- Understanding Forex Flat Markets

- Trading Strategies for Forex Flat Markets

- Risk Management in Forex Flat Markets

- Forex Flat Market Table Breakdown

- Conclusion

-

FAQ about Forex Flat

- What is a forex flat?

- What causes a forex flat?

- How long does a forex flat typically last?

- What are the trading strategies for a forex flat?

- What are the risks of trading during a forex flat?

- How can I avoid the risks of trading during a forex flat?

- What are the benefits of trading during a forex flat?

- What are the indicators that can help me identify a forex flat?

- What is the best way to trade a forex flat?

- What are the common mistakes that traders make when trading forex flats?

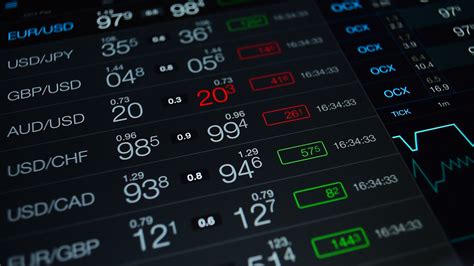

What is Forex Flat?

Forex flat refers to a situation in market activity where currency prices move within a tight range, displaying minimal volatility and no clear trend. This period of sideways movement is characterized by consolidation, where supply and demand forces offset each other, preventing significant price changes. Traders commonly encounter flat markets in forex trading, creating unique opportunities and challenges.

Understanding Forex Flat Markets

Forex flat markets can be frustrating for traders accustomed to volatile market conditions; however, they offer distinct trading strategies and risk management approaches that can lead to profitability. To understand the dynamics of forex flats, it’s crucial to identify the following characteristics:

Range Bound Movement

The most evident feature of a forex flat market is its range-bound movement. The price remains confined within a specific range, defined by support and resistance levels. These levels act as barriers, preventing significant breakouts and maintaining the sideways trend.

Low Volatility

Low volatility is another defining aspect of forex flat markets. There are minimal price fluctuations as the forces of supply and demand reach an equilibrium. This stability often results in a lack of clear trading signals, making it challenging to identify entry and exit points.

Trading Strategies for Forex Flat Markets

Flat markets may not exhibit significant trends, but they present opportunities for profit if traded strategically. Here are some effective strategies:

Range Trading

Range trading involves exploiting the support and resistance levels established within the range-bound movement. Traders identify these levels and place buy orders near support and sell orders near resistance, aiming to capture profits from price fluctuations within the range.

Breakout Trading

Breakout trading focuses on identifying and profiting from potential breakouts from the established range. Traders monitor price action for signs of a breakout, such as a strong surge in volume or a clear break of support or resistance, and enter the market accordingly.

Risk Management in Forex Flat Markets

While flat markets can offer trading opportunities, they require proper risk management techniques to mitigate potential losses. Here’s how to approach risk management:

Tight Stop-Loss Orders

Placing stop-loss orders close to your entry price is crucial in forex flat markets. The tight range can result in rapid price reversals, and tight stop-loss orders prevent significant losses if the market moves against your position.

Controlled Position Sizing

Managing the size of your trading positions is equally important. Avoid overleveraging in flat markets, and only commit a small portion of your trading capital to each trade, allowing for margin to accommodate potential losses.

Forex Flat Market Table Breakdown

| Characteristic | Description |

|---|---|

| Price Movement | Range-bound within support and resistance levels |

| Volatility | Low, with minimal price fluctuations |

| Trend | No clear trend, sideways movement |

| Trading Strategies | Range trading, breakout trading |

| Risk Management | Tight stop-loss orders, controlled position sizing |

Conclusion

Forex flat markets are a common occurrence in currency trading. Understanding their characteristics and employing appropriate trading strategies can lead to profitability. By embracing the unique opportunities and managing risk effectively, traders can navigate flat markets successfully. Don’t forget to check out our other articles on forex trading for more insightful content and trading tips.

FAQ about Forex Flat

What is a forex flat?

- A forex flat is a period of time in which the price of a currency pair moves within a relatively narrow range.

What causes a forex flat?

- Forex flats can be caused by a number of factors, including:

- Lack of news or economic data to drive the market

- A balance between supply and demand

- Technical factors, such as support and resistance levels

How long does a forex flat typically last?

- Forex flats can last for anywhere from a few hours to several days or even weeks.

What are the trading strategies for a forex flat?

- There are a number of trading strategies that can be used during a forex flat, including:

- Range trading: Buying and selling the currency pair within the range

- Scalping: Taking small, quick profits from the small price movements

- Day trading: Trading the currency pair within a single day

What are the risks of trading during a forex flat?

- The main risk of trading during a forex flat is that the price may not move enough to make a profit.

How can I avoid the risks of trading during a forex flat?

- There are a number of ways to avoid the risks of trading during a forex flat, including:

- Using a stop-loss order to limit your losses

- Trading with a small position size

- Only trading during periods of high volatility

What are the benefits of trading during a forex flat?

- The main benefit of trading during a forex flat is that the market is less volatile, which can make it easier to trade profitably.

What are the indicators that can help me identify a forex flat?

- There are a number of indicators that can help you identify a forex flat, including:

- Bollinger Bands: A technical indicator that measures the volatility of a currency pair

- Moving averages: A technical indicator that shows the average price of a currency pair over a period of time

- Support and resistance levels: Areas where the price of a currency pair has historically found resistance or support

What is the best way to trade a forex flat?

- The best way to trade a forex flat is to use a trading strategy that is designed for that type of market. This may include using a range trading, scalping, or day trading strategy.

What are the common mistakes that traders make when trading forex flats?

- Some common mistakes that traders make when trading forex flats include:

- Overtrading: Trading too much during a flat market

- Not using a stop-loss order: Allowing losses to build up

- Trading with a large position size: Losing too much money on a single trade