- Introduction

- Choosing the Right Forex Broker for Beginners

- Discovering the Features of Forex Brokers for Beginners

- Forex Broker Comparison Table

- Conclusion

-

FAQ about Forex Brokers for Beginners

- What is a forex broker?

- What are the types of forex brokers?

- What is a leverage?

- What is a spread?

- What is a margin call?

- Can I trade forex with a small amount of money?

- What is the minimum deposit required to open a forex account?

- What are the risks involved in forex trading?

- How can I choose a good forex broker for beginners?

- How can I learn more about forex trading?

Introduction

Hey there, readers! Are you a newbie in the forex market, eager to embark on the thrilling journey of currency trading? Look no further! This comprehensive guide will equip you with everything you need to know about finding the best forex brokers for beginners.

As a novice trader, it’s crucial to choose a broker that caters to your needs and supports your trading endeavors. With a myriad of options available, navigating the world of forex brokers can be daunting. This guide will simplify the process, providing you with invaluable insights to make an informed decision.

Choosing the Right Forex Broker for Beginners

Essential Considerations

Before diving into the vast ocean of forex brokers, it’s essential to consider these fundamental factors:

- Regulation: Opt for brokers that are licensed and regulated by reputable authorities, ensuring the safety and credibility of your trading.

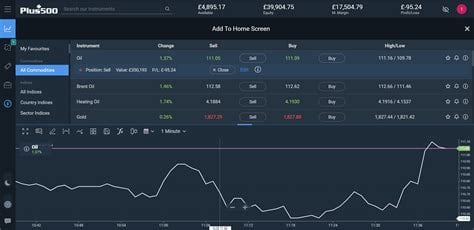

- Trading Platforms: Choose brokers with user-friendly and intuitive trading platforms, tailored to beginner traders’ needs.

- Account Types: Explore various account types to find one that aligns with your trading style and capital.

- Customer Support: Seek brokers with responsive and accessible customer support, guiding you through your trading journey.

Types of Forex Brokers for Beginners

- Market Maker Brokers: These brokers act as the counterparty to your trades, often offering tight spreads and faster execution.

- STP Brokers: Also known as Straight-Through-Processing brokers, they forward your orders directly to liquidity providers, providing greater transparency.

- ECN Brokers: Electronic Communication Network brokers connect you directly with other market participants, offering the most competitive pricing.

Discovering the Features of Forex Brokers for Beginners

Educational Resources

- Tutorials and Webinars: Look for brokers that provide comprehensive educational materials to empower beginners with the basics of forex trading.

- Demo Accounts: Experience the trading environment risk-free with demo accounts, allowing you to practice your skills and strategies.

- Market Analysis: Access insights, market updates, and technical tools to aid your decision-making.

Trading Tools and Features

- One-Click Trading: Execute trades quickly and easily with one-click trading features, suitable for fast-paced trading.

- Mobile Trading: Trade on the go with mobile trading apps, allowing you to manage your positions from anywhere.

- Social Trading: Connect with other traders, share strategies, and learn from experienced traders.

Forex Broker Comparison Table

| Feature | Market Maker | STP | ECN |

|---|---|---|---|

| Spreads | Typically tighter | Slightly wider | Widest |

| Execution | Faster | Intermediate | Slower |

| Liquidity | Counterparty to trades | Liquidity provider intermediary | Direct access to liquidity |

| Transparency | Limited | Moderate | Highest |

| Commissions | Often included in spreads | Charged separately | No commissions |

Conclusion

Welcome to the exhilarating world of forex trading, beginners! Embarking on this journey with the right forex broker is paramount to your success. By considering the factors outlined in this guide, you can make an informed choice and find a broker that aligns with your trading aspirations.

Don’t stop here! Continue exploring our blog for more enlightening articles on forex trading strategies, risk management, and market analysis. Join the community of knowledgeable traders and empower yourself with the insights you need to excel in the forex market.

FAQ about Forex Brokers for Beginners

What is a forex broker?

A forex broker is a financial intermediary that facilitates the trading of currencies on the foreign exchange market.

What are the types of forex brokers?

There are three main types of forex brokers: Dealing Desk Brokers (DDs), Non-Dealing Desk Brokers (NDDs), and Electronic Communication Networks (ECNs).

What is a leverage?

Leverage is a financial tool that allows traders to amplify their trading positions using borrowed capital.

What is a spread?

A spread is the difference between the bid and ask prices of a currency pair.

What is a margin call?

A margin call is a notice from a broker demanding additional funds to maintain the minimum required balance on a trading account.

Can I trade forex with a small amount of money?

Yes, many forex brokers offer accounts that require a minimum deposit of only a few hundred dollars.

What is the minimum deposit required to open a forex account?

The minimum deposit requirements vary depending on the broker but typically range from a few hundred dollars to several thousand dollars.

What are the risks involved in forex trading?

Forex trading involves a high level of risk, including the potential for significant losses of capital.

How can I choose a good forex broker for beginners?

When choosing a forex broker, beginners should look for one that offers low spreads, high leverage, and a user-friendly trading platform.

How can I learn more about forex trading?

There are numerous resources available to help beginners learn about forex trading, such as educational articles, tutorials, and webinars.