- The Ultimate Guide to Forex Trade Apps: Supercharge Your Trading Experience

- Types of Forex Trade Apps

- Essential Features to Look for in a Forex Trade App

- Benefits of Using Forex Trade Apps

- Potential Drawbacks of Forex Trade Apps

- Comparative Table of Forex Trade Apps

- Conclusion

-

FAQ about Forex Trade Apps

- What is a forex trade app?

- Why should I use a forex trade app?

- What are the benefits of using a forex trade app?

- What are the different types of forex trade apps?

- How do I choose the right forex trade app for me?

- Are forex trade apps safe?

- What are the fees associated with using a forex trade app?

- How do I get started with a forex trade app?

- What should I keep in mind when using a forex trade app?

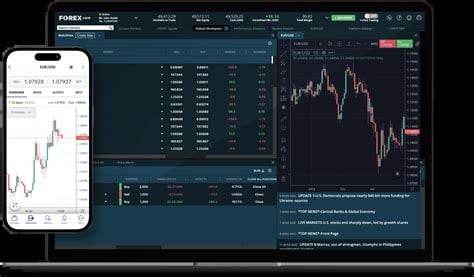

The Ultimate Guide to Forex Trade Apps: Supercharge Your Trading Experience

Hey there, readers! Welcome to our in-depth guide to the world of forex trade apps. If you’re a seasoned trader or just starting out, this article has everything you need to know to elevate your trading game. In this comprehensive guide, we’ll delve into the types of forex trade apps, their features, benefits, and potential drawbacks, so you can make an informed decision about the best app for your trading needs. Let’s dive right in!

Types of Forex Trade Apps

Specialized Forex Trading Apps

These apps are designed specifically for forex trading and offer a range of features tailored to traders’ needs. They provide access to live market data, charting tools, technical analysis indicators, and risk management tools. For serious traders who demand precision and control, specialized forex trading apps are an indispensable tool.

Multi-Asset Trading Apps

As the name suggests, these apps allow you to trade not only forex but also other financial instruments such as stocks, commodities, and cryptocurrencies. They are ideal for traders who want to diversify their portfolio and access multiple markets from a single platform.

Algorithmic Trading Apps

For traders who prefer to automate their trading strategies, algorithmic trading apps are the perfect solution. These apps allow you to create and execute algorithms that automatically buy and sell currencies based on pre-defined criteria. They’re a great option for traders who want to remove emotion from their trading and optimize their returns.

Essential Features to Look for in a Forex Trade App

Live Market Data

Real-time access to market data is crucial for making informed trading decisions. Look for apps that provide up-to-date quotes, charts, and news updates to keep you on top of the latest market movements.

Advanced Charting Tools

Technical analysis is an essential aspect of forex trading, and having access to powerful charting tools can significantly enhance your analysis. Choose apps that offer a variety of chart types, indicators, and drawing tools to help you identify trends and trading opportunities.

Risk Management Tools

Managing risk is paramount in forex trading. Look for apps that provide features such as stop-loss and take-profit orders, margin calculators, and volatility alerts to help you mitigate potential losses and protect your capital.

User-Friendly Interface

The user interface of a forex trade app should be intuitive and easy to navigate. Look for apps that are designed with the trader in mind, providing quick access to essential features and a customizable dashboard to suit your preferences.

Customer Support

Reliable customer support can make a big difference when you encounter technical issues or have questions about the app. Choose apps that offer responsive support through live chat, email, or phone to ensure you get the assistance you need quickly.

Benefits of Using Forex Trade Apps

Convenience and Accessibility

Forex trade apps empower you to trade from anywhere with an internet connection. They allow you to stay connected to the markets and make trades on the go, giving you the flexibility to trade whenever and wherever it suits you.

Enhanced Analysis and Decision-Making

With live market data, advanced charting tools, and technical indicators, forex trade apps provide traders with a wealth of information to make informed decisions. The ability to analyze charts and identify trading opportunities in real-time can significantly improve your trading success.

Automated Trading

Algorithmic trading apps automate the trading process, removing the need for manual intervention. This can free up your time, reduce emotional decision-making, and optimize your trading results based on pre-defined criteria.

Risk Management

Forex trade apps offer a range of risk management tools to help you protect your capital. Stop-loss orders, take-profit orders, and margin calculators allow you to set limits on your losses and manage your risk exposure effectively.

Cost-Effectiveness

Compared to traditional brokerage services, forex trade apps are often more cost-effective. They typically charge lower fees and commissions, making them an attractive option for traders who want to maximize their profits.

Potential Drawbacks of Forex Trade Apps

Limited Features

While some forex trade apps offer a comprehensive suite of features, others may be more limited in their functionality. Consider your specific trading needs and choose an app that provides the features you require.

Connectivity Issues

Stable internet connectivity is essential for using forex trade apps. If your internet connection is unreliable, you may experience delays or disruptions in your trading.

Technical Glitches

Like any software, forex trade apps can occasionally experience technical glitches. These glitches can affect the accuracy of data, the execution of trades, or the overall functionality of the app.

Security Concerns

As with any online platform that handles financial transactions, security is a primary concern. Choose apps that employ robust security measures to protect your personal and financial data from unauthorized access or fraud.

Comparative Table of Forex Trade Apps

| App Name | Features | Benefits | Drawbacks |

|---|---|---|---|

| MetaTrader 4 | Live market data, advanced charting tools, algorithmic trading, risk management | Widely used, customizable, reputable | Can be complex for beginners |

| cTrader | Intuitive interface, powerful charting tools, social trading | User-friendly, great for beginners | Limited features compared to some competitors |

| eToro | Multi-asset trading, social trading, copy trading | Easy to use, beginner-friendly | Higher fees for some trades |

| OANDA | Live market data, advanced charting tools, risk management | Reliable, reputable, transparent | Lack of algorithmic trading |

| IG | Multi-asset trading, advanced charting tools, comprehensive education | Extensive product offerings, award-winning | Higher spreads on some instruments |

Conclusion

Forex trade apps have revolutionized the way traders access and execute trades. With the right app, you can enjoy the convenience, enhanced analysis, automated trading, risk management, and cost-effectiveness that these apps offer. By understanding the different types of forex trade apps, their essential features, benefits, and potential drawbacks, you can make an informed decision about the best app for your trading needs. Don’t forget to check out our other articles for more in-depth insights into the world of forex trading and investments. Happy trading!

FAQ about Forex Trade Apps

What is a forex trade app?

- A forex trade app is a mobile or desktop application that allows traders to buy and sell foreign currencies.

Why should I use a forex trade app?

- Forex trade apps offer a convenient and accessible way to trade currencies from anywhere with an internet connection. They provide real-time quotes, charts, and analysis tools to help traders make informed decisions.

What are the benefits of using a forex trade app?

- Convenience: Trade anytime, anywhere with an internet connection.

- Real-time data: Access up-to-date currency quotes, charts, and news.

- Technical analysis: Use technical indicators and charting tools to analyze market trends.

- Risk management tools: Set stop-loss and take-profit orders to manage risk.

- Social trading: Share ideas and strategies with other traders within the app’s community.

What are the different types of forex trade apps?

- Mobile apps: Available on smartphones and tablets for on-the-go trading.

- Desktop apps: Designed for desktop computers and offer more advanced features.

- Web apps: Accessed through a web browser, providing a similar experience to desktop apps but without the need for installation.

How do I choose the right forex trade app for me?

- Consider your trading style, experience level, and devices you use. Read reviews and compare features to find an app that meets your specific needs.

Are forex trade apps safe?

- Reputable forex trade apps use SSL encryption and implement security measures to protect user data and transactions. However, it is always important to do your research and choose a reliable provider.

What are the fees associated with using a forex trade app?

- Fees can vary depending on the app and trading platform used. Look for apps with competitive spreads and low commissions to minimize trading costs.

How do I get started with a forex trade app?

- Create an account with the app’s provider. Fund your account and choose the currency pairs you wish to trade. Familiarize yourself with the app’s interface and features before placing any trades.

What should I keep in mind when using a forex trade app?

- Forex trading involves risk. Manage your risk by using appropriate position sizing and risk management tools. Monitor market news and economic events that can impact currency prices. Never invest more than you can afford to lose.