- Introduction

- Benefits of Keeping a Forex Log

- Components of a Forex Log

- How to Maintain an Effective Forex Log

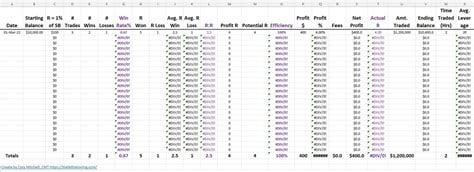

- Table: Forex Log Metrics

- Conclusion

-

FAQ about Forex Log

- What is a forex log?

- Why should I keep a forex log?

- What information should I include in my forex log?

- How often should I update my forex log?

- What is the best way to organize my forex log?

- Can I use a spreadsheet to create a forex log?

- Can I use a software program to create a forex log?

- Are there any other tips for keeping a forex log?

- Where can I find more information about forex logs?

- Is it mandatory to keep a forex log?

Introduction

Greetings, dear readers! Welcome to our comprehensive guide to the world of forex logs. For those unfamiliar with this valuable trading tool, a forex log is an essential record of your trades, strategies, and performance. It serves as a priceless asset for analyzing your trading history, identifying patterns, and improving your decision-making prowess. In this article, we will delve into the intricacies of forex logs, exploring their benefits, best practices, and how they can elevate your trading journey.

Benefits of Keeping a Forex Log

- Comprehensive Performance Tracking: A forex log allows you to meticulously track your trading performance, providing insights into your strengths and weaknesses. By recording the outcomes of each trade, you can pinpoint areas for improvement and fine-tune your strategies accordingly.

- Trade Analysis and Optimization: Each trade recorded in your log offers a valuable data point for analysis. By examining your entries, exits, and risk management practices, you can identify patterns and trends that can inform future trades and optimize your overall approach.

- Emotional Accountability: Trading can be an emotionally charged endeavor, and a forex log serves as an objective witness to your decision-making process. By reviewing your log, you can assess your emotional state during trades and identify triggers that may have influenced your judgment.

Components of a Forex Log

- Trade Details: Record essential details such as trade date, time, currency pair, position (buy/sell), entry and exit prices, and the number of units traded.

- Technical Analysis: Note any technical indicators or chart patterns that influenced your trade decision.

- Trade Strategy: Briefly describe the trading strategy employed, including any specific rules or parameters.

- Risk Management: Log your stop-loss and take-profit levels, as well as any risk-to-reward calculations.

- Notes and Observations: Jot down any additional observations or insights regarding the trade, such as market conditions, news events, or personal reflections.

How to Maintain an Effective Forex Log

- Consistency is Key: Make it a daily habit to diligently log your trades, regardless of their outcome. Regular logging ensures that you capture a comprehensive and accurate record of your trading activity.

- Accuracy Matters: Strive for precision and accuracy in your entries. Incorrect or incomplete data will hinder the effectiveness of your log and its value for analysis.

- Be Objective: Avoid subjective opinions or biases in your notes. Focus on recording facts and data that can be used to objectively assess your performance.

Table: Forex Log Metrics

| Metric | Description |

|---|---|

| Trade Number | Unique identifier for each trade |

| Date and Time | Date and time of trade initiation |

| Symbol | Currency pair traded |

| Direction | Buy or sell position |

| Lot Size | Number of units traded |

| Entry Price | Price at which the trade was opened |

| Exit Price | Price at which the trade was closed |

| Result | Profit or loss in pips or monetary value |

| Profit/Loss (%) | Percentage gain or loss |

| Risk-to-Reward Ratio | Ratio of potential profit to potential loss |

| Stop-Loss Level | Predetermined price level at which the trade will automatically close to limit losses |

| Take-Profit Level | Predetermined price level at which the trade will automatically close to secure profits |

Conclusion

Harnessing the power of a forex log can significantly elevate your trading journey. By meticulously recording your trades, analyzing your performance, and identifying areas for improvement, you can transform yourself into a more disciplined and successful trader. Remember to check out our other articles for further insights and tips on forex trading. May your trading logs guide you towards financial freedom and trading triumphs!

FAQ about Forex Log

What is a forex log?

A forex log is a record of your forex trading activity, including your trades, profits, and losses. It helps you track your progress and identify areas for improvement.

Why should I keep a forex log?

Keeping a forex log has several benefits, including:

- Track your progress and identify areas for improvement

- Analyze your trading strategy and make adjustments

- Prove your trading results to potential investors or brokers

- Manage your risk and protect your profits

What information should I include in my forex log?

Your forex log should include the following information for each trade:

- Date and time of entry and exit

- Currency pair traded

- Trade size

- Entry and exit prices

- Profit or loss

- Notes on the trade

How often should I update my forex log?

It is best to update your forex log after each trade. This will ensure that your records are accurate and up-to-date.

What is the best way to organize my forex log?

There are several ways to organize your forex log, including:

- By date

- By currency pair

- By profit or loss

- By trade type

Can I use a spreadsheet to create a forex log?

Yes, you can use a spreadsheet to create a forex log. This is a convenient and easy way to track your trading activity.

Can I use a software program to create a forex log?

Yes, there are several software programs available that can help you create a forex log. These programs can provide additional features, such as charting and analysis tools.

Are there any other tips for keeping a forex log?

Here are a few additional tips for keeping a forex log:

- Be consistent with your entries

- Include as much detail as possible

- Review your log regularly

- Use your log to identify patterns and improve your trading

Where can I find more information about forex logs?

There are several online resources available that can provide you with more information about forex logs. You can also find books and articles on the topic.

Is it mandatory to keep a forex log?

While it is not mandatory to keep a forex log, it is highly recommended. A forex log can help you improve your trading and achieve your financial goals.