- Introduction

- Benefits of Micro Forex Accounts

- Types of Micro Forex Accounts

- Choosing the Right Micro Forex Account

- Comparison of Micro Forex Account Providers

- Conclusion

-

FAQ about Micro Forex Accounts

- What is a micro forex account?

- What are the benefits of using a micro forex account?

- Who should consider using a micro forex account?

- How do I open a micro forex account?

- What is the minimum deposit required for a micro forex account?

- What is the spread on a micro forex account?

- Can I use leverage with a micro forex account?

- How do I calculate the profit or loss on a micro forex trade?

- Can I make a profit with a micro forex account?

- Where can I learn more about micro forex accounts?

Introduction

Greetings, readers! Are you intrigued by the world of forex trading but overwhelmed by the daunting prospect of significant investments? Fear not, for micro forex accounts have emerged as the perfect solution, offering a low-cost entry point into this captivating financial realm.

Micro forex accounts are designed specifically for novice traders, allowing them to test the waters with minimal risk. These accounts feature incredibly small lot sizes, typically starting at 0.01 micro-lot, which translates to a trade of just $1 per pip moved. This minuscule investment enables traders to hone their skills and gain valuable experience without the potential for substantial losses.

Benefits of Micro Forex Accounts

Reduced Risk

The most notable advantage of micro forex accounts lies in their inherent risk reduction. With micro-lot sizes, even significant market movements result in only marginal monetary fluctuations. This allows traders to experiment with different strategies and leverage without the fear of catastrophic financial consequences.

Flexibility and Convenience

Micro forex accounts offer unparalleled flexibility and convenience. They cater to traders of all experience levels and time constraints, as they can be accessed from anywhere with an internet connection. Furthermore, micro-lot sizes allow for precise position sizing, enabling traders to tailor their trades to their risk tolerance and capital.

Educational Tool

Micro forex accounts serve as an invaluable educational tool for aspiring traders. They provide a risk-free environment for exploring market dynamics, testing trading strategies, and refining risk management techniques. By experimenting with small-scale trades, traders can gain practical experience that translates directly to live trading.

Types of Micro Forex Accounts

Standard Micro Accounts

Standard micro accounts are the most basic type of micro forex account. They offer fixed spreads and minimal commissions, making them suitable for beginners who prioritize simplicity and transparency.

ECN Micro Accounts

ECN (Electronic Communication Network) micro accounts provide direct access to the interbank market, offering tighter spreads and improved liquidity. However, they typically involve higher commissions, which may not be ideal for low-volume traders.

Commission-Free Micro Accounts

Commission-free micro accounts eliminate the need for paying commissions on trades. Instead, they incorporate a small markup into the spread, making them more cost-effective for high-frequency traders.

Choosing the Right Micro Forex Account

Selecting the appropriate micro forex account is crucial for a successful trading experience. Here are some factors to consider:

- Spreads and Commissions: Compare the spreads and commissions offered by different brokers to ensure they align with your trading style and budget.

- Liquidity: Choose an account with sufficient liquidity to minimize slippage and ensure efficient order execution.

- Platform and Tools: Select a broker that provides a user-friendly trading platform and access to essential trading tools.

- Customer Support: Opt for a broker with responsive and knowledgeable customer support to address any inquiries or issues promptly.

Comparison of Micro Forex Account Providers

| Broker | Spreads | Commissions | Platform | Customer Support |

|---|---|---|---|---|

| Exness | 0.1-0.5 pips | $0 | MT4, MT5 | 24/7 |

| XM | 0.2-0.8 pips | $0 | MT4, MT5 | 24/5 |

| IC Markets | 0.5-1.0 pips | $0.3 | cTrader, MT4 | 24/7 |

| FBS | 0.3-1.0 pips | $0 | MT4, MT5 | 24/7 |

| AxiTrader | 0.2-0.6 pips | $0 | MT4, MT5 | 24/5 |

Conclusion

Micro forex accounts have revolutionized the accessibility of forex trading, empowering beginners to pursue their financial dreams with minimal risk. By carefully considering the factors discussed in this article, you can select the ideal micro forex account that matches your trading style and aspirations.

Remember, the path to trading success requires dedication, learning, and a commitment to prudent risk management. Embrace the opportunities presented by micro forex accounts and embark on your trading journey with confidence and a thirst for knowledge.

Explore additional articles on our website to further enhance your trading acumen and expand your financial horizons.

FAQ about Micro Forex Accounts

What is a micro forex account?

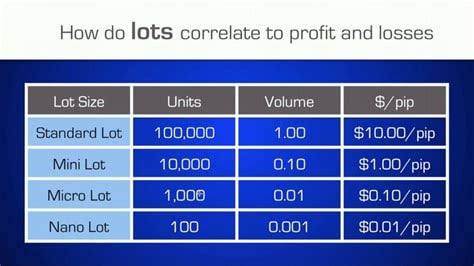

A micro forex account is a type of trading account that allows traders to trade with smaller lot sizes, typically 1,000 or 10,000 units of currency, compared to the standard lot size of 100,000 units.

What are the benefits of using a micro forex account?

Using a micro forex account allows traders to trade with less capital, manage their risk more effectively, and potentially reduce their losses.

Who should consider using a micro forex account?

Micro forex accounts are suitable for beginner traders, those with limited capital, or traders who want to test their strategies without risking a large amount of money.

How do I open a micro forex account?

You can open a micro forex account by contacting a forex broker that offers these accounts.

What is the minimum deposit required for a micro forex account?

The minimum deposit required for a micro forex account varies depending on the broker. It can range from a few dollars to a few hundred dollars.

What is the spread on a micro forex account?

The spread is the difference between the bid and ask price of a currency pair. Micro forex accounts typically have slightly wider spreads than standard accounts.

Can I use leverage with a micro forex account?

Yes, you can use leverage with a micro forex account, but it is important to use it responsibly. Higher leverage increases both your potential profits and losses.

How do I calculate the profit or loss on a micro forex trade?

The profit or loss on a forex trade is calculated by multiplying the number of pips gained or lost by the pip value for the lot size traded.

Can I make a profit with a micro forex account?

Yes, it is possible to make a profit with a micro forex account, but it requires discipline, risk management, and a sound trading strategy.

Where can I learn more about micro forex accounts?

You can find plenty of resources online about micro forex accounts, including articles, videos, and webinars.