- Introduction

- Forex Market Overview

- Types of Forex Traders in the USA

- Forex Trading Strategies

- Risk Management for Forex Traders in the USA

- Resources for Forex Traders in the USA

- Conclusion

-

FAQ about Forex Trader in USA

- 1. What is forex trading?

- 2. Is forex trading legal in the USA?

- 3. Do I need a license to trade forex in the USA?

- 4. What are the requirements to become a forex trader in the USA?

- 5. How much money do I need to start forex trading in the USA?

- 6. What are the risks of forex trading?

- 7. What are the benefits of forex trading?

- 8. How do I choose a forex broker in the USA?

- 9. What are the tax implications of forex trading in the USA?

- 10. Where can I learn more about forex trading?

Introduction

Greetings, readers! Welcome to the comprehensive guide to forex trading in the United States. Forex trading, or foreign exchange trading, involves buying and selling currencies from different countries to make a profit from currency rate fluctuations. The forex market is the world’s largest financial market, providing ample opportunities for individuals and institutions to invest and trade.

Whether you’re a seasoned trader or just starting, this guide will provide you with crucial information about forex trading in the USA. We will delve into the basics, including market structure, trading strategies, risk management, and resources available to traders. So, buckle up and get ready to embark on your forex trading journey in the United States.

Forex Market Overview

Market Structure

The forex market operates 24 hours a day, five days a week, with trading taking place in different financial centers around the world. It involves trading currency pairs, such as EUR/USD (euro versus US dollar), GBP/JPY, (British pound versus Japanese yen), and AUD/CAD (Australian dollar versus Canadian dollar). The exchange rate between any two currencies constantly fluctuates due to various factors, such as economic data, political events, and supply and demand.

Market Participants

The forex market is a global decentralized market with traders comprising banks, financial institutions, hedge funds, retail traders, and central banks. Each participant has different motivations, strategies, and trading volumes, contributing to the liquidity and volatility of the market.

Types of Forex Traders in the USA

Institutional Traders

Institutional traders include banks, hedge funds, and large investment firms. They typically trade in large volumes, using advanced trading platforms and strategies to speculate on market trends and hedge against risk.

Retail Traders

Retail traders are individuals who trade forex on a smaller scale. They may trade for profit or as a hobby. Retail traders often use online brokers to access the market and employ various trading strategies based on their risk tolerance and knowledge.

Advantages of Forex Trading in the USA

1. Strong Regulatory Environment: The forex market in the USA is regulated by the Commodity Futures Trading Commission (CFTC), which ensures fair and transparent trading practices.

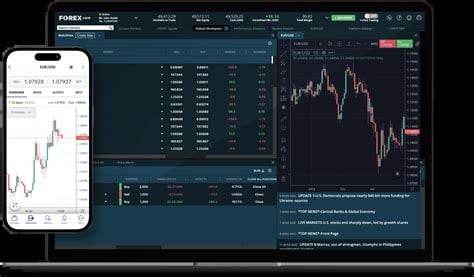

2. Access to Advanced Trading Platforms: Retail traders in the USA have access to a wide range of sophisticated trading platforms that provide real-time market data, charting tools, and risk management features.

3. High Liquidity and Low Spreads: The forex market is highly liquid, allowing traders to execute orders quickly and efficiently with minimal slippage. Additionally, the spreads between bid and ask prices are often very tight, reducing trading costs.

Forex Trading Strategies

Scalping

Scalping is a short-term trading strategy that involves entering and exiting trades within minutes or seconds, capturing small profits from minor price movements. Scalpers use technical analysis to identify short-term trends and rely on tight stop-loss and take-profit orders.

Day Trading

Day trading involves holding positions overnight, but with the intention of closing them before the market closes for the day. Day traders typically use technical analysis to identify trading opportunities based on market conditions and patterns.

Swing Trading

Swing trading is a medium-term strategy where traders hold positions for several days or weeks, seeking to profit from larger price swings. Swing traders focus on identifying and trading potential trends using a combination of technical and fundamental analysis.

Risk Management for Forex Traders in the USA

Setting Stop-Loss Orders

A stop-loss order is a crucial risk management tool that automatically closes a trade when the price reaches a predetermined level, limiting potential losses. Retail traders in the USA should understand the importance of using stop-loss orders to protect their capital.

Position Sizing

Position sizing refers to determining the amount of capital to allocate to each trade. Proper position sizing helps traders manage risk and prevent excessive losses. Traders should consider their risk tolerance and account balance when deciding on position size.

Resources for Forex Traders in the USA

Forex Brokers

Forex brokers provide platforms for traders to access the forex market and facilitate trading. It is essential to choose a reputable and regulated broker that offers competitive spreads, low commissions, and reliable customer support.

Trading Education

Education is paramount in forex trading. Traders can access educational resources from online courses, webinars, books, and articles to enhance their knowledge and trading skills.

Economic Calendar

Staying informed about economic events and data releases is crucial for successful forex trading. Traders can access economic calendars to keep track of upcoming events that may impact currency prices.

| Currency | Symbol | Country |

|---|---|---|

| US Dollar | USD | United States |

| Euro | EUR | European Union |

| Japanese Yen | JPY | Japan |

| British Pound | GBP | United Kingdom |

| Swiss Franc | CHF | Switzerland |

| Canadian Dollar | CAD | Canada |

| Australian Dollar | AUD | Australia |

| New Zealand Dollar | NZD | New Zealand |

Conclusion

Forex trading in the USA offers exciting opportunities for investors and traders. Understanding the market structure, employing suitable trading strategies, and implementing effective risk management practices are key to achieving success. By leveraging the resources and regulations available, individuals can navigate the forex market in the United States with confidence and make informed trading decisions.

If you’re eager to start your forex trading journey, check out our other articles on choosing a reputable broker, understanding technical analysis, and developing a profitable trading strategy. Keep learning, practice, and make wise use of the resources at your disposal to increase your chances of success.

FAQ about Forex Trader in USA

1. What is forex trading?

Foreign exchange (forex) trading involves buying and selling currencies with the aim of profiting from price fluctuations.

2. Is forex trading legal in the USA?

Yes, forex trading is legal in the USA for both retail and institutional traders.

3. Do I need a license to trade forex in the USA?

No, you do not need a license to trade forex in the USA. However, you may need to register with the Financial Industry Regulatory Authority (FINRA).

4. What are the requirements to become a forex trader in the USA?

To become a forex trader in the USA, you will need a brokerage account with a regulated forex broker. You will also need a basic understanding of forex trading and financial markets.

5. How much money do I need to start forex trading in the USA?

The minimum deposit to open a forex trading account in the USA can vary depending on the broker you choose. Some brokers offer accounts with low minimum deposits, such as $100 or less.

6. What are the risks of forex trading?

Forex trading involves significant risk of loss. The value of currencies can fluctuate rapidly, and losses can occur even when a trader makes informed decisions.

7. What are the benefits of forex trading?

Forex trading offers the potential for high returns, as well as flexibility and 24/7 access to the market. It can also be a good way to diversify your investment portfolio.

8. How do I choose a forex broker in the USA?

When choosing a forex broker in the USA, consider factors such as regulation, fees, trading platforms, customer support, and reputation.

9. What are the tax implications of forex trading in the USA?

Forex trading is taxed as income in the USA. Gains and losses from forex trading are reported on your annual tax return.

10. Where can I learn more about forex trading?

There are numerous resources available to learn about forex trading, including books, online courses, and webinars. Additionally, many forex brokers offer educational materials and support to their traders.