- Introduction

- What is a Forex Automated Trading Platform?

- Benefits of Using a Forex Automated Trading Platform

- Types of Forex Automated Trading Platforms

- Key Features of a Forex Automated Trading Platform

- Choosing the Right Forex Automated Trading Platform

- Table: Comparison of Popular Forex Automated Trading Platforms

- Conclusion

-

FAQ about Forex Automated Trading Platform

- What is a forex automated trading platform?

- How do forex automated trading platforms work?

- What are the benefits of using a forex automated trading platform?

- Are forex automated trading platforms profitable?

- What is the difference between a trading robot and an automated trading platform?

- What are the risks of using forex automated trading platforms?

- How can I choose a reliable forex automated trading platform?

- Can I use forex automated trading platforms on any device?

- Is it necessary to have programming knowledge to use forex automated trading platforms?

- How much does it cost to use a forex automated trading platform?

Introduction

Greetings, readers! Are you ready to delve into the world of forex automated trading platforms? In this comprehensive article, we’ll guide you through the ins and outs of these powerful tools that can help you streamline your trading experience.

From understanding the basics to exploring advanced features, we’ve got you covered. So, sit back, relax, and let’s embark on this journey into the realm of automated forex trading.

What is a Forex Automated Trading Platform?

A forex automated trading platform is a software that enables traders to automate their trading strategies. It eliminates the need for manual intervention, allowing traders to set specific parameters and let the platform execute trades automatically based on those parameters.

By leveraging advanced algorithms and artificial intelligence, these platforms analyze real-time market data, identify trading opportunities, and execute trades according to the predefined strategy. This allows traders to save time and effort while potentially optimizing their trading performance.

Benefits of Using a Forex Automated Trading Platform

Time-Saving and Convenience

Automated trading platforms free up your time, eliminating the need to constantly monitor markets and manually execute trades. This allows you to focus on other important tasks, such as strategy development and portfolio management.

Emotional Control

Emotions can wreak havoc on trading decisions. Automated platforms remove the emotional element from trading by executing trades based on predefined rules. This helps avoid impulsive decisions and promotes discipline.

Backtesting and Optimization

Automated trading platforms enable you to backtest your strategies on historical data, allowing you to refine and optimize them before deploying them live. This reduces the risk of losing real money and improves your chances of success.

Types of Forex Automated Trading Platforms

Rule-Based Platforms

These platforms execute trades based on predefined rules set by the trader. The rules may be based on technical indicators, market conditions, or other factors. Rule-based platforms are relatively simple to use but require careful strategy development.

Machine Learning Platforms

Machine learning platforms use algorithms to analyze market data and identify trading opportunities. They can adapt and evolve their strategies over time, potentially improving their performance. However, they may be more complex to use and require a higher level of technical expertise.

Key Features of a Forex Automated Trading Platform

Strategy Builder

This feature allows traders to create and customize their trading strategies using a drag-and-drop interface or coding tools. It provides flexibility and control over the trading parameters.

Backtesting Engine

A backtesting engine simulates trading strategies on historical data, helping traders evaluate their performance and identify areas for improvement. It can also be used to optimize strategies before deploying them live.

Real-Time Data Feed

Real-time data feeds ensure that the platform has access to the latest market data, allowing for accurate trade execution and risk management.

Risk Management Tools

Automated trading platforms provide risk management tools such as stop-loss orders, take-profit orders, and trailing stops to protect against losses and lock in profits.

Choosing the Right Forex Automated Trading Platform

When choosing an automated trading platform, consider the following factors:

Trading Strategy

Match the platform’s capabilities with your trading strategy. Ensure it provides the necessary features and flexibility to implement your approach.

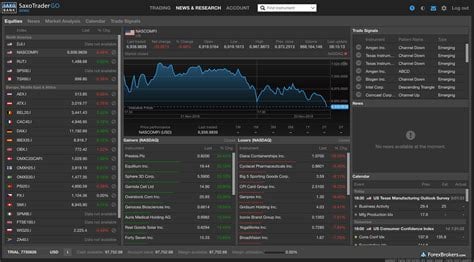

User Interface

Choose a platform with an intuitive and user-friendly interface that simplifies strategy development and trade execution.

Support and Documentation

Opt for platforms that provide comprehensive support and documentation to assist you in setting up and using the platform effectively.

Fees and Commissions

Understand the platform’s fees and commissions to avoid surprises and ensure they align with your budget.

Table: Comparison of Popular Forex Automated Trading Platforms

| Platform | Features | Pros | Cons |

|---|---|---|---|

| MetaTrader 4 | Rule-based, backtesting, wide community | Extensive customization, popular among many traders | Can be complex for beginners |

| cTrader | Rule-based, advanced charting, user-friendly interface | Intuitive design, easy to use | Limited backtesting capabilities |

| NinjaTrader | Rule-based, backtesting, technical analysis tools | Powerful backtesting engine, extensive technical analysis tools | Can be expensive |

| ZuluTrade | Social trading, copy trading, multiple strategies | Easy to follow other traders, access to proven strategies | Performance may vary depending on signal providers |

| FXCM Trading Station | Rule-based, technical analysis, mobile trading | State-of-the-art technical analysis tools, mobile trading capabilities | May not be suitable for all trading styles |

Conclusion

Forex automated trading platforms can be a powerful tool for streamlining your trading experience and potentially improving your performance. Whether you’re a seasoned trader or a beginner, there’s a platform tailored to your needs. By understanding the basics, exploring the different types, and choosing the right platform, you can harness the power of automation to trade smarter and save time.

We invite you to explore our other articles on forex trading and financial markets to further enhance your knowledge and skills. Stay tuned for more valuable insights and trading tips.

FAQ about Forex Automated Trading Platform

What is a forex automated trading platform?

Forex automated trading platforms are software tools that use algorithms and trading strategies to execute trades in the foreign exchange market without human intervention.

How do forex automated trading platforms work?

These platforms connect to a forex broker and monitor market conditions based on predetermined rules. They analyze data, identify trading opportunities, and automatically place and manage trades.

What are the benefits of using a forex automated trading platform?

- Backtesting: Test strategies on historical data before deploying them live.

- Time saving: Automate repetitive trading tasks, freeing up time for traders.

- Discipline: Remove emotions from trading decisions, enforcing predefined rules.

Are forex automated trading platforms profitable?

Profitability depends on factors such as trading strategy, market conditions, and risk management. While these platforms automate trading, they do not guarantee profits.

What is the difference between a trading robot and an automated trading platform?

Trading robots are specific algorithms that execute trades within an automated trading platform. These platforms typically offer a range of trading robots with varying strategies.

What are the risks of using forex automated trading platforms?

Risks include technical glitches, unreliable data, and unpredictable market conditions. Traders should carefully evaluate strategies and manage risk accordingly.

How can I choose a reliable forex automated trading platform?

Consider factors such as track record, user reviews, transparency, and support. Look for platforms that provide detailed documentation and performance data.

Can I use forex automated trading platforms on any device?

Many forex automated trading platforms are cloud-based, allowing access from various devices with internet connection.

Is it necessary to have programming knowledge to use forex automated trading platforms?

Most platforms offer user-friendly interfaces that allow traders with minimal programming knowledge to set up and use automated trading systems.

How much does it cost to use a forex automated trading platform?

Costs vary depending on the platform, features, and subscription plans. Some platforms offer free or trial versions with limited functionality.