- Trade Stocks or Forex: A Comprehensive Guide to Financial Markets

-

FAQ about Trading Stocks or Forex

- 1. What is the difference between stocks and forex?

- 2. Which is better, trading stocks or forex?

- 3. How do I start trading?

- 4. What is a trading platform?

- 5. What is a position?

- 6. What is leverage?

- 7. What is a spread?

- 8. How do I manage risk?

- 9. What is a technical indicator?

- 10. How do I make a profit?

Trade Stocks or Forex: A Comprehensive Guide to Financial Markets

Introduction

Hello there, readers! Welcome to the world of finance, where the possibilities are endless. Today, we’re diving into the exciting realm of trading stocks and forex, two avenues that offer ample opportunities for financial growth. Get ready to explore the intricacies of these markets, their advantages, and the strategies you need to succeed.

Trading Stocks

What Are Stocks?

Stocks represent fractional ownership in a publicly traded company. By investing in stocks, you become a shareholder and gain a portion of the company’s profits, growth, and assets. The stock market, where stocks are bought and sold, provides a platform for investors to trade companies they believe in and potentially make substantial returns.

Benefits of Trading Stocks

- Ownership in Growing Companies: Owning stocks in successful companies allows you to participate in their growth and share in their profits.

- Long-Term Appreciation: Stocks have historically performed well over the long term, offering the potential for significant returns.

- Diversification: Investing in stocks diversifies your portfolio and reduces your risk exposure. By owning shares in various companies across different industries, you mitigate the impact of downturns in any particular sector.

Trading Forex

What Is Forex?

Forex (Foreign Exchange) refers to the global market where currencies are bought and sold. It’s the largest and most liquid financial market in the world, with trillions of dollars traded daily. Forex trading involves speculating on the relative value of one currency to another.

Benefits of Trading Forex

- High Liquidity: Forex is highly liquid, allowing you to enter and exit trades quickly without significant price slippage.

- Global Market: Forex trading is accessible 24/5, making it convenient for traders around the world.

- Leverage: Forex brokers offer leverage, which enables traders to amplify their profits but also increases their risk.

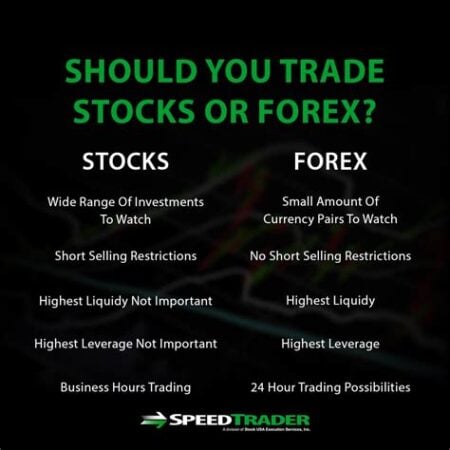

Comparison of Stocks vs. Forex

| Feature | Stocks | Forex |

|---|---|---|

| Ownership | Fractional ownership in a company | No ownership |

| Underlying Asset | Shares of a company | Currencies |

| Trading Time | Varies depending on the exchange | 24/5 |

| Leverage | Not typically available | Available through brokers |

| Risk | Moderate to high | High due to leverage and currency volatility |

| Returns | Potential for significant long-term returns | Short-term speculative returns |

The Decision: Stocks or Forex?

The choice between stocks and forex depends on your financial goals, risk tolerance, and investment horizon. If you’re looking for long-term growth and diversification, stocks may be a more suitable option. However, if you’re comfortable with higher risk and prefer short-term trading, forex might be more appropriate.

Tips for Success in Trading

Regardless of whether you choose stocks or forex, follow these tips for success:

- Educate Yourself: Invest time in learning fundamental market principles and technical analysis techniques.

- Manage Your Risk: Determine your risk tolerance and implement proper risk management strategies.

- Plan Your Trades: Define your entry and exit points clearly before entering a trade.

- Stay Disciplined: Stick to your trading plan and avoid emotional decision-making.

- Seek Professional Advice: Consult with a financial advisor if needed to guide you through the process.

Conclusion

Trading stocks or forex can be a lucrative and rewarding endeavor. However, it’s essential to approach these markets with knowledge, strategy, and a healthy dose of discipline. By embracing the principles discussed in this article, you can increase your chances of success in the world of finance.

So, readers, explore these markets, weigh your options, and embark on your financial journey with confidence. Remember, we’ve got a treasure trove of other articles on finance and investing waiting for you. Check them out to enhance your knowledge and make informed decisions in your financial endeavors.

FAQ about Trading Stocks or Forex

1. What is the difference between stocks and forex?

- Stocks: Represent ownership in a company and can fluctuate in value based on the company’s performance.

- Forex: Refers to the foreign exchange market where currencies are traded against each other.

2. Which is better, trading stocks or forex?

- The better option depends on individual preferences and risk tolerance. Stocks offer potential for growth but also risk, while forex offers high liquidity but can also be volatile.

3. How do I start trading?

- Open a trading account with a reputable broker, fund it, and learn about the basics of trading.

4. What is a trading platform?

- A software or website that allows traders to access markets, place orders, and monitor their trades.

5. What is a position?

- An open trade represents a purchase or sale of an asset, called a position.

6. What is leverage?

- Allows traders to borrow funds to increase their trading power, but also amplifies potential losses.

7. What is a spread?

- The difference between the bid and ask prices of an asset, which is the broker’s commission.

8. How do I manage risk?

- Use stop-loss orders, monitor positions, and manage leverage wisely to mitigate potential losses.

9. What is a technical indicator?

- A tool used to analyze price trends and identify potential trading opportunities.

10. How do I make a profit?

- Buy an asset at a lower price and sell it at a higher price (long position), or sell an asset at a higher price and buy it back at a lower price (short position).