- Forex Brokers Micro Lots: A Beginner’s Guide to Trading Smaller Sizes

- Advantages of Using Forex Brokers Micro Lots

- Disadvantages of Forex Brokers Micro Lots

- How to Choose the Right Micro Lot Broker

- Table: Forex Brokers Micro Lot Comparison

- Conclusion

-

FAQ about Forex Brokers Micro Lots

- What is a micro lot?

- Why use a micro lot?

- How do I trade with micro lots?

- What are the benefits of using micro lots?

- What are the disadvantages of using micro lots?

- How do I find a broker that offers micro lots?

- What is the difference between a micro lot and a mini lot?

- How can I use micro lots to manage my risk?

- What are some tips for trading with micro lots?

Forex Brokers Micro Lots: A Beginner’s Guide to Trading Smaller Sizes

What are Forex Brokers Micro Lots?

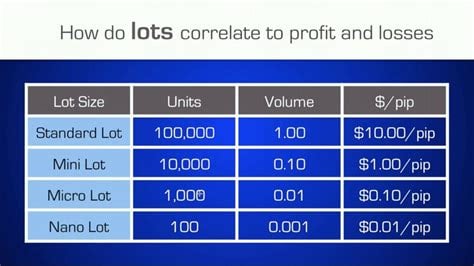

Forex brokers micro lots are tiny trading units representing 1/10th of a standard lot (1,000 base currency units). This means that a micro lot contains only 100 units of a specific currency, allowing traders to trade with smaller amounts of capital and minimize their risk exposure.

How Do Forex Brokers Micro Lots Work?

Micro lots are traded like standard lots, with traders placing buy or sell orders for specific currency pairs. However, the smaller size of micro lots means that the profit or loss per trade is also proportionally smaller. This allows traders to test different strategies or trade with smaller amounts of money without risking a significant portion of their capital.

Advantages of Using Forex Brokers Micro Lots

Reduced Risk

The primary benefit of using micro lots is their reduced risk. By trading smaller units, traders can limit their potential losses to a smaller amount, making it easier to manage their risk and prevent significant account depletion.

Enhanced Flexibility

Micro lots provide greater flexibility, allowing traders to open smaller positions that align with their capital and risk tolerance. This flexibility enables traders to experiment with different trading strategies or test new ideas without committing significant funds.

Lower Trading Costs

Trading micro lots typically incurs lower trading costs, including spreads, commissions, and other fees. Since the trade size is smaller, the associated costs are also reduced, allowing traders to save on expenses and improve their overall profitability.

Disadvantages of Forex Brokers Micro Lots

Limited Profit Potential

While micro lots reduce risk, they also limit profit potential. Since the trading units are smaller, the potential profits are also proportionally smaller. This may not be suitable for traders looking to generate substantial profits from each trade.

Execution Slippage

Trading micro lots can sometimes lead to execution slippage, which occurs when orders are executed at prices different from the intended price. This is because the smaller trade size may not be readily available in the market, resulting in the order being filled at the next available price.

Lower Market Presence

Trading micro lots may result in a lower market presence, meaning traders may have less impact on the market. This can be a disadvantage for scalpers or traders who need to enter or exit positions quickly and efficiently.

How to Choose the Right Micro Lot Broker

Reputation and Regulation

Choose a broker with a good reputation and a proven track record in the industry. Ensure they are regulated by reputable financial authorities to ensure trustworthiness and adherence to ethical standards.

Trading Instruments

Consider brokers that offer a wide range of currency pairs and other trading instruments. This will provide you with flexibility and more trading options.

Trading Platform

The trading platform is a crucial aspect of your trading experience. Choose a platform that is user-friendly, offers advanced charting tools, and supports different trading strategies.

Trading Costs

Compare the trading costs of different brokers, including spreads, commissions, and other fees. Opt for brokers that offer competitive pricing and low trading expenses.

Table: Forex Brokers Micro Lot Comparison

| Broker | Minimum Deposit | Spread (EUR/USD) | Commission |

|---|---|---|---|

| Pepperstone | $200 | 0.6 pips | $7 per round-trip lot |

| Exness | $10 | 0.1 pips | $0.08 per 1 micro lot |

| FBS | $5 | 0.5 pips | $0.05 per micro lot |

| XM | $5 | 0.6 pips | $0.08 per micro lot |

| IC Markets | $200 | 0.6 pips | $0.07 per micro lot |

Conclusion

Forex brokers micro lots offer a valuable tool for traders seeking to minimize risk and enhance flexibility while trading the foreign exchange market. Understanding the advantages and disadvantages of micro lots can help you make informed trading decisions and choose the best broker for your specific needs. Consider exploring other related articles to expand your knowledge of forex trading and make the most of your trading journey.

FAQ about Forex Brokers Micro Lots

What is a micro lot?

A micro lot is a very small unit of currency, typically 1,000 units of the base currency. This makes it a fraction of a standard lot, which is typically 100,000 units of the base currency.

Why use a micro lot?

Micro lots are popular with beginner traders because they allow them to trade with smaller amounts of money. This can reduce the risk of losing a large amount of money, and it can also help traders to learn how to trade without risking too much capital.

How do I trade with micro lots?

Trading with micro lots is the same as trading with standard lots. The only difference is the size of the position. When you trade with micro lots, you will be trading with a smaller amount of currency, and your profits and losses will be smaller.

What are the benefits of using micro lots?

Micro lots offer several benefits for beginner traders, including:

- Reduced risk: Micro lots allow traders to trade with smaller amounts of money, which can reduce the risk of losing a large amount of money.

- Learning experience: Micro lots can help traders to learn how to trade without risking too much capital.

- Flexibility: Micro lots are very flexible, and they can be used to trade a variety of currency pairs.

What are the disadvantages of using micro lots?

Micro lots also have some disadvantages, including:

- Smaller profits: Because micro lots are smaller, the profits that can be made are also smaller.

- Limited liquidity: Micro lots may not be as liquid as standard lots, which can make it difficult to enter and exit trades quickly.

How do I find a broker that offers micro lots?

Many brokers offer micro lots. When choosing a broker, it is important to consider the following factors:

- The broker’s reputation

- The broker’s fees

- The broker’s trading platform

What is the difference between a micro lot and a mini lot?

A micro lot is smaller than a mini lot. A micro lot is typically 1,000 units of the base currency, while a mini lot is typically 10,000 units of the base currency.

How can I use micro lots to manage my risk?

Micro lots can be used to manage risk by allowing traders to trade with smaller amounts of money. This can reduce the risk of losing a large amount of money, and it can also help traders to learn how to trade without risking too much capital.

What are some tips for trading with micro lots?

Here are some tips for trading with micro lots:

- Start small: Start trading with a small amount of money, and gradually increase your trading size as you gain experience.

- Use a stop loss order: A stop loss order will help to protect your profits and limit your losses.

- Be patient: Trading is a marathon, not a sprint. Be patient and let your trades develop.