Forex Online Handeln: A Comprehensive Guide for Beginners and Experts

Greetings, Readers!

Welcome to our comprehensive guide on Forex online handeln. Whether you’re a seasoned trader or a newcomer to the world of currency trading, this article will provide you with a thorough understanding of everything you need to know about Forex online handeln.

Forex, short for Foreign Exchange, is the world’s largest and most liquid financial market, with trillions of dollars traded every day. Online Forex trading allows you to buy and sell currencies from anywhere in the world, 24 hours a day, 5 days a week.

Forex Trading Strategies

Before you start trading Forex online, it’s essential to develop a trading strategy. There are numerous strategies to choose from, each with its own strengths and weaknesses.

Fundamental Analysis

Fundamental analysis involves analyzing economic data, news events, and other factors that can affect currency prices. By understanding the underlying fundamentals of a currency, you can make informed trading decisions.

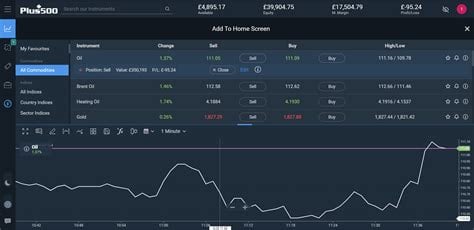

Technical Analysis

Technical analysis focuses on studying past price patterns to identify potential trading opportunities. By using charts and technical indicators, you can identify trends, support and resistance levels, and other technical factors that can guide your trading decisions.

Risk Management

Risk management is paramount in Forex online handeln. It’s crucial to protect your capital from potential losses. There are various risk management tools available, such as stop-loss orders and risk-reward ratios, which can help you minimize your risk exposure.

Currency Pairs

In Forex online handeln, you trade currency pairs, such as EUR/USD, GBP/JPY, and AUD/CHF. Each currency pair represents the value of one currency relative to another. By understanding the factors that influence the value of currency pairs, you can identify potential trading opportunities.

Forex Trading Platforms

To trade Forex online, you’ll need to choose a trading platform. There are numerous Forex brokers offering different platforms with varying features and functionality. Consider factors such as user-friendliness, trading tools, and spreads when selecting a trading platform.

Table: Key Aspects of Forex Online Handeln

| Aspect | Description |

|---|---|

| Market Size | Largest and most liquid financial market in the world |

| Trading Hours | 24/5, Monday to Friday |

| Currency Pairs | Traded in pairs, such as EUR/USD and GBP/JPY |

| Trading Strategies | Fundamental analysis, technical analysis, and risk management |

| Risk Management | Use stop-loss orders and risk-reward ratios to minimize losses |

| Trading Platforms | Choose a platform based on user-friendliness, trading tools, and spreads |

| Potential Returns | High potential returns, but also high risk |

Conclusion

Forex online handeln can be a rewarding endeavor, but it’s essential to approach it with a comprehensive understanding of the market and the risks involved. By following the strategies and tips outlined in this article, you can increase your chances of success in Forex trading.

For further exploration of Forex trading, we recommend checking out our other articles on technical analysis, risk management, and currency pairs. Good luck in your Forex trading journey!

FAQ about Forex Online Trading

What is forex trading?

Answer: Forex trading (FX) involves buying and selling currencies on the global currency market to make a profit.

How do I start forex trading?

Answer: Choose a reputable broker, open an account, learn about trading strategies, and practice on a demo account.

What are the benefits of forex trading?

Answer: High liquidity, 24/7 market availability, potential for high returns, and flexibility.

What are the risks of forex trading?

Answer: Loss of capital, high volatility, and emotional trading.

What is a currency pair?

Answer: A pair of currencies, such as EUR/USD, that are traded against each other.

What is leverage?

Answer: Borrowing money from your broker to increase your buying power, but also magnifying your potential loss.

What is a pip?

Answer: The smallest price movement of a currency pair, usually the fourth or fifth decimal.

What are the different forex trading strategies?

Answer: Scalping, day trading, swing trading, and position trading.

What is technical analysis?

Answer: Studying historical price data and patterns to predict future price movements.

What is fundamental analysis?

Answer: Analyzing economic and geopolitical factors that affect currency prices.