- Introduction

- Understanding the Role of a Forex Market Broker

- Types of Forex Market Brokers

- How to Choose a Forex Market Broker

- Benefits of Using a Forex Market Broker

- Forex Market Brokerage: A Comparative Table

- Conclusion

-

FAQ about Forex Market Broker

- 1. What is a Forex Market Broker?

- 2. How do Forex Market Brokers make money?

- 3. How do I choose a Forex Market Broker?

- 4. What is the difference between a Dealing Desk Broker (DD) and a Non-Dealing Desk Broker (NDD)?

- 5. How much leverage can I get from a Forex Market Broker?

- 6. What types of trading platforms do Forex Market Brokers offer?

- 7. How can I open a Forex trading account?

- 8. What is a Demo Account?

- 9. How do I withdraw money from my Forex trading account?

- 10. Are Forex Market Brokers regulated?

Introduction

Readers,

Welcome to the fascinating world of forex! As you embark on this financial adventure, it’s essential to equip yourself with knowledge and guidance. In this comprehensive guide, we will explore the realm of forex market brokers, your trusty companions in navigating the global currency market.

As we delve into the complexities of currency exchange, you will uncover the crucial role played by brokers in facilitating seamless transactions and ensuring a secure trading environment. So, buckle up and let’s dive into the intricacies of forex market brokerage.

Understanding the Role of a Forex Market Broker

1. Intermediaries in Currency Trading

At the heart of forex trading lies the role of a broker. They serve as intermediaries between traders and the vast network of liquidity providers, bridging the gap between the buy and sell orders. By connecting traders to the interbank market, brokers facilitate the execution of forex transactions efficiently.

2. Safeguarding Funds and Security

Beyond their intermediary function, forex market brokers play a vital role in safeguarding trader funds and ensuring the security of transactions. They are regulated by financial authorities to adhere to strict compliance measures and provide robust security protocols to protect sensitive information. This regulatory oversight instills confidence and trust in the trading process.

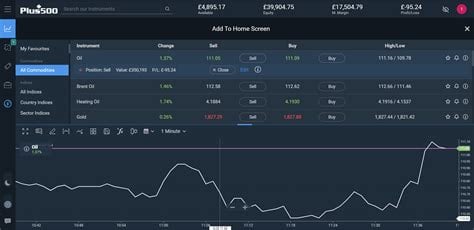

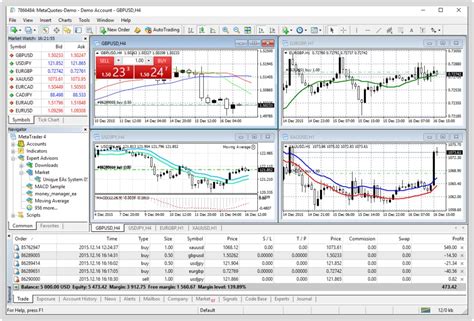

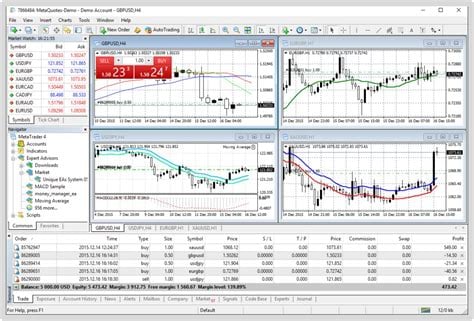

3. Access to Trading Platforms and Tools

Reputable forex market brokers provide traders with access to state-of-the-art trading platforms and sophisticated tools. These platforms offer real-time market data, advanced charting capabilities, and automated trading options. By equipping traders with such tools, brokers empower them to make informed decisions and execute trades with precision.

Types of Forex Market Brokers

1. Dealing Desk Brokers (DD Brokers)

Dealing desk brokers operate as market makers, quoting buy and sell prices based on the prevailing market conditions. They facilitate transactions within their own network, offering traders a more personalized experience and tighter spreads. However, DD brokers may face potential conflicts of interest as their profit margin is derived from the spread between the quoted prices.

2. No Dealing Desk Brokers (NDD Brokers)

No dealing desk brokers provide direct access to the interbank market, eliminating the potential for conflicts of interest. They act as execution-only brokers, passing on the market quotes to traders without any intervention. As a result, NDD brokers offer greater transparency and potentially lower spreads.

How to Choose a Forex Market Broker

1. Regulatory Compliance

When selecting a forex market broker, it is paramount to prioritize regulatory compliance. Ensure that the broker is licensed and regulated by a reputable financial authority, such as the Financial Conduct Authority (FCA) in the UK or the National Futures Association (NFA) in the US. This compliance guarantees adherence to ethical standards and responsible practices.

2. Trading Costs and Spreads

Trading costs vary among brokers, and traders should carefully consider the impact on their profitability. Spreads, which represent the difference between the bid and ask prices, are a primary cost. Focus on brokers offering competitive spreads and minimal commissions, enabling you to maximize your returns.

3. Trading Platform and Features

The trading platform is your gateway to the forex market. Choose a platform that is user-friendly, intuitive, and equipped with the necessary features. Consider factors such as charting tools, technical indicators, and order execution speed to ensure a seamless trading experience.

Benefits of Using a Forex Market Broker

1. Market Access and Liquidity

Forex market brokers provide instant access to the global currency market, offering traders the opportunity to capitalize on market fluctuations. With unparalleled liquidity, brokers ensure that your orders are executed swiftly and efficiently during market hours.

2. Education and Support

Professional forex market brokers prioritize education and customer support. They offer comprehensive trading resources, seminars, webinars, and dedicated support teams to guide traders through their journey. This knowledge and assistance empower traders to make informed decisions and navigate the market confidently.

3. Risk Management Tools

To mitigate risks and protect traders’ capital, reputable forex market brokers provide access to risk management tools. These include stop-loss orders, limit orders, and margin calls, enabling traders to control their exposure and safeguard their investments.

Forex Market Brokerage: A Comparative Table

| Feature | Dealing Desk Brokers (DD) | No Dealing Desk Brokers (NDD) |

|---|---|---|

| Market Making | Yes | No |

| Potential Conflicts of Interest | Yes | No |

| Quote Transparency | Limited | High |

| Spread Type | Variable | Fixed |

| Regulatory Requirements | Less stringent | More stringent |

Conclusion

Readers, as you embark on your forex trading journey, the choice of a reliable forex market broker is paramount. By understanding the role, types, and benefits of brokers, you can make an informed decision that aligns with your trading goals. Remember to prioritize regulatory compliance, competitive trading costs, and a user-friendly trading platform.

To delve deeper into the world of trading, we invite you to explore our other articles. Discover the latest trading strategies, market trends, and insights to enhance your trading knowledge and unlock financial success.

FAQ about Forex Market Broker

1. What is a Forex Market Broker?

- A Forex market broker is a company or an intermediary that provides traders with access to the foreign exchange (Forex) market. They act as a bridge between traders and the liquidity providers, facilitating the buying and selling of currency pairs.

2. How do Forex Market Brokers make money?

- Forex market brokers typically earn their revenue through spreads, commissions, or a combination of both. A spread is the difference between the bid and ask prices of a currency pair, and brokers charge a markup on this spread. Commissions are additional fees charged per trade.

3. How do I choose a Forex Market Broker?

- Consider factors such as regulation, trading platforms, trading conditions (spreads, commissions), customer support, and educational resources when choosing a broker.

4. What is the difference between a Dealing Desk Broker (DD) and a Non-Dealing Desk Broker (NDD)?

- A DD broker acts as a counterparty to its clients’ trades, while an NDD broker passes trades directly to liquidity providers. NDD brokers generally offer lower spreads and more transparent trading conditions.

5. How much leverage can I get from a Forex Market Broker?

- The amount of leverage offered varies between brokers. Leverage is the ratio of borrowed funds to your own capital, allowing traders to control larger positions with a smaller amount of equity. However, higher leverage also increases potential risks.

6. What types of trading platforms do Forex Market Brokers offer?

- Brokers offer various trading platforms, including proprietary platforms, MetaTrader 4 (MT4), and MetaTrader 5 (MT5). These platforms provide tools for technical analysis, trade execution, and risk management.

7. How can I open a Forex trading account?

- Visit the broker’s website, complete an account application, and provide necessary documentation. Once approved, you can fund your account and start trading.

8. What is a Demo Account?

- A demo account is a practice account provided by brokers, allowing traders to test their strategies and familiarize themselves with the trading platform without risking real money.

9. How do I withdraw money from my Forex trading account?

- Once a trade is settled, you can request a withdrawal using the same method you used to fund your account.

10. Are Forex Market Brokers regulated?

- Yes, reputable Forex market brokers are regulated by financial authorities in their respective jurisdictions, ensuring compliance with industry standards and protecting traders’ funds.