- Bottomry in Maritime Law: A Comprehensive Guide

- A Detailed Examination of Bottomry

- Key Features of Bottomry

- Table of Bottomry Provisions

- Conclusion

-

FAQ about Bottomry in Maritime Law

- What is bottomry?

- Who can issue a bottomry loan?

- Who can take out a bottomry loan?

- What is the purpose of a bottomry loan?

- How does a bottomry loan work?

- What is a maritime lien?

- What are the risks of a bottomry loan for the lender?

- What are the risks of a bottomry loan for the borrower?

- Are there any regulations on bottomry loans?

- Are bottomry loans still common today?

Bottomry in Maritime Law: A Comprehensive Guide

Introduction

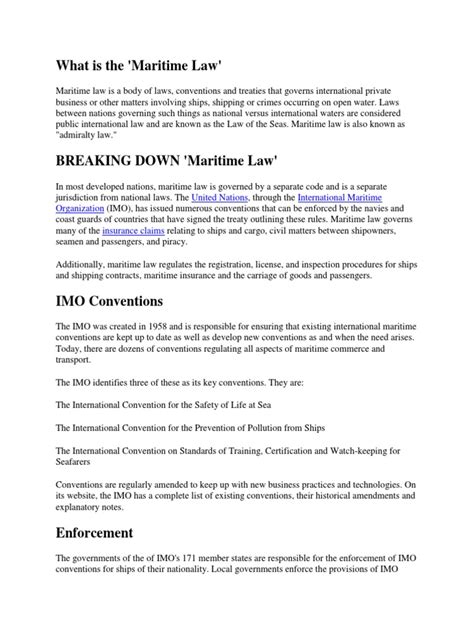

Greetings, readers! Today, let’s venture into the fascinating realm of maritime law and unravel the intriguing concept of bottomry. Simply put, bottomry is a unique type of loan secured by a ship and its cargo, offering a lifeline to ship owners in times of financial distress. So, get ready to dive deep into this maritime mystery as we explore the intricate world of bottomry in maritime law.

A Detailed Examination of Bottomry

Nature of Bottomry

Bottomry, rooted in the Latin term "bottom," is a loan agreement secured exclusively against a sea vessel and its cargo. It serves as a crucial rescue mechanism for ship owners facing unexpected expenses or emergencies during their voyages. By pledging their ship and cargo as collateral, shipowners can access funds to cover essential costs, ranging from repairs to supplies.

Legal Framework

The legal framework governing bottomry is complex and varies across jurisdictions. In common law countries, bottomry is recognized as a maritime lien that takes priority over other claims on the ship. This legal status ensures that bottomry lenders have a strong security interest in the vessel and cargo, making their loans highly attractive.

Interest Rates

One defining characteristic of bottomry is its typically high interest rates. These rates reflect the inherent risk associated with the loan, as the lender’s repayment is contingent upon the successful completion of the voyage and the safe return of the ship and cargo. The interest rate is negotiated between the borrower and lender and is influenced by factors such as the ship’s value, the loan amount, and the projected length of the voyage.

Types of Bottomry

Bottomry loans are classified into two main types:

-

Respondentia Loan: Secured solely by the cargo, respondentia loans provide funds to cover cargo-related expenses, such as loading, handling, and transportation costs.

-

Bottomry Loan: Secured by both the ship and the cargo, bottomry loans cover a broader range of expenses, including ship repairs, crew wages, and navigation costs.

Key Features of Bottomry

Security and Priority

Bottomry loans are secured by a maritime lien on the ship and cargo, giving lenders a first-priority claim over other creditors. This security provides lenders with a strong incentive to extend credit to shipowners.

Limited Liability

The liability of the borrower in a bottomry loan is typically limited to the value of the ship and the cargo pledged as collateral. This limited liability protects the borrower from personal liability beyond the value of the pledged assets.

Enforcement of Lien

In the event of default, the lender has the right to enforce the maritime lien and seize the pledged ship and cargo. However, the lender must exercise this right with caution, as wrongful seizure can result in liability for damages.

Insurance

To mitigate the risk of loss due to maritime perils, bottomry lenders often require the borrower to obtain insurance on both the ship and the cargo. This insurance provides additional protection for the lender in the event of damage or loss during the voyage.

Table of Bottomry Provisions

| Provision | Description |

|---|---|

| Interest Rates | Typically high to reflect the risk associated with the loan |

| Security | Maritime lien on the ship and cargo, giving the lender first-priority claim |

| Liability | Limited to the value of the pledged assets |

| Enforcement | Lender has the right to enforce the maritime lien and seize the pledged assets |

| Responsibilities | Borrower is responsible for obtaining insurance on the ship and cargo |

Conclusion

Bottomry in maritime law is a critical mechanism that provides financial support to ship owners in times of need. By understanding the nature, legal framework, and key features of bottomry, readers gain a deeper appreciation for its significance in the maritime industry. If you’re interested in exploring other aspects of maritime law, be sure to check out our comprehensive articles on:

- Admiralty Law: The Jurisdiction of the High Seas

- Charterparty: A Guide to Ship Rental Contracts

- Collision at Sea: Legal Implications and Liability

FAQ about Bottomry in Maritime Law

What is bottomry?

A loan secured by a maritime vessel, where the vessel itself serves as collateral for the loan.

Who can issue a bottomry loan?

Typically, a lender or bank that specializes in maritime financing.

Who can take out a bottomry loan?

Generally, a shipowner or charterer who needs financial assistance for vessel-related expenses.

What is the purpose of a bottomry loan?

To cover expenses such as repairs, insurance premiums, supplies, or wages, allowing vessels to remain operational.

How does a bottomry loan work?

The lender advances funds and takes a maritime lien against the vessel as security. The loan is repayable when the vessel completes its voyage or a specified period of time.

What is a maritime lien?

A legal claim against a vessel that gives the lienholder priority in case of a default on a loan or other obligation.

What are the risks of a bottomry loan for the lender?

The vessel may be lost or damaged, reducing or eliminating the value of the collateral.

What are the risks of a bottomry loan for the borrower?

If the loan is not repaid, the lender may seize and sell the vessel to recover the debt.

Are there any regulations on bottomry loans?

Yes, they are usually governed by maritime law and regulations within each jurisdiction.

Are bottomry loans still common today?

While not as common as in the past, bottomry loans are still used in certain situations where traditional financing options are unavailable or insufficient.