortgagee’s rights. In case of default, the mortgagee can enforce the mortgage through a foreclosure proceeding in admiralty court.

Section 3: The Bottomry Bond

A bottomry bond is a unique form of maritime financing where the vessel itself serves as the security for a loan. Unlike a mortgage, which creates a fixed lien, a bottomry bond represents a privileged loan that takes precedence over all other liens.

Subsection 3.1: Characteristics of Bottomry Bonds

Bottomry bonds share distinct characteristics:

- Priority: Bottomry bonds have the highest priority among maritime liens, giving lenders maximum security.

- Limited Liability: Borrowers are only liable to the extent of the vessel’s value, unlike personal loans.

- Maritime Risk: The lender bears the risk of the vessel’s loss or damage, as repayment depends on its successful voyage.

Subsection 3.2: Uses and Regulation of Bottomry Bonds

Bottomry bonds are commonly used to finance ship repairs and supplies during a voyage. Their use is regulated by maritime law, which imposes strict requirements to ensure fairness and prevent abuse.

Table: Maritime Liens, Mortgages, and Bottomry Bonds

| Type | Nature | Security | Priority | Enforcement |

|---|---|---|---|---|

| Maritime Lien | Statutory or contractual | Vessel | Varies | Admiralty court proceedings |

| Maritime Mortgage | Contractual | Vessel | High | Foreclosure proceedings |

| Bottomry Bond | Loan secured by vessel | Vessel | Highest | Admiralty court proceedings |

Conclusion

Readers, our exploration of the hypothecary nature of maritime law has illuminated the unique legal framework that governs maritime commerce. From maritime liens to mortgages and bottomry bonds, this specialized legal regime empowers creditors, protects lenders, and facilitates the smooth functioning of global trade. As you navigate your own maritime endeavors, remember the intricate legal landscape that governs these uncharted waters. Feel free to explore our other articles on maritime law to deepen your understanding of this fascinating field.

FAQ about Hypothecary Nature of Maritime Law

What is the hypothecary nature of maritime law?

Answer: It is a principle that gives maritime liens or mortgages priority over other claims against a vessel, regardless of the time of their creation.

What types of claims have priority under this law?

Answer: Maritime liens, such as those for repairs, wages, and salvage, and mortgages registered with a maritime authority.

What is the purpose of this principle?

Answer: To encourage investment and lending in the maritime industry by providing lenders with a secure form of collateral.

How does the hypothecary nature protect maritime liens?

Answer: By giving them a higher priority than non-maritime claims, ensuring that maritime creditors are paid before general creditors.

Can maritime liens be extinguished?

Answer: Yes, they can be extinguished through payment, discharge by the court, or waiver by the lienholder.

What is the difference between a maritime lien and a mortgage?

Answer: A maritime lien is a non-consensual claim against a vessel, while a mortgage is a consensual lien created by a loan agreement.

How is the priority of maritime liens determined?

Answer: By the time they are created, with earlier liens having higher priority.

What happens if multiple maritime liens are registered against a vessel?

Answer: They are paid in order of priority.

Can a vessel be sold to satisfy maritime liens?

Answer: Yes, if the liens are not paid, the vessel can be sold through a judicial sale to satisfy the claims.

What is the benefit of registering a maritime mortgage?

Answer: It gives the mortgagee a secure interest in the vessel and entitles it to priority over other creditors in the event of default.