- Forex Brokers Rated: A Comprehensive Guide for Traders

- Introduction

- Types of Forex Brokers

- Key Factors to Consider

- Comparing Forex Brokers

- Tips for Choosing a Forex Broker

- Conclusion

-

FAQ about Forex Brokers Rated

- 1. What are the most important factors to consider when choosing a forex broker?

- 2. How do I know if a forex broker is regulated?

- 3. Are all forex brokers scams?

- 4. What are the different types of forex trading accounts?

- 5. What is spread betting?

- 6. What is the best forex trading platform?

- 7. How do I become a successful forex trader?

- 8. How much money do I need to start trading forex?

- 9. What are the risks involved in forex trading?

- 10. How do I withdraw my profits from a forex broker?

Forex Brokers Rated: A Comprehensive Guide for Traders

Introduction

Greetings, readers! Are you seeking the crème de la crème of forex brokers? Whether you’re a seasoned trader or just dipping your toes into the world of currency exchange, choosing the right broker is paramount to your success. This comprehensive guide will delve into all aspects of forex brokers rated, empowering you to make an informed decision that aligns with your trading goals.

Types of Forex Brokers

Dealing-Desk Brokers

Dealing-desk brokers act as your trading counterpart, essentially buying or selling currencies directly from you. They typically offer fixed spreads and can provide a more personalized service.

Non-Dealing-Desk Brokers

Non-dealing-desk brokers match your orders with other clients or connect you directly to liquidity providers. They often offer lower spreads but may charge a commission per trade.

Key Factors to Consider

Regulation and Reputation

Ensure your broker is regulated by a reputable financial authority, such as the FCA, ASIC, or NFA. This provides a layer of protection and ensures compliance with industry standards.

Spreads and Commissions

Spreads are the difference between the bid and ask prices of a currency pair. Commissions are additional fees charged per trade. Consider the overall cost of trading with different brokers.

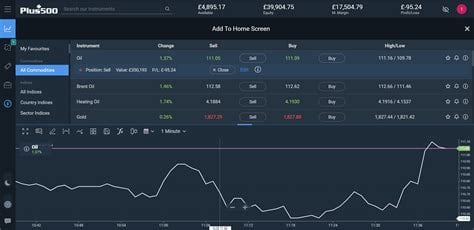

Trading Platforms

A reliable trading platform is essential for executing trades seamlessly. Look for platforms that offer advanced features, intuitive navigation, and robust charting tools.

Comparing Forex Brokers

To help you make an informed decision, we’ve compiled a table comparing several top-rated forex brokers:

| Broker | Regulation | Spreads | Commissions | Trading Platform |

|---|---|---|---|---|

| AvaTrade | FCA, ASIC, CBI | Fixed, starting from 0.8 pips | None | MetaTrader 4, MetaTrader 5 |

| XM | CySEC, ASIC, FCA | Variable, starting from 0.6 pips | None | MetaTrader 4, MetaTrader 5 |

| eToro | CySEC, ASIC, FCA | Variable, starting from 1 pip | None | Proprietary |

| FXCM | FCA, ASIC, NFA | Variable, starting from 1 pip | None | Trading Station, MetaTrader 4 |

| IC Markets | ASIC, FCA | Raw spreads, starting from 0.0 pips | Commissions start from $0.8/lot | MetaTrader 4, MetaTrader 5 |

Tips for Choosing a Forex Broker

- Determine your trading style and requirements.

- Research and compare different brokers thoroughly.

- Check reviews and testimonials from other traders.

- Consider the broker’s customer support and education materials.

- Open a demo account to test the platform and trading conditions.

Conclusion

Navigating the forex market requires a reliable and trustworthy broker. By understanding the different types of brokers, key factors to consider, and comparing top-rated options, you can find a broker that meets your specific needs. Utilize the tips provided to make an informed choice and take your trading journey to new heights.

For more insightful articles on forex trading, check out our other resources:

- A Beginner’s Guide to Forex Trading

- Strategies for Profitable Forex Trading

- Risk Management in Forex

FAQ about Forex Brokers Rated

1. What are the most important factors to consider when choosing a forex broker?

Answer: Spreads, commissions, trading platform, customer service, and regulation.

2. How do I know if a forex broker is regulated?

Answer: Check the broker’s website for a license number from a reputable regulatory authority, such as the Financial Conduct Authority (FCA) or the Cyprus Securities and Exchange Commission (CySEC).

3. Are all forex brokers scams?

Answer: No, not all forex brokers are scams. However, there are many unregulated brokers that engage in fraudulent activities.

4. What are the different types of forex trading accounts?

Answer: Standard accounts, mini accounts, micro accounts, and ECN accounts.

5. What is spread betting?

Answer: Spread betting is a type of derivative trading where you bet on the price movements of an underlying asset, without taking ownership of the asset itself.

6. What is the best forex trading platform?

Answer: The best trading platform for you depends on your individual needs and preferences. Some popular platforms include MetaTrader 4, MetaTrader 5, and cTrader.

7. How do I become a successful forex trader?

Answer: There is no guaranteed way to become a successful forex trader. However, there are some key principles that can help you increase your chances of success, such as learning how to manage risk, understanding technical and fundamental analysis, and developing a trading strategy.

8. How much money do I need to start trading forex?

Answer: You can start trading forex with as little as $100. However, it is important to note that the more money you have to trade with, the more you can potentially make.

9. What are the risks involved in forex trading?

Answer: The risks involved in forex trading include the possibility of losing money, as well as the risk of fraud. It is important to understand these risks before you start trading.

10. How do I withdraw my profits from a forex broker?

Answer: The process for withdrawing your profits from a forex broker will vary depending on the broker. However, most brokers offer a variety of withdrawal methods, such as bank wire, credit card, and PayPal.