What Are Forex Spreads?

Introduction

Greetings, readers! Welcome to our comprehensive guide on forex spreads. Are you curious about what they are and how they affect your trading? Join us as we delve into the world of forex spreads, explaining the nitty-gritty in a way that’s easy to understand.

Forex spreads are an integral part of any currency trade, whether you’re a seasoned trader or just starting out. By understanding the basics, you can make informed decisions and potentially improve your trading strategy. So, buckle up and let’s get started!

What Are Forex Spreads?

The Basics

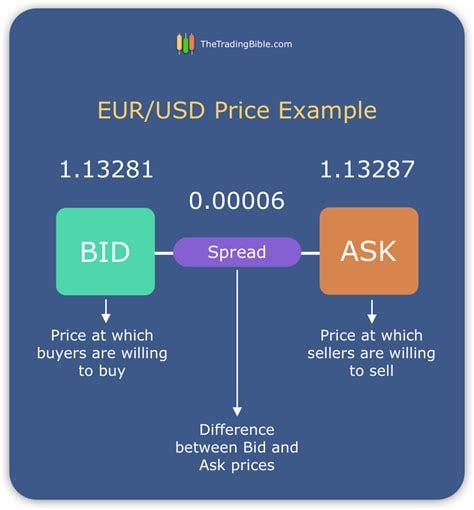

A forex spread is simply the difference between the bid and ask price of a currency pair. The bid price is the price at which you can sell a currency pair, while the ask price is the price at which you can buy it. The spread is expressed in pips, which are the smallest unit of price movement in the forex market.

For instance, let’s say you want to buy the EUR/USD currency pair. The bid price might be 1.1000, while the ask price might be 1.1005. This means that the spread for this pair is 5 pips. In other words, you would pay 5 pips more to buy the EUR/USD pair than you would receive if you sold it at the current market prices.

Types of Spreads

There are two main types of forex spreads: fixed and variable.

Fixed Spreads: With fixed spreads, the difference between the bid and ask price remains constant. This means that you know exactly how much you will pay to trade a particular currency pair. Fixed spreads are typically offered by market makers, who quote prices on both sides of the market.

Variable Spreads: Variable spreads fluctuate depending on market conditions. They can widen during periods of high volatility or when there is less liquidity in the market. Variable spreads are often offered by liquidity providers, who connect buyers and sellers in the forex market.

Factors Affecting Forex Spreads

Liquidity

Liquidity refers to the ease with which you can buy or sell a currency pair. The more liquid a currency pair, the tighter the spread will be. This is because there are more buyers and sellers actively participating in the market, leading to lower bid-ask spreads.

Market Volatility

Market volatility measures the rate at which currency prices change over time. During periods of high volatility, such as during news releases or geopolitical events, spreads tend to widen. This is because traders are demanding a higher premium to take on the additional risk associated with trading in volatile markets.

Time of Day

Forex spreads can also vary depending on the time of day. During the most active trading hours, when there is more liquidity in the market, spreads tend to be tighter. However, during less active hours, such as overnight or during weekends, spreads can widen.

Forex Spreads and Trading Strategies

Scalping

Scalping is a trading strategy that involves profiting from small price movements over short periods of time. Scalpers rely on tight spreads to maximize their profits. Even a few pips difference in the spread can significantly impact their trading results.

Day Trading

Day traders typically close out their positions before the end of the trading day. They generally prefer fixed spreads, as they can more accurately predict their trading costs. However, variable spreads can also be used by day traders who are willing to take on the additional risk associated with wider spreads.

Swing Trading

Swing traders hold onto positions for longer periods, typically ranging from a few days to several weeks. They are not as sensitive to spreads as scalpers or day traders. However, tighter spreads can still improve their overall trading profitability.

Forex Spreads Table Breakdown

| Spread Type | Description | Advantages | Disadvantages |

|---|---|---|---|

| Fixed | Constant spread | Predictable trading costs | Can be higher than variable spreads |

| Variable | Fluctuating spread | Can be lower than fixed spreads | Can widen during market volatility |

| Low | Less than 1 pip | Ideal for scalpers and high-frequency traders | Can be difficult to find |

| Medium | 1-2 pips | Suitable for most traders | Widely available |

| High | More than 2 pips | May affect profitability | Can be found during periods of low liquidity or market volatility |

Conclusion

Congratulations, readers! By now, you should have a solid understanding of what forex spreads are, how they work, and how they can impact your trading. Remember, choosing the right spread type and understanding the factors that affect them can help you optimize your trading strategy and potentially improve your profits.

Don’t forget to explore our website for more informative articles on forex trading, risk management, and other related topics. Happy trading!

FAQ about Forex Spreads

What is a forex spread?

A forex spread is the difference between the bid price (the price at which you can sell a currency) and the ask price (the price at which you can buy a currency).

Why do forex spreads exist?

Forex spreads exist because market makers need to profit from the transactions they facilitate.

How are forex spreads quoted?

Forex spreads are typically quoted in pips, which are the smallest increment of price movement for a currency pair.

What factors affect forex spreads?

Forex spreads can be affected by a variety of factors, including:

- Market liquidity

- The volatility of the currency pair

- The size of the order

How can I reduce forex spreads?

There are a few ways to reduce forex spreads:

- Use a broker with low spreads

- Choose a currency pair with high liquidity

- Trade during less volatile hours

What are typical forex spreads?

Typical forex spreads for major currency pairs range from 0.5 to 2 pips

Are forex spreads fixed or variable?

Forex spreads can be either fixed or variable. Fixed spreads remain the same regardless of market conditions, while variable spreads can fluctuate depending on market liquidity and volatility.

What is the spread in forex?

The spread in forex is the difference between the bid and ask prices of a currency pair. It is expressed in pips, which are the smallest unit of price movement.

How is the spread determined?

The spread is determined by a number of factors, including:

- The liquidity of the currency pair

- The volatility of the currency pair

- The time of day

-The broker’s commission

What is a good spread?

A good spread is one that is low and consistent. Low spreads save you money on your trades, and consistent spreads make it easier to predict your trading costs.