- Introduction

- The Basics of Forex Currency Trading

- The Dynamics of Forex Currency Trading

- Benefits and Risks of Forex Currency Trading

- Table: Key Forex Currency Trading Terms

- Conclusion

-

FAQ about Forex Currency Trading

- What is forex trading?

- How does forex trading work?

- What are the benefits of forex trading?

- What are the risks of forex trading?

- How do I get started with forex trading?

- What are the different types of forex orders?

- What is leverage in forex trading?

- What is a spread in forex trading?

- How do I choose a forex broker?

- What are some beginner tips for forex trading?

Introduction

Welcome, readers! Embarking on the exciting world of forex currency trading, also known as foreign exchange trading, can be both thrilling and daunting. As you delve into this captivating arena, we’ll guide you through its complexities, empowering you to navigate the fascinating realm of currencies.

Forex currency trading involves buying and selling different currencies, with the aim of profiting from currency exchange rate fluctuations. It’s the largest financial market in the world, facilitating trillions of dollars in transactions daily. Join us as we explore the intricacies of forex currency trading, unraveling its mechanisms and empowering you with the knowledge to navigate its dynamic landscape.

The Basics of Forex Currency Trading

Understanding Currency Pairs

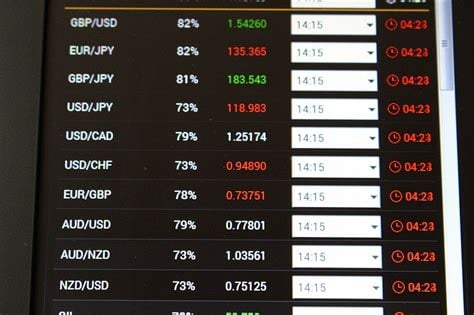

Forex trading always involves a currency pair, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). The first currency in the pair is the base currency, while the second is the quote currency. The exchange rate between these currencies determines the value of the base currency relative to the quote currency.

Forex Market Participants

The forex market is a decentralized network of participants, including banks, financial institutions, corporations, and individual traders. These participants engage in currency exchange for various reasons, such as facilitating international trade, managing currency risk, and speculating on currency fluctuations.

The Dynamics of Forex Currency Trading

Factors Influencing Currency Exchange Rates

Currency exchange rates are influenced by a myriad of economic, political, and social factors, including interest rates, inflation rates, economic growth prospects, political stability, and global events. These factors can impact the demand for a particular currency, thereby causing its value to fluctuate against other currencies.

Types of Forex Trading

Traders engage in forex trading through various strategies, including:

- Spot trading: Buying and selling currencies for immediate delivery.

- Forward trading: Agreeing to buy or sell currencies at a predetermined rate and date in the future.

- Options trading: Purchasing contracts that grant the trader the right, but not the obligation, to buy or sell currencies at a specified price.

Benefits and Risks of Forex Currency Trading

Benefits of Forex Currency Trading

- High liquidity: Forex is the most liquid market in the world, enabling traders to enter and exit positions quickly and efficiently.

- 24/7 access: Forex trading is conducted around the clock, providing traders with flexible trading hours.

- Potential for high returns: With proper risk management and a sound trading strategy, traders can potentially generate significant profits.

Risks of Forex Currency Trading

- Volatility: Currency exchange rates can be extremely volatile, resulting in rapid and unexpected price fluctuations.

- Leverage: Forex trading often involves the use of leverage, which can amplify both profits and losses.

- Market risk: Global economic and political events can significantly impact currency values, potentially causing traders to lose money.

Table: Key Forex Currency Trading Terms

| Term | Definition |

|---|---|

| Base currency | The first currency in a currency pair. |

| Quote currency | The second currency in a currency pair. |

| Exchange rate | The price of one currency in relation to another. |

| Bid price | The price at which a trader is willing to buy a currency. |

| Ask price | The price at which a trader is willing to sell a currency. |

| Spread | The difference between the bid and ask prices. |

Conclusion

Forex currency trading presents both opportunities and challenges for traders. By understanding the basics, dynamics, benefits, and risks of forex trading, you can embark on this exciting journey with greater confidence. As you continue to explore the world of forex, be sure to check out our other articles on trading strategies, market analysis, and risk management techniques. Embrace the thrill of forex currency trading, and may your trades be profitable!

FAQ about Forex Currency Trading

What is forex trading?

Forex trading involves buying and selling currencies in pairs, such as EUR/USD or GBP/JPY, with the aim of making a profit from currency fluctuations.

How does forex trading work?

When trading a currency pair, you are speculating on the value of one currency relative to the other. If the currency you buy increases in value against the currency you sell, you make a profit. If it decreases in value, you make a loss.

What are the benefits of forex trading?

Forex trading offers several benefits, including:

- High liquidity, making it easy to enter and exit trades quickly

- 24/5 market availability, providing plenty of trading opportunities

- Potential for high returns, but also carries high risks

What are the risks of forex trading?

Forex trading can be risky, so it’s important to be aware of the potential risks, such as:

- Market volatility, which can lead to sudden price swings

- Leverage, which can amplify both profits and losses

- Transaction costs, which can reduce your returns

How do I get started with forex trading?

To begin forex trading, you need:

- A forex trading account with a broker

- A trading plan and strategy

- A thorough understanding of the risks involved

What are the different types of forex orders?

Common forex orders include:

- Market order: Executes immediately at the current market price

- Limit order: Executes when the price reaches a specified level

- Stop order: Executes when the price moves in an unfavorable direction

What is leverage in forex trading?

Leverage allows you to trade with more capital than you actually have, potentially increasing your profits or losses. However, it also amplifies the risks.

What is a spread in forex trading?

The spread is the difference between the bid and ask prices of a currency pair. It represents the broker’s commission for executing your trade.

How do I choose a forex broker?

When choosing a forex broker, consider factors such as:

- Regulation and reputation

- Trading platform and tools

- Spreads and fees

- Customer support

What are some beginner tips for forex trading?

For beginners, it’s recommended to:

- Start with a demo account to practice without risking real money

- Learn about technical and fundamental analysis

- Manage your risk effectively by using stop-loss orders and limiting your leverage