- Introduction

- Account Types and Features

- Trading Tools and Platforms

- Fees and Commissions

- Customer Support

- Other Features

- Conclusion

-

FAQ about Trading Forex with Interactive Brokers

- What is Forex trading?

- What are the benefits of trading forex with Interactive Brokers?

- How do I get started with forex trading?

- What trading platforms does Interactive Brokers offer?

- What currency pairs can I trade?

- What are the risks of forex trading?

- How do I learn about forex trading?

- What is the minimum deposit required to trade forex with Interactive Brokers?

- What are the fees associated with forex trading at Interactive Brokers?

- How do I withdraw funds from my forex account?

Introduction

Hey there, readers! Welcome to our in-depth guide on trading forex with Interactive Brokers. In this article, we’ll dive into everything you need to know about this renowned platform, from its account types and trading tools to its fees and customer support. Whether you’re a seasoned trader or just getting started, we’ve got you covered.

Interactive Brokers has earned its reputation as one of the most trusted and reliable forex brokers in the industry. With its vast range of currency pairs, advanced trading tools, and low commissions, it’s no wonder that traders of all levels flock to this platform. Now, let’s explore the various aspects of trading forex with Interactive Brokers.

Account Types and Features

Standard Account

The Standard Account is suitable for both new and experienced forex traders. It offers competitive spreads, no minimum deposit, and access to a wide range of currency pairs. You’ll also benefit from advanced charting tools, risk management features, and 24/7 customer support.

Pro Account

The Pro Account is designed for active traders who require more advanced features. It comes with lower spreads, the ability to trade in larger lot sizes, and access to advanced order types. You’ll also have dedicated support and access to webinars and seminars.

Custodian Account

The Custodian Account is tailored to high-net-worth individuals and institutions. It offers exceptional security, personalized service, and the ability to trade a wider range of financial instruments, including stocks, bonds, and options.

Trading Tools and Platforms

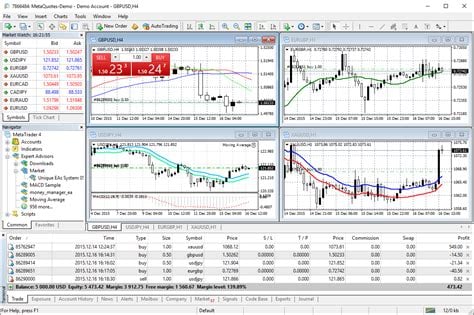

Trader Workstation (TWS)

TWS is Interactive Brokers’ flagship trading platform. It’s a comprehensive and customizable platform that allows you to trade forex, stocks, options, and futures all from one interface. TWS features advanced charting tools, real-time data feeds, and a wide range of order types.

WebTrader

WebTrader is a web-based platform that provides traders with a more user-friendly interface than TWS. It’s perfect for beginners who want to trade forex without having to install software. WebTrader offers similar functionality to TWS, including charting, order placement, and risk management tools.

Mobile App

Interactive Brokers’ mobile app allows you to trade forex from anywhere in the world. The app provides a convenient and user-friendly interface, allowing you to access your account, monitor markets, and place trades on the go.

Fees and Commissions

Interactive Brokers’ fees and commissions are highly competitive. The Standard Account has spreads starting from 0.1 pips, while the Pro Account offers spreads as low as 0.05 pips. The platform also charges a small clearing fee of $0.005 per share for stocks and ETFs.

Customer Support

Interactive Brokers offers 24/7 customer support via email, phone, and live chat. The support team is knowledgeable and responsive, ensuring that you get the help you need when you need it.

Other Features

In addition to the features mentioned above, Interactive Brokers also offers a range of other features that enhance the trading experience. These include:

- Margin trading for advanced traders

- Market data from multiple providers

- Automated trading via APIs

- Educational resources and webinars

Conclusion

Interactive Brokers is an exceptional platform for trading forex. With its wide range of account types, advanced trading tools, competitive fees, and excellent customer support, it’s no wonder that it’s the choice of traders worldwide. Whether you’re a beginner or a seasoned professional, Interactive Brokers has something to offer everyone.

If you’re interested in learning more about forex trading or other financial markets, be sure to check out our other articles. We cover everything from trading strategies to market analysis, so there’s something for everyone.

FAQ about Trading Forex with Interactive Brokers

What is Forex trading?

Interactive Brokers allows you to trade foreign exchange (forex), which involves buying and selling currencies to profit from fluctuations in their values.

What are the benefits of trading forex with Interactive Brokers?

Interactive Brokers offers competitive spreads, low commissions, and access to a wide range of currency pairs.

How do I get started with forex trading?

To start trading forex with Interactive Brokers, you need to create an account, fund it, and choose a trading platform.

What trading platforms does Interactive Brokers offer?

Interactive Brokers offers several platforms for forex trading, including Trader Workstation (TWS), Client Portal, and IBKR Mobile.

What currency pairs can I trade?

Interactive Brokers offers over 120 currency pairs, including major pairs like EUR/USD and USD/JPY, as well as minor and exotic pairs.

What are the risks of forex trading?

Forex trading carries significant risks, including the potential for large losses. It is important to understand the risks and manage them carefully.

How do I learn about forex trading?

Interactive Brokers provides educational resources, webinars, and access to experienced traders who can assist with your learning journey.

What is the minimum deposit required to trade forex with Interactive Brokers?

The minimum deposit for a forex account at Interactive Brokers varies based on your country of residence.

What are the fees associated with forex trading at Interactive Brokers?

Interactive Brokers charges commissions on each trade, as well as currency conversion fees.

How do I withdraw funds from my forex account?

You can withdraw funds from your forex account through the Client Portal or by contacting customer support.