- Section 1: Starting Your Forex Trading Journey in the USA

- Section 2: Navigating the Forex Market in the USA

- Section 3: Considerations for Forex Traders in the USA

- Section 4: Table Breakdown: Factors to Consider for Forex Traders USA

- Section 5: Conclusion

-

FAQ about Forex Traders USA

- What is forex trading?

- How does forex trading work?

- What are the risks of forex trading?

- What are the benefits of forex trading?

- What is a forex broker?

- How do I choose a forex broker?

- What is the minimum deposit required for forex trading?

- What is leverage in forex trading?

- What is a forex trading strategy?

- How do I become a successful forex trader?

Greetings, readers!

Embarking on the world of Forex trading in the United States requires an understanding of the specific regulations, considerations, and opportunities unique to this market. This comprehensive guide will provide you with an in-depth exploration of Forex traders USA, empowering you to navigate this dynamic financial landscape with confidence.

Section 1: Starting Your Forex Trading Journey in the USA

Sub-Section 1.1: Understanding the Regulatory Landscape

The Forex market in the US is regulated by the Commodity Futures Trading Commission (CFTC). Brokers operating in the United States must adhere to strict regulations to ensure transparency, fairness, and investor protection.

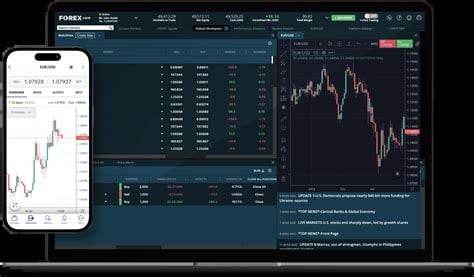

Sub-Section 1.2: Choosing a Reputable Forex Broker

Selecting a reputable Forex broker is crucial for successful trading. Consider factors such as regulation, trading platform, fees, spreads, and customer support when evaluating potential brokers.

Section 2: Navigating the Forex Market in the USA

Sub-Section 2.1: Currency Pairs and Market Hours

The US Forex market operates 24 hours a day, from 5 pm EST on Sunday to 5 pm EST on Friday. Major currency pairs like EUR/USD, GBP/USD, and USD/JPY are actively traded during these hours.

Sub-Section 2.2: Trading Strategies and Risk Management

Develop a robust trading strategy that aligns with your risk tolerance. Implement effective risk management techniques, such as stop-loss orders and position sizing, to mitigate potential losses.

Section 3: Considerations for Forex Traders in the USA

Sub-Section 3.1: Tax Implications

Forex trading profits are subject to taxation in the United States. Understand the tax laws applicable to your situation to avoid any legal or financial complications.

Sub-Section 3.2: Brokerage Fees and Spreads

Forex brokers typically charge fees for their services, including trading commissions and spreads. Choose a broker that offers competitive fees to maximize your trading profits.

Section 4: Table Breakdown: Factors to Consider for Forex Traders USA

| Factor | Consideration |

|---|---|

| Regulation | Choose a CFTC-regulated broker |

| Brokerage Fees | Compare commissions and spreads |

| Trading Platform | Select a user-friendly and reliable platform |

| Currency Pairs | Focus on major currency pairs for liquidity |

| Market Hours | Trade during active trading hours for optimal execution |

| Risk Management | Implement stop-loss orders and position sizing |

| Tax Implications | Understand the tax laws applicable to Forex trading |

Section 5: Conclusion

This comprehensive guide has provided you with an in-depth understanding of Forex traders USA. By embracing the insights and recommendations outlined in this article, you can confidently navigate the Forex market in the United States, seize trading opportunities, and achieve your financial goals.

Don’t forget to explore our other articles for additional insights on Forex trading, investment strategies, and financial literacy.

FAQ about Forex Traders USA

What is forex trading?

Forex trading, also known as foreign exchange trading, involves buying and selling currencies on the foreign exchange market.

How does forex trading work?

Forex traders buy and sell currency pairs, such as EUR/USD, GBP/JPY, or USD/CAD, speculating on changes in their exchange rates.

What are the risks of forex trading?

Forex trading carries significant risks, including potential losses of capital, leverage risks, and market volatility.

What are the benefits of forex trading?

Forex trading offers potential opportunities for profit, flexibility in trading hours, and access to a global market.

What is a forex broker?

A forex broker is a company that provides traders with access to the forex market, executing their trades and facilitating currency exchanges.

How do I choose a forex broker?

Choose a reputable and regulated broker with low fees, reliable trading platforms, and excellent customer support.

What is the minimum deposit required for forex trading?

The minimum deposit varies depending on the broker, but it can range from a few hundred dollars to thousands of dollars.

What is leverage in forex trading?

Leverage allows traders to trade with a larger position size than their account balance, potentially increasing profits but also magnifying losses.

What is a forex trading strategy?

A forex trading strategy is a set of rules or guidelines that traders use to make decisions about entering and exiting trades.

How do I become a successful forex trader?

Becoming a successful forex trader requires education, practice, risk management, and patience.