- A Beginner’s Guide to Understanding Forex Rates with OANDA

- Section 1: Forex Basics and OANDA’s Offerings

- Section 2: Factors Influencing Forex Rates

- Section 3: Utilizing FX Tools for Informed Decisions

- Section 4: Detailed Table Breakdown of Forex Trading

- Section 5: Enhancing Your Forex Knowledge

-

FAQ about OANDA’s Forex Rates

- What is a forex rate?

- What factors affect forex rates?

- Where can I find the latest forex rates?

- How can I track forex rates?

- How do I convert currency using OANDA?

- What payment methods does OANDA accept?

- How does OANDA calculate its forex rates?

- Is it possible for forex rates to change quickly?

- What is the best way to learn about forex trading?

- How can I open a forex trading account with OANDA?

A Beginner’s Guide to Understanding Forex Rates with OANDA

Introduction

Greetings, readers! Welcome to our comprehensive guide to forex rates, powered by the unparalleled services of OANDA, a leading provider in the foreign exchange market. In this article, we will embark on a journey to demystify the world of forex rates, empowering you with the knowledge to navigate this dynamic and potentially lucrative financial landscape.

Section 1: Forex Basics and OANDA’s Offerings

Understanding Forex

Forex, short for foreign exchange, refers to the buying and selling of currencies from different countries. It involves exchanging one currency for another, influencing the economic activities, travel, and investment decisions worldwide.

OANDA: Your Trusted Forex Partner

OANDA has earned its reputation as a trusted and reliable forex broker, offering traders of all levels access to competitive exchange rates, advanced trading platforms, and invaluable educational resources.

Section 2: Factors Influencing Forex Rates

Economic Indicators and Central Bank Decisions

Economic indicators, such as GDP growth, inflation rates, and employment data, significantly impact forex rates. Central bank decisions regarding interest rates and monetary policies also play a vital role.

Political and Geopolitical Events

Political stability, social unrest, and international relations can create volatility in forex rates. Major news events and policy changes can drastically influence the value of currencies.

Market Sentiment and Speculation

Forex rates are also affected by market sentiment and speculation. Trader and investor expectations of future economic conditions can drive currency movements.

Section 3: Utilizing FX Tools for Informed Decisions

Live Market Data and Charts

OANDA’s platform provides real-time market data and advanced charting tools, allowing traders to analyze currency pairs, identify trends, and make informed trading decisions.

Technical and Fundamental Analysis

Technical analysis involves studying historical price movements to identify patterns and predict future trends. Fundamental analysis delves into economic data and broader market factors to assess the intrinsic value of currencies.

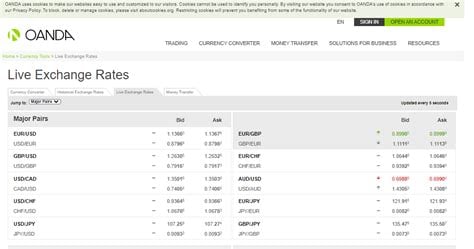

Section 4: Detailed Table Breakdown of Forex Trading

| Term | Description |

|---|---|

| Currency Pair | Two currencies traded against each other, e.g., EUR/USD |

| Bid/Ask Price | Buying and selling prices quoted by broker |

| Spread | Difference between bid and ask prices, usually measured in pips |

| Leverage | Borrowing funds to increase trading exposure, amplifying both potential profits and losses |

| Margin | Collateral required to maintain leveraged positions |

| Trading Volume | Number of units traded in a currency pair over a specific period |

Section 5: Enhancing Your Forex Knowledge

We highly encourage you to explore our other articles and resources dedicated to enhancing your understanding of forex trading. By continuously educating yourself, you can develop a deep understanding of market dynamics and optimize your trading strategies.

Conclusion

Navigating the forex market requires a strong understanding of forex rates and the factors that influence them. OANDA provides an exceptional platform and invaluable resources to support traders of all levels. We hope this comprehensive guide has equipped you with the knowledge and confidence to embark on your own forex trading journey.

FAQ about OANDA’s Forex Rates

What is a forex rate?

A forex rate, also known as an exchange rate, is the price of one currency in terms of another currency. For example, the EUR/USD exchange rate of 1.12 means that one euro is worth 1.12 US dollars.

What factors affect forex rates?

Numerous factors affect forex rates, including economic data, political events, geopolitical risks, and interest rate decisions.

Where can I find the latest forex rates?

You can find the latest forex rates on OANDA’s website or through our API.

How can I track forex rates?

You can track forex rates using a variety of methods, such as:

- Subscribing to our email or SMS alerts

- Using a forex rate tracking app

- Checking the OANDA website or API

How do I convert currency using OANDA?

You can convert currency using OANDA through our website or API.

What payment methods does OANDA accept?

OANDA accepts various payment methods, including credit cards, debit cards, bank transfers, and e-wallets.

How does OANDA calculate its forex rates?

OANDA calculates forex rates using a combination of market data, industry benchmarks, and proprietary algorithms.

Is it possible for forex rates to change quickly?

Yes, forex rates can change rapidly, especially during volatile market conditions.

What is the best way to learn about forex trading?

There are various ways to learn about forex trading, including:

- Reading books and articles

- Attending webinars and workshops

- Practicing with a demo account

How can I open a forex trading account with OANDA?

You can open a forex trading account with OANDA by following these steps:

- Visit our website

- Click on "Open Account"

- Complete the application form

- Submit your application