- Hello Traders! Welcome to the World of Forex Trading on Interactive Brokers!

- Unleashing the Power of Interactive Brokers for Forex Trading

- Mastering Forex Trading Strategies

- Forex Trading on Interactive Brokers: A Detailed Comparison

- Conclusion

-

FAQ about Forex Trading on Interactive Brokers

- What is forex trading?

- What is FXTrader?

- What currency pairs can I trade on FXTrader?

- What is leverage in forex trading?

- How do I open a forex trading account with Interactive Brokers?

- What are the account requirements for forex trading?

- What are the trading fees on FXTrader?

- Does FXTrader offer educational resources?

- How do I withdraw funds from a forex trading account?

- Is forex trading profitable?

Hello Traders! Welcome to the World of Forex Trading on Interactive Brokers!

Greetings, dear readers! Are you ready to dive into the exciting world of forex trading on one of the most popular platforms, Interactive Brokers? Get ready for a comprehensive journey where we’ll uncover the ins and outs of this dynamic market.

Unleashing the Power of Interactive Brokers for Forex Trading

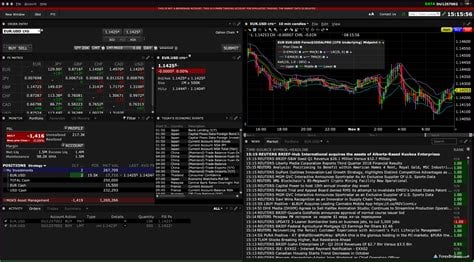

A Trader’s Paradise: State-of-the-Art Platform

Interactive Brokers (IB) empowers traders with a robust and user-friendly platform that caters to both seasoned veterans and aspiring traders alike. With lightning-fast execution speeds, advanced charting tools, and an array of customizable settings, IB provides the optimal environment for executing precise trades and optimizing your strategies.

Global Market Access: Connect to the Trading Hub

Step into a global marketplace with IB’s extensive connectivity to numerous exchanges and liquidity providers worldwide. This unparalleled access allows traders to tap into diverse currency pairs, ensuring you never miss an opportunity to capitalize on market fluctuations.

Mastering Forex Trading Strategies

Dive into Technical Analysis: Unraveling Market Patterns

Master the art of technical analysis by utilizing IB’s comprehensive arsenal of charting tools. Identify support and resistance levels, decipher trendlines, and recognize chart patterns like a seasoned pro. With the ability to analyze multiple time frames and employ various technical indicators, you’ll gain a deeper understanding of market behavior and make informed trading decisions.

Embrace Fundamental Analysis: Understanding Economic Factors

Delve into the world of fundamental analysis and unravel the impact of economic events, central bank policies, and geopolitical factors on currency movements. Armed with the knowledge gained from IB’s real-time news and economic calendar, you’ll stay ahead of the curve and make strategic trades based on macroeconomic trends.

Risk Management: Essential Pillars for Success

In the realm of forex trading, risk management is paramount. IB provides a suite of risk management tools to safeguard your investments. Set stop-loss and take-profit orders to limit potential losses and lock in profits. Utilize position sizing strategies to manage your risk exposure and maintain a balanced portfolio.

Forex Trading on Interactive Brokers: A Detailed Comparison

| Feature | Interactive Brokers |

|—|—|—|

| Trading Platform | Trader Workstation, IBKR Mobile App |

| Execution Speed | High-speed with low latency |

| Market Connectivity | Access to multiple exchanges and liquidity providers |

| Trading Tools | Advanced charting, technical indicators, fundamental analysis suite |

| Risk Management | Stop-loss, take-profit orders, position sizing strategies |

| Account Types | Individual, joint, corporate |

| Commission Fees | Competitive, varies based on account type and trading volume |

Conclusion

Navigating the world of forex trading on Interactive Brokers requires a combination of knowledge, strategy, and risk management. Embrace the features and tools offered by IB, and you’ll elevate your trading journey to new heights.

As you continue your exploration, be sure to check out our other articles on forex trading, where we delve deeper into specific strategies, market analysis, and expert insights. Stay tuned for more valuable content that will empower you to conquer the forex markets with confidence.

FAQ about Forex Trading on Interactive Brokers

What is forex trading?

Answer: Forex trading, also known as foreign exchange trading, is the buying and selling of currencies with the aim of profiting from fluctuations in their exchange rates.

What is FXTrader?

Answer: FXTrader is an advanced trading platform offered by Interactive Brokers that provides access to a wide range of forex markets.

What currency pairs can I trade on FXTrader?

Answer: FXTrader offers trading in over 100 currency pairs, including major, minor, and exotic pairs.

What is leverage in forex trading?

Answer: Leverage allows traders to trade with more capital than they have available, which can amplify both profits and losses. Interactive Brokers offers leverage of up to 50:1 for forex pairs.

How do I open a forex trading account with Interactive Brokers?

Answer: You can open a forex trading account by visiting the Interactive Brokers website and completing the application process.

What are the account requirements for forex trading?

Answer: The minimum deposit requirement for a forex trading account is $10,000. However, it is recommended to have a larger account balance to accommodate potential losses.

What are the trading fees on FXTrader?

Answer: Interactive Brokers charges a commission-based fee structure for forex trading. The fees vary based on the currency pair being traded and the account type.

Does FXTrader offer educational resources?

Answer: Yes, FXTrader provides a range of educational resources, including tutorials, webinars, and a dedicated knowledge base.

How do I withdraw funds from a forex trading account?

Answer: You can withdraw funds from your forex trading account by contacting Interactive Brokers’ support team. Funds can be withdrawn through wire transfer or check.

Is forex trading profitable?

Answer: Forex trading can be profitable, but it also carries a high level of risk. It is important to have a sound trading strategy, proper risk management, and a deep understanding of the markets before engaging in forex trading.