- Forex MAM Account: The Ultimate Guide for Investors

- Introduction

- Understanding Forex MAM Accounts

- Benefits of Using a Forex MAM Account

- Choosing the Right Forex MAM Manager

- Managing Your Forex MAM Account

- Forex MAM Account Fees

- Conclusion

-

FAQ about Forex MAM Account

- What is a Forex MAM account?

- How does a MAM account work?

- Who can use a MAM account?

- What are the benefits of using a MAM account?

- What are the risks of using a MAM account?

- How do I choose a Forex MAM provider?

- What are the fees associated with a MAM account?

- How do I get started with a Forex MAM account?

- What are the alternatives to a Forex MAM account?

- What is the future of Forex MAM accounts?

Forex MAM Account: The Ultimate Guide for Investors

Introduction

Hey there, readers!

Welcome to our comprehensive guide to forex MAM accounts. For those of you new to the forex world, MAM stands for Multi-Account Manager. It’s a powerful tool that allows experienced traders to manage multiple investor accounts simultaneously. In this guide, we’ll dive deep into the ins and outs of forex MAM accounts, empowering you to make informed decisions about using them for your investment journey.

Understanding Forex MAM Accounts

A forex MAM account is a specialized platform that connects a single master account to multiple sub-accounts. The master account is managed by an experienced trader who trades for all of the sub-accounts. This allows investors to benefit from the expertise and skill of a professional trader without having to make trading decisions themselves.

Here are some key features of forex MAM accounts:

-

Centralized Management: The master trader can manage multiple investor accounts simultaneously, ensuring consistency in trading strategy and risk management.

-

Performance Monitoring: Investors have real-time access to the performance of the master trader’s account, enabling them to track their investments closely.

-

Risk Mitigation: MAM accounts offer risk mitigation as investors only expose their capital to the extent they choose, rather than entrusting their entire wealth to a single manager.

Benefits of Using a Forex MAM Account

There are numerous benefits to using a forex MAM account, including:

Professional Trading Expertise: Investors gain access to the trading skills and knowledge of a seasoned trader, enabling them to benefit from professional expertise without having to learn complex trading strategies.

Simplified Investment Process: Forex MAM accounts streamline the investment process by eliminating the need for investors to make individual trading decisions.

Diversification: Investors can diversify their portfolio by allocating capital to multiple sub-accounts managed by different traders.

Transparency and Accountability: Investors have complete visibility into the performance and trading activities of the master trader, promoting transparency and accountability.

Choosing the Right Forex MAM Manager

Selecting the right forex MAM manager is crucial for the success of your investments. Here are some factors to consider:

Performance Track Record: Evaluate the manager’s historical performance and consistency over time.

Trading Style: Match the manager’s trading style with your risk tolerance and investment goals.

Regulation and Compliance: Ensure that the manager is regulated by a reputable authority and adheres to industry best practices.

Reviews and Testimonials: Seek out reviews and testimonials from previous investors to gain insights into the manager’s performance and reliability.

Managing Your Forex MAM Account

Once you have selected a forex MAM manager, it’s important to actively manage your investment. Here are some steps to consider:

Monitor Performance Regularly: Monitor the performance of your sub-account to ensure it aligns with your expectations and risk tolerance.

Communicate with Your Manager: Maintain regular communication with the manager to understand their trading strategy and any potential changes.

Adjust Capital Allocation: As your investment grows or circumstances change, consider adjusting your capital allocation to optimize returns or manage risks.

Forex MAM Account Fees

MAM account providers typically charge fees for their services. These fees may vary based on factors such as the number of sub-accounts, the performance of the manager, and the provider’s reputation.

Conclusion

Forex MAM accounts offer a powerful investment tool for those seeking professional trading expertise and simplified portfolio management. By understanding the intricacies of MAM accounts, investors can make informed decisions about their investments and potentially benefit from the skill of experienced traders. We encourage you to explore other articles on our website for additional insights into the world of forex trading.

FAQ about Forex MAM Account

What is a Forex MAM account?

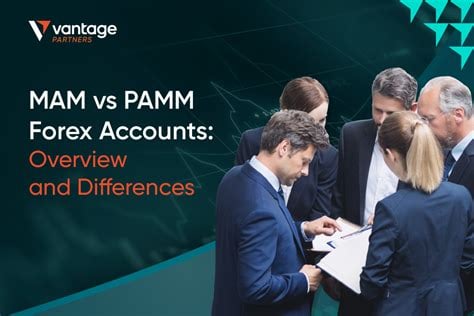

A Forex MAM (Multi-Account Manager) account allows a fund manager to manage multiple client accounts simultaneously.

How does a MAM account work?

The MAM account platform connects the fund manager’s account to the client accounts. The fund manager trades on the clients’ accounts, with each client’s funds being managed separately.

Who can use a MAM account?

MAM accounts are typically used by professional fund managers or traders who want to manage multiple client accounts.

What are the benefits of using a MAM account?

MAM accounts offer several benefits, including:

- Centralized account management

- Automated risk management

- Transparent trading records

- Increased efficiency

What are the risks of using a MAM account?

The risks of using a MAM account include:

- Fund manager’s performance may not meet expectations

- Technical issues with the MAM platform

- Loss of funds due to poor trading decisions

How do I choose a Forex MAM provider?

When choosing a Forex MAM provider, consider the following factors:

- The provider’s reputation

- The platform’s features

- The fees and commissions

What are the fees associated with a MAM account?

MAM providers typically charge a management fee and a performance fee. The management fee covers the cost of managing the accounts, while the performance fee is a percentage of the profits generated.

How do I get started with a Forex MAM account?

To get started with a Forex MAM account, you need to:

- Find a MAM provider

- Open an account with the provider

- Fund your account

- Authorize the fund manager to trade on your account

What are the alternatives to a Forex MAM account?

Alternatives to a Forex MAM account include:

- Managed Forex accounts

- Copy trading platforms

- Self-trading

What is the future of Forex MAM accounts?

Forex MAM accounts are expected to continue growing in popularity as the demand for professional fund management increases.