- Forex Foreign Exchange Trading: A Comprehensive Guide to Currency Trading

-

FAQ about Forex Foreign Exchange Trading

- What is Forex Trading?

- What are the Benefits of Forex Trading?

- What are the Risks of Forex Trading?

- How Do I Start Forex Trading?

- What is Leverage in Forex Trading?

- What are Currency Pairs?

- What is a Pip?

- What is Technical Analysis in Forex Trading?

- What is Fundamental Analysis in Forex Trading?

- How Can I Learn More About Forex Trading?

Forex Foreign Exchange Trading: A Comprehensive Guide to Currency Trading

Introduction

Howdy, readers! Welcome to this extensive guide on forex foreign exchange trading. In this article, we’ll dive into the captivating world of currency trading, exploring its ins and outs with you. Whether you’re a seasoned trader or just starting your journey into forex, this guide will equip you with the knowledge and insights you need to navigate this exhilarating market.

Forex foreign exchange trading, often referred to as FX trading, is the global marketplace where currencies are exchanged. It’s the largest financial market in the world, with an average daily trading volume exceeding $5 trillion. The forex market operates 24 hours a day, five days a week, making it accessible to traders around the globe.

What is Forex Trading?

Forex trading involves buying and selling different currencies, speculating on their price movements. The goal is to profit from the fluctuations in currency values. Traders analyze various economic and political factors that influence currency prices, such as interest rates, inflation, and political events.

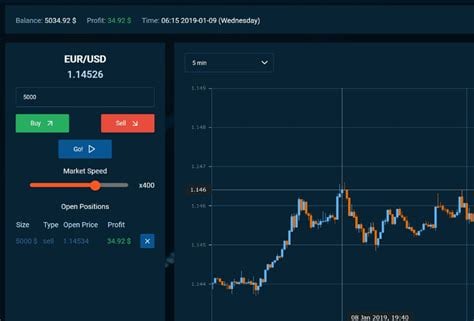

Unlike stock or bond trading, forex trading does not involve physical exchange of currencies. Instead, traders execute contracts known as currency pairs, which represent the exchange rate between two currencies. The most commonly traded currency pair is the EUR/USD (euro/U.S. dollar).

Types of Forex Traders

There are various types of forex traders, each with their own strategies and risk tolerance. Here are a few common types:

- Scalpers: These traders hold positions for a short period, often just a few seconds or minutes, and profit from small price fluctuations.

- Day traders: They enter and exit positions within a single trading day, aiming to capture intraday price movements.

- Swing traders: They hold positions for several days or weeks, taking advantage of longer-term trends.

- Position traders: These traders hold positions for an extended period, sometimes months or years, seeking to profit from major market movements.

Forex Trading Strategies

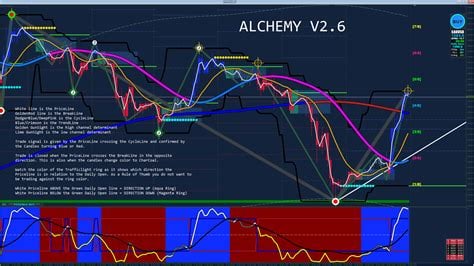

The success of forex trading heavily depends on the trader’s strategy. There are numerous trading strategies, and traders often tailor them to their individual risk tolerance and trading style. Some common strategies include:

- Trend trading: This strategy involves identifying and following trends in currency prices. Traders buy currencies that are trending up and sell currencies that are trending down.

- Range trading: This strategy focuses on trading within a defined price range. Traders buy currencies when they reach the lower end of the range and sell them when they reach the upper end.

- News trading: This strategy involves exploiting sudden market movements caused by news events. Traders analyze economic and political news releases to identify potential trading opportunities.

Forex Trading Platforms

Forex trading is executed through online trading platforms. These platforms provide traders with access to real-time market data, trading tools, and risk management features. Some popular forex trading platforms include:

- MetaTrader 4

- MetaTrader 5

- cTrader

- ZuluTrade

Risks of Forex Trading

Forex trading carries significant risks, and it’s crucial to be aware of them before entering the market. The following are some of the risks associated with forex trading:

- Market volatility: Currency prices can fluctuate rapidly, making it difficult to predict market movements and leading to potential losses.

- Leverage: Many forex brokers offer leverage, which allows traders to trade with more capital than they have in their accounts. While leverage can amplify profits, it can also magnify losses.

- Slippage: This occurs when the executed price of a trade is different from the intended price due to rapid market movements or liquidity issues.

Forex Trading Table

| Aspect | Description |

|---|---|

| Currency Pairs | The forex market trades in currency pairs, representing the exchange rate between two currencies. |

| Trading Volume | The forex market is the largest financial market in the world, with an average daily trading volume exceeding $5 trillion. |

| Trading Hours | Forex trading operates 24 hours a day, five days a week. |

| Leverage | Forex brokers offer leverage, allowing traders to trade with more capital than they have in their accounts. |

| Risks | Forex trading carries significant risks due to market volatility, leverage, and slippage. |

Conclusion

Hey there, readers! We hope this guide has provided you with a comprehensive overview of forex foreign exchange trading. Whether you’re a seasoned trader or just starting out, it’s essential to approach forex trading with knowledge, strategy, and risk management.

If you’re intrigued by the world of currency trading, we encourage you to explore the other articles on our website. We cover various topics related to forex trading, from beginner’s guides to advanced trading strategies. Stay tuned for more exciting content, and we wish you success in your forex trading endeavors.

FAQ about Forex Foreign Exchange Trading

What is Forex Trading?

Forex trading involves buying and selling currencies from different countries in order to profit from fluctuations in their exchange rates.

What are the Benefits of Forex Trading?

- 24-hour market with high liquidity

- Potential for high returns with leverage

- Accessibility from anywhere with an internet connection

What are the Risks of Forex Trading?

- Market volatility can lead to significant losses

- High leverage magnifies both potential profits and losses

- Requires extensive knowledge, skills, and risk management

How Do I Start Forex Trading?

- Open a trading account with a reputable broker

- Fund your account with sufficient capital

- Learn about forex market analysis and trading strategies

- Practice on a demo account before trading live

What is Leverage in Forex Trading?

Leverage allows traders to control a larger position with a smaller amount of capital, but it also increases both potential profits and losses.

What are Currency Pairs?

In forex trading, currencies are traded in pairs, such as EUR/USD or GBP/JPY. The first currency is the base currency, and the second is the quote currency.

What is a Pip?

A pip (point in percentage) is the smallest unit of measurement for currency exchange rates, representing a change of 0.0001 or 0.01% for most currency pairs.

What is Technical Analysis in Forex Trading?

Technical analysis involves studying historical price charts and patterns to predict future price movements.

What is Fundamental Analysis in Forex Trading?

Fundamental analysis considers economic data, political events, and other factors that influence currency values over the long term.

How Can I Learn More About Forex Trading?

- Online courses and tutorials

- Books and articles

- Webinars and seminars

- Demo trading platforms