- Introduction

- Benefits of Using a Forex Demo Account

- Choosing the Right Forex Demo Account

- Trading on a Forex Demo Account

- Forex Demo Account Comparison Table

- Conclusion

-

FAQ about Forex Demo Account

- What is a forex demo account?

- Why should I use a forex demo account?

- How do I create a forex demo account?

- What are the advantages of using a forex demo account?

- What are the limitations of a forex demo account?

- How long can I use a forex demo account?

- Can I withdraw funds from a forex demo account?

- Can I switch from a forex demo account to a live account?

- What’s the difference between a forex demo account and a live account?

- What should I look for when choosing a forex demo account provider?

Introduction

Hey there, readers! Are you interested in learning about the financial markets and exploring the exciting world of forex trading? If so, then you’ve come to the right place. In this comprehensive guide, we’ll dive deep into the concept of a forex demo account and its importance in the journey of any aspiring trader.

A forex demo account is an invaluable tool that allows you to practice trading in a risk-free environment. It simulates real market conditions, providing traders with the opportunity to test their strategies, hone their skills, and gain valuable experience before venturing into live trading.

Benefits of Using a Forex Demo Account

Practice Trading Strategies

One of the primary advantages of a forex demo account is the ability to test and refine your trading strategies without any financial risk. You can experiment with different market conditions, currency pairs, and trading techniques without having to worry about losing real money. This allows you to develop and optimize your strategies before implementing them in live trading.

Familiarize Yourself with the Market

Forex trading can be complex and intimidating for beginners. A demo account provides a safe space where you can familiarize yourself with the market, learn how to navigate trading platforms, and gain a deeper understanding of how currency pairs move and interact.

Control Your Emotions

Trading involves emotions, and it’s crucial to be able to control them effectively. A demo account allows you to practice managing your emotions in real-time, without the pressure of risking real capital. This helps you develop discipline and avoid costly mistakes that can occur when trading with real money.

Choosing the Right Forex Demo Account

Find a Reputable Broker

When choosing a forex demo account, it’s essential to select a reputable and regulated broker. Look for brokers with a proven track record, transparency, and positive customer reviews. These brokers should offer reliable and accurate market data, advanced trading platforms, and comprehensive educational resources.

Consider Trading Conditions

Different brokers offer varying trading conditions, including spreads, commission fees, and leverage. Compare these conditions and choose a broker that aligns with your trading style and risk tolerance. Consider the spread, which represents the difference between the bid and ask prices, as well as the leverage, which can amplify both profits and losses.

Check Demo Account Features

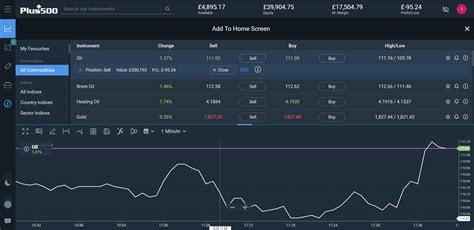

Demo accounts come with a range of features, such as customizable charts, technical indicators, and news feeds. Ensure that the broker you choose provides a demo account with the features you need to practice your trading effectively.

Trading on a Forex Demo Account

Simulate Real Trading

Approach your demo account trading as if it were real money trading. Treat it with the same level of discipline, patience, and risk management principles. This will help you develop the mindset and habits required for successful live trading.

Keep a Trading Journal

Document your trades, observations, and insights in a trading journal. Regularly review your journal to identify patterns, assess your performance, and pinpoint areas for improvement.

Seek Mentorship

Consider seeking guidance from experienced traders or mentors to accelerate your learning curve. They can provide valuable insights, share best practices, and help you avoid common pitfalls.

Forex Demo Account Comparison Table

| Broker | Platform | Spreads | Leverage | Features |

|---|---|---|---|---|

| MetaTrader 4 | MT4 | 1.2 pips | 1:500 | Customizable charts, technical indicators, expert advisors |

| cTrader | cTrader | 0.8 pips | 1:1000 | Advanced order types, risk management tools, algorithmic trading |

| XStation 5 | XStation 5 | 1.0 pips | 1:200 | Proprietary platform, social trading, economic calendar |

| NinjaTrader | NinjaTrader | Variable | 1:200 | High-end trading platform, market replay, advanced charting |

| OANDA | OANDA FXTrade | Variable | 1:50 | Real-time market data, proprietary indicators, personalized insights |

Conclusion

A forex demo account is an indispensable tool for aspiring traders. It provides a risk-free environment to practice trading strategies, develop trading skills, and gain valuable experience before transitioning to live trading. By choosing a reputable broker, understanding the trading conditions, and utilizing the features of the demo account effectively, you can maximize your learning and prepare yourself for success in the forex market.

Additionally, we invite you to explore our other articles that delve into specific aspects of forex trading. Whether you’re a beginner or an experienced trader, you’re sure to find valuable insights and practical tips to enhance your trading journey.

FAQ about Forex Demo Account

What is a forex demo account?

A forex demo account is a virtual trading account that allows traders to practice trading without risking real money.

Why should I use a forex demo account?

A demo account allows you to learn about forex trading, test trading strategies, and develop your trading skills without putting your own capital at risk.

How do I create a forex demo account?

Most forex brokers offer demo accounts that can be created online within minutes.

What are the advantages of using a forex demo account?

- Learn about forex trading without risking real money.

- Test trading strategies and develop your skills.

- Practice trading in a risk-free environment.

What are the limitations of a forex demo account?

- Market conditions in a demo account can be different from live markets.

- Emotional responses to trading losses can be different in a demo account than in a live account.

How long can I use a forex demo account?

Most brokers offer demo accounts that do not expire, allowing you to use them for as long as you need.

Can I withdraw funds from a forex demo account?

No, you cannot withdraw funds from a demo account as the funds are not real.

Can I switch from a forex demo account to a live account?

Yes, most brokers allow you to easily switch from a demo account to a live account when you’re ready to start trading with real money.

What’s the difference between a forex demo account and a live account?

A demo account uses virtual funds and does not involve any real financial risk, while a live account uses real funds and involves the potential for both profit and loss.

What should I look for when choosing a forex demo account provider?

- Consider factors such as the broker’s reputation, trading platform, customer support, and demo account features (e.g., duration, leverage).