- Introduction: Dive into the World of Forex Trading

- Step-by-Step Forex Trade Sign Up Process

- Exploring Forex Trading Strategies

- Essential Forex Trade Sign Up Checklist

- Conclusion

-

FAQ about Forex Trade Sign Up

- 1. What is Forex?

- 2. What is Forex Trading?

- 3. How do I sign up for Forex Trading?

- 4. What documents do I need to provide to sign up?

- 5. Is Forex trading legal?

- 6. Is Forex trading safe?

- 7. What is the minimum deposit required to start trading Forex?

- 8. How do I make a profit in Forex trading?

- 9. What are the risks involved in Forex trading?

- 10. How do I choose a Forex broker?

Introduction: Dive into the World of Forex Trading

Greetings, readers! Welcome to the thrilling world of forex trading. Whether you’re a seasoned pro or just starting your journey, this comprehensive guide will arm you with the knowledge and tools you need to sign up for an account and start trading the currency markets.

Forex trading involves buying and selling currencies in pairs, like EUR/USD or GBP/CAD. It’s one of the largest and most liquid financial markets globally, offering countless opportunities to profit from currency fluctuations.

Step-by-Step Forex Trade Sign Up Process

1. Choosing a Forex Broker

The first step in forex trade sign up is selecting a reputable broker. Look for a broker that offers:

- Low spreads (the difference between the buy and sell price)

- Competitive fees and commissions

- Positive reviews and a strong reputation in the industry

- Access to a robust trading platform with advanced features

2. Creating Your Trading Account

Once you’ve chosen a broker, you’ll need to create a trading account. Typically, this involves providing personal information, verifying your identity, and setting up your account preferences.

- Account Types: Brokers may offer different account types tailored to different experience levels and trading strategies.

- Account Funding: You’ll need to deposit funds into your account to start trading. Brokers may offer various funding options like bank transfers, e-wallets, or credit cards.

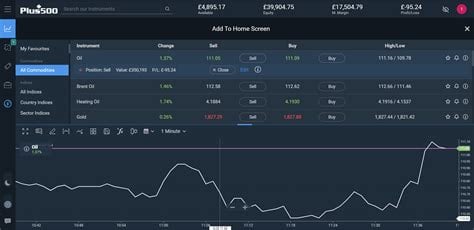

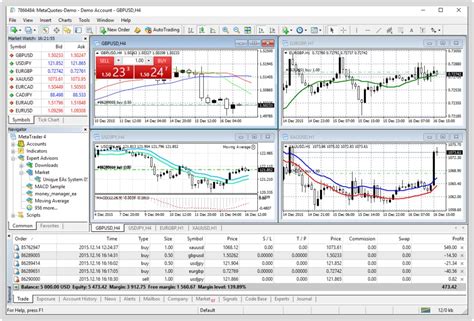

3. Familiarizing Yourself with the Trading Platform

Each broker provides its own trading platform, which is the software you’ll use to execute trades, monitor your account, and analyze market data.

- Getting Started: Take some time to explore the platform’s features and familiarize yourself with its functionality.

- Demo Account: Many brokers offer demo accounts where you can practice trading without risking real money.

Exploring Forex Trading Strategies

1. Technical Analysis

Technical analysts use historical price data to identify patterns and predict future currency movements.

- Chart Patterns: Traders use candlestick charts to study historical price patterns that signal potential market trends.

- Technical Indicators: Mathematical formulas and statistical calculations help traders analyze price trends and identify overbought or oversold conditions.

2. Fundamental Analysis

Fundamental analysts focus on macroeconomic factors that influence currency values, such as economic growth, interest rates, and political events.

- Economic Calendars: Traders use economic calendars to track important economic news releases that can impact currency prices.

- Fundamental News: Monitoring economic and political news can provide valuable insights into currency movements.

3. Scalping vs. Day Trading vs. Swing Trading

Different trading styles suit different experience levels and risk appetites:

- Scalping: Involves executing multiple small trades within a short time frame.

- Day Trading: Traders enter and exit positions within the same trading day.

- Swing Trading: Traders hold positions for several days or weeks, capitalizing on longer-term market fluctuations.

Essential Forex Trade Sign Up Checklist

| Step | Description |

|---|---|

| 1 | Choose a reputable forex broker |

| 2 | Create a trading account |

| 3 | Familiarize yourself with the trading platform |

| 4 | Choose your desired trading strategy |

| 5 | Determine your risk tolerance and trading style |

| 6 | Fund your account and start trading |

Conclusion

Signing up for forex trade is an exciting opportunity to enter the world of currency trading. By following the steps outlined in this guide and choosing a strategy that aligns with your risk tolerance and trading style, you can increase your chances of success in the forex markets.

Don’t forget to explore our other articles for more tips, insights, and strategies related to forex trading. Best of luck on your trading journey!

FAQ about Forex Trade Sign Up

1. What is Forex?

- Forex is the foreign exchange market, where currencies are traded.

2. What is Forex Trading?

- Forex trading involves buying and selling different currencies to make a profit from fluctuations in their exchange rates.

3. How do I sign up for Forex Trading?

- You need to choose a reputable Forex broker and create an account on their platform.

4. What documents do I need to provide to sign up?

- Typically, you will need to provide your ID, address proof, and bank statement.

5. Is Forex trading legal?

- Yes, Forex trading is legal in most countries, including the US, UK, and Australia.

6. Is Forex trading safe?

- Forex trading can be safe if you use a reputable broker and manage your risk responsibly.

7. What is the minimum deposit required to start trading Forex?

- The minimum deposit varies depending on the broker, but it can be as low as $100.

8. How do I make a profit in Forex trading?

- You make a profit by buying currencies when their price is low and selling them when their price is high.

9. What are the risks involved in Forex trading?

- Forex trading involves the risk of losing your investment, so it’s important to trade responsibly.

10. How do I choose a Forex broker?

- Consider factors such as regulation, fees, customer support, and trading platform.