- Introduction

- Choosing the Right Forex Broker

- Opening a Forex Trading Account

- Fundamental Forex Trading Concepts

- Forex Trading Strategies

- Benefits and Risks of Forex Trading

- Forex Trading Educational Resources

- Conclusion

-

FAQ about Forex Trading Create Account

- 1. What is a forex trading account?

- 2. How do I create a forex trading account?

- 3. What are the different types of forex trading accounts?

- 4. How much money do I need to open a forex trading account?

- 5. What are the benefits of using a forex trading account?

- 6. What are the risks of using a forex trading account?

- 7. How do I choose a forex trading account?

- 8. What is the best forex trading account for beginners?

- 9. How do I fund my forex trading account?

- 10. How do I withdraw money from my forex trading account?

Introduction

Welcome, readers! Are you looking to venture into the exciting world of forex trading? If so, you’ve come to the right place. In this comprehensive guide, we’ll walk you through everything you need to know about creating a forex trading account and starting your journey towards financial freedom. So, grab a cup of coffee, sit back, and let’s dive right in.

Choosing the Right Forex Broker

When selecting a forex broker, it’s essential to consider several key factors:

Regulation and Reputation

Verify that the broker is regulated by a reputable financial authority, such as the FCA or ASIC. This ensures that the broker operates within established guidelines and adheres to industry best practices.

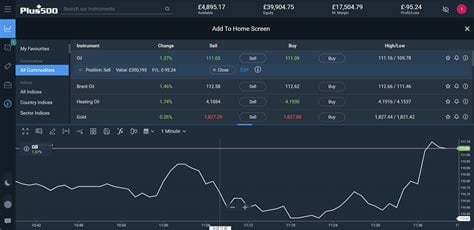

Trading Platform and Tools

Evaluate the trading platform offered by the broker. Ensure it’s user-friendly, reliable, and provides access to advanced trading tools and features.

Account Types and Fees

Compare the different account types and fee structures offered by brokers. Choose an account type that aligns with your trading style and budget. Consider spreads, commissions, and any other fees associated with trading.

Opening a Forex Trading Account

Step 1: Gather Required Documents

Most brokers will require you to provide identification documents, such as a passport or driver’s license, and proof of residence, such as a utility bill.

Step 2: Complete the Application Form

Fill out the online or paper application form with your personal and financial information. Carefully review the terms and conditions before submitting your application.

Step 3: Fund Your Account

Once your account is approved, you’ll need to fund it with the amount you wish to trade. Brokers offer various deposit methods, such as bank wire transfers, credit cards, and e-wallets.

Fundamental Forex Trading Concepts

Currency Pairs

In forex trading, you trade currencies in pairs, such as EUR/USD or GBP/JPY. The first currency in the pair is the base currency, and the second is the quote currency.

Leverage

Leverage allows you to control a larger position than your account balance. While it can magnify your profits, it also amplifies potential losses. Use leverage responsibly.

Spread

The spread is the difference between the bid and ask prices of a currency pair. It represents the broker’s commission for executing your trade.

Forex Trading Strategies

Scalping

Scalping involves making multiple small trades within a short period, taking advantage of small price movements.

Trend Trading

Trend traders aim to capture profits by riding market trends. They hold positions for longer periods, aiming to maximize gains during trend reversals.

News Trading

News traders speculate on currency price movements based on news events that may impact the market.

Benefits and Risks of Forex Trading

Benefits

- Potential for high returns

- 24/7 market access

- Leverage can amplify profits

Risks

- Loss of capital

- Currency fluctuations

- High risk of leverage

Forex Trading Educational Resources

| Resource | Description |

|---|---|

| Trading Academy | Comprehensive educational material for beginners and experienced traders |

| Demo Accounts | Practice trading in a simulated environment without risking real funds |

| Webinars and Seminars | Live and recorded educational sessions hosted by experts |

| Forex Trading Books | In-depth guides on trading strategies, market analysis, and risk management |

Conclusion

Creating a forex trading account is the first step towards embarking on an exciting and potentially lucrative journey. By following the steps outlined in this article, you can open an account with a reputable broker, understand fundamental trading concepts, and explore different strategies. Remember, forex trading carries both benefits and risks. Educate yourself thoroughly, practice diligently, and always trade responsibly.

And that’s it for today! If you found this article helpful, be sure to check out our other educational resources on forex trading, cryptocurrencies, and other investment topics. Happy trading!

FAQ about Forex Trading Create Account

1. What is a forex trading account?

A forex trading account is an account with a brokerage firm that allows you to buy and sell currencies. It’s similar to a bank account, but instead of holding cash, you hold currencies.

2. How do I create a forex trading account?

To create a forex trading account, you’ll need to find a brokerage firm and open an account. You’ll provide some personal information, such as your name and address, and you’ll need to deposit funds into your account.

3. What are the different types of forex trading accounts?

There are two main types of forex trading accounts: live accounts and demo accounts. Live accounts use real money, while demo accounts use virtual money. Demo accounts are a good way to learn how to trade forex without risking any real money.

4. How much money do I need to open a forex trading account?

The minimum deposit amount varies depending on the brokerage firm. Some firms require a minimum deposit of $100, while others require a minimum deposit of $1,000 or more.

5. What are the benefits of using a forex trading account?

There are many benefits to using a forex trading account, including:

- Potential for profit: Forex trading can be a profitable way to invest your money.

- Flexibility: You can trade forex 24 hours a day, 5 days a week.

- Liquidity: Forex is the most liquid market in the world, meaning that you can easily buy and sell currencies.

6. What are the risks of using a forex trading account?

There are also some risks associated with forex trading, including:

- Loss of capital: You can lose money when you trade forex.

- Market volatility: The forex market can be volatile, meaning that prices can change quickly.

- Leverage: Leverage can magnify your profits, but it can also magnify your losses.

7. How do I choose a forex trading account?

When choosing a forex trading account, you should consider the following factors:

- The minimum deposit amount

- The fees and commissions

- The customer service

- The trading platform

8. What is the best forex trading account for beginners?

The best forex trading account for beginners is a demo account. This will allow you to learn how to trade forex without risking any real money.

9. How do I fund my forex trading account?

You can fund your forex trading account with a variety of methods, including:

- Bank wire

- Credit card

- Debit card

- PayPal

10. How do I withdraw money from my forex trading account?

You can withdraw money from your forex trading account with a variety of methods, including:

- Bank wire

- Credit card

- Debit card

- PayPal