- Forex Future Trade: A Comprehensive Guide

- Understanding Forex Future Contracts

- Trading Forex Futures

- Forex Future Trading Strategies

- Table: Forex Future Contract Specifications

- Conclusion

-

FAQ about Forex Future Trade

- What is forex future trade?

- How does forex future trade work?

- What are the benefits of forex future trade?

- What are the risks of forex future trade?

- How do I start forex future trade?

- What are the different types of forex future contracts?

- How do I choose the right forex future contract?

- How do I trade forex future contracts?

- What are the tax implications of forex future trade?

- What are some tips for successful forex future trade?

Forex Future Trade: A Comprehensive Guide

Introduction

Hey readers! You’re interested in the exciting world of forex future trade, aren’t you? We’re here to take you on a comprehensive journey through this dynamic financial realm. Forex future trade is an incredible opportunity to capitalize on currency fluctuations, but it’s important to approach it with knowledge and strategy. So, buckle up and let’s dive right in!

Forex, short for foreign exchange, involves trading currencies against each other. Futures, on the other hand, are financial contracts that obligate the buyer to purchase or the seller to sell a specified asset at a predetermined price on a future date. Combining these two worlds creates forex future trade, a market where you can speculate on future currency movements.

Understanding Forex Future Contracts

Standard Contract Specifications

Forex future contracts have standardized specifications, ensuring uniformity and liquidity in the marketplace. They typically involve large contract sizes, ranging from 100,000 to 1 million units of the base currency. The trading unit is a "lot," which represents the contract size.

Contract Maturities

Forex future contracts have specific maturity dates, which determine when the contract expires and must be settled. Maturities vary depending on the exchange and contract type, but common intervals include one month, three months, six months, and one year.

Trading Currencies

Forex future contracts encompass a wide range of currency pairs, including major currencies (such as EUR/USD, USD/JPY, and GBP/USD) and emerging market currencies. This diversity allows traders to speculate on currency movements across different geographical regions and economic conditions.

Trading Forex Futures

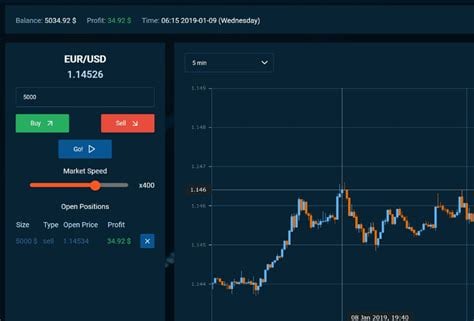

Opening a Position

To trade forex futures, you need an account with a futures broker. Once you’ve funded your account, you can start opening positions. A long position means you expect the currency pair’s value to rise, while a short position means you expect it to fall.

Managing Risk

Managing risk is crucial in forex future trade. Use stop-loss orders to limit potential losses and position sizing to match your risk tolerance and account balance. Also, leverage (trading with borrowed funds) can significantly amplify both gains and losses, so be cautious in its use.

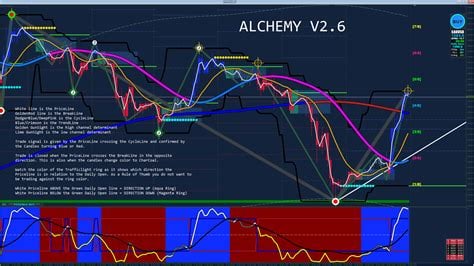

Market Analysis

Successful forex future traders rely heavily on market analysis. Fundamental analysis examines economic indicators, news events, and political developments to gauge currency movements. Technical analysis, on the other hand, studies historical price data to identify patterns and trends.

Forex Future Trading Strategies

Carry Trade Strategy

The carry trade strategy involves borrowing a currency with a low interest rate and investing it in a currency with a higher interest rate. The profit comes from the interest rate differential, but it’s important to manage currency risk and interest rate fluctuations.

Range Trading Strategy

Range trading involves identifying a currency pair’s support and resistance levels and trading within that range. The goal is to capture profits from price fluctuations within the established range, avoiding the risk of larger movements.

Trend Following Strategy

Trend following is a strategy that seeks to ride currency trends for extended periods. Traders identify the direction of the trend and enter trades that follow the trend, attempting to capture a portion of the price movement.

Table: Forex Future Contract Specifications

| Exchange | Currency Pair | Contract Size | Maturities |

|---|---|---|---|

| CME Group | EUR/USD | 125,000 euros | March, June, September, December |

| ICE | USD/JPY | 1 million yen | March, June, September, December |

| Eurex | GBP/USD | 62,500 pounds | March, June, September, December |

Conclusion

Readers, you’ve now reached the end of our comprehensive guide to forex future trade. We hope this article has shed light on the intricacies of this dynamic market and provided you with valuable insights to embark on your trading journey. Remember, forex future trade involves both opportunities and risks, so approach it with a well-informed and disciplined mindset.

Don’t forget to check out our other articles on trading strategies and market analysis to enhance your forex knowledge and skills. Happy trading!

FAQ about Forex Future Trade

What is forex future trade?

Forex future trade is a contract to buy or sell a certain amount of currency at a fixed price on a future date.

How does forex future trade work?

When you enter into a forex future trade, you are agreeing to buy or sell a certain amount of currency at a fixed price on a future date. The price of the currency will be determined by the market at the time the contract is executed.

What are the benefits of forex future trade?

There are a number of benefits to forex future trade, including:

- Hedging against currency risk

- Speculating on the future value of currencies

- Taking advantage of leverage

What are the risks of forex future trade?

There are also a number of risks associated with forex future trade, including:

- The possibility of losing money

- The risk of the counterparty defaulting

- The risk of the market moving against you

How do I start forex future trade?

To start forex future trade, you will need to open an account with a forex broker. Once you have opened an account, you can start trading forex futures contracts.

What are the different types of forex future contracts?

There are a number of different types of forex future contracts, including:

- Currency futures

- Currency options

- Currency swaps

How do I choose the right forex future contract?

The type of forex future contract that is right for you will depend on your individual needs and circumstances. You should consider the following factors when choosing a contract:

- The amount of currency you want to trade

- The date you want to trade the currency

- The price of the currency

- The risks associated with the contract

How do I trade forex future contracts?

To trade forex future contracts, you will need to follow these steps:

- Open an account with a forex broker

- Fund your account

- Choose the forex future contract you want to trade

- Enter into a contract

- Monitor the contract

- Close the contract

What are the tax implications of forex future trade?

The tax implications of forex future trade will vary depending on your individual tax situation. You should consult with a tax professional to determine the tax implications of your trading activities.

What are some tips for successful forex future trade?

Here are some tips for successful forex future trade:

- Do your research

- Start small

- Use a stop-loss order

- Manage your risk

- Don’t trade emotionally