- Forex Brokers with Low Commission: A Guide to Finding the Right Broker

-

FAQ about Forex Brokers with Low Commission

- 1. What is a forex broker with low commission?

- 2. Why choose a forex broker with low commission?

- 3. What are the different types of commission structures offered by forex brokers?

- 4. How do I choose the right forex broker with low commission?

- 5. What are some of the best forex brokers with low commission?

- 6. What should I look for in the terms and conditions of a forex broker with low commission?

- 7. Can I open a demo account with a forex broker with low commission?

- 8. Is it possible to negotiate commission rates with a forex broker?

- 9. How can I avoid paying high commissions on forex trades?

- 10. What are the benefits of using a forex broker with low commission?

Forex Brokers with Low Commission: A Guide to Finding the Right Broker

Introduction

Hey readers, welcome to the ultimate guide to finding forex brokers with low commission! If you’re in the forex market, you know that commissions can eat into your profits. That’s why finding a broker with competitive rates is crucial for maximizing your earnings. In this article, we’ll explore various aspects of low-commission forex brokers, providing you with valuable insights and tips to make an informed decision.

Understanding Commission Structures

Commissions are fees charged by brokers for executing trades on your behalf. There are two main types of commission structures:

Percentage-Based Commissions

These commissions are calculated as a percentage of the trade value. For example, a broker may charge 0.5% on each trade, meaning you’ll pay $5 for every $1,000 traded.

Fixed Commissions

Fixed commissions are a set amount charged per trade regardless of the trade value. For instance, a broker may charge $5 per trade, whether it’s a small or large trade.

Benefits of Low-Commission Brokers

Choosing a forex broker with low commission offers several benefits:

Lower Trading Costs

Lower commissions mean you’ll keep more of your trading profits. By minimizing fees, you can increase your potential earnings significantly.

Greater Flexibility

Low-commission brokers provide greater flexibility, allowing you to trade more frequently without worrying about excessive costs. This flexibility enables you to take advantage of market opportunities and optimize your trading strategy.

Increased Profitability

By reducing commission expenses, you’ll improve your overall profitability and enhance your chances of success in the forex market.

Finding the Right Low-Commission Broker

Finding the right low-commission broker requires careful research and consideration. Here are some key factors to keep in mind:

Reputation and Regulation

Choose brokers with a strong reputation and are regulated by reputable financial authorities. This ensures they operate within established guidelines and standards.

Trading Platform

Consider the trading platform offered by the broker. Ensure it’s user-friendly, reliable, and provides advanced features to support your trading needs.

Assets and Spreads

Check the range of currency pairs, commodities, and other assets offered by the broker. Low spreads (the difference between buy and sell prices) can significantly reduce your trading costs.

Additional Features

Look for brokers that offer additional features, such as educational resources, market analysis, and customer support. These features can enhance your trading experience.

Low-Commission Broker Comparison Table

| Broker | Commission Structure | Spreads | Assets | Features |

|---|---|---|---|---|

| Forex.com | Percentage-based | From 0.6 pips | 80+ currency pairs | Advanced trading tools |

| Oanda | Fixed commissions | From $0.35 per trade | 40+ currency pairs | Market analysis |

| Interactive Brokers | Tiered pricing | From $0.01 per trade | 100+ currency pairs | Professional trading platform |

| eToro | Percentage-based | From 0.09% | 50+ currency pairs | Social trading |

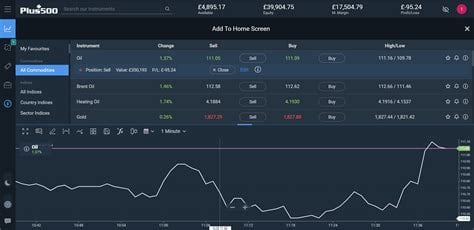

| Plus500 | Fixed commissions | From $0.02 per trade | 60+ currency pairs | Intuitive trading app |

Conclusion

Choosing a forex broker with low commission is a crucial step for successful trading. By understanding commission structures and considering the factors discussed in this article, you’ll be able to find the right broker for your needs. Maximize your profitability, increase your flexibility, and enhance your trading experience by opting for a low-commission forex broker.

Before you go, check out our other articles on forex trading, risk management, and financial markets. Stay informed and stay profitable!

FAQ about Forex Brokers with Low Commission

1. What is a forex broker with low commission?

A forex broker with low commission charges a small fee for each trade you make, rather than a percentage of the spread. This can save you money, especially if you trade frequently.

2. Why choose a forex broker with low commission?

If you’re a high-volume trader, choosing a broker with low commission can save you a significant amount of money over time.

3. What are the different types of commission structures offered by forex brokers?

There are two main types of commission structures offered by forex brokers: fixed and variable. Fixed commissions are a set amount per trade, regardless of the size of the trade. Variable commissions are a percentage of the spread.

4. How do I choose the right forex broker with low commission?

When choosing a forex broker with low commission, it’s important to consider the following factors:

a. Regulation

b. Trading platform

c. Customer service

d. Trading costs

5. What are some of the best forex brokers with low commission?

Some of the best forex brokers with low commission include:

a. IG

b. Saxo Bank

c. Interactive Brokers

6. What should I look for in the terms and conditions of a forex broker with low commission?

When reviewing the terms and conditions of a forex broker with low commission, be sure to pay attention to the following:

a. The minimum deposit required

b. The maximum leverage offered

c. The spreads charged

7. Can I open a demo account with a forex broker with low commission?

Yes, most forex brokers with low commission offer demo accounts. This allows you to practice trading without risking any real money.

8. Is it possible to negotiate commission rates with a forex broker?

In some cases, it may be possible to negotiate commission rates with a forex broker. However, this is typically only possible for high-volume traders.

9. How can I avoid paying high commissions on forex trades?

There are several ways to avoid paying high commissions on forex trades:

a. Choose a broker with low commission.

b. Trade less frequently.

c. Use a forex broker that offers rebates.

10. What are the benefits of using a forex broker with low commission?

The benefits of using a forex broker with low commission include:

a. Saving money on trading costs

b. Increasing your trading profits

c. Gaining a competitive edge in the forex market.