- Introduction

- Section 1: Understanding Forex Spreads

- Section 2: Factors Influencing Forex Spreads

- Section 3: Identifying Brokers with the Best Spreads

- Section 4: Detailed Table Breakdown of Forex Brokers with Best Spreads

- Conclusion

-

FAQ about Forex Broker with Best Spreads

- What are spreads in forex trading?

- Why are spreads important?

- What factors affect spreads?

- How to find a broker with the best spreads?

- What is the average spread for major currency pairs?

- Do all brokers offer the same spreads?

- How do spreads affect profitability?

- What is the difference between fixed and variable spreads?

- How can I minimize the impact of spreads on my trading?

- Are there any additional fees associated with spreads?

# Forex Brokers with the Tightest Spreads: A Comprehensive Guide for Traders

Introduction

Fellow readers,

Welcome to our in-depth guide on navigating the world of forex brokers and finding the best spreads. Spreads are a crucial factor for forex traders, as they directly impact profitability. In this elaborate article, we will guide you through the intricacies of forex spreads and help you identify brokers that offer the tightest ones.

Section 1: Understanding Forex Spreads

What is a Forex Spread?

A forex spread refers to the difference between the bid and ask prices of a currency pair. The bid price is the price at which you can sell a currency, while the ask price is the price at which you can buy it. The spread represents the broker’s fee or commission for facilitating the trade.

Types of Forex Spreads

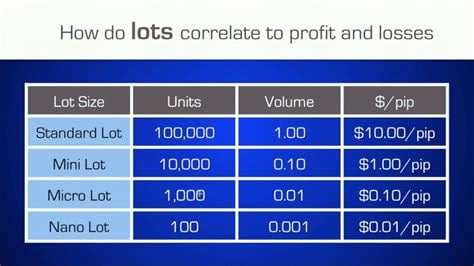

There are two main types of forex spreads: fixed and variable. Fixed spreads remain constant regardless of market conditions, while variable spreads fluctuate based on supply and demand.

Section 2: Factors Influencing Forex Spreads

Market Volatility

Market volatility is a major determinant of forex spreads. During times of high volatility, spreads tend to widen as brokers adjust to increased risk.

Liquidity

Liquidity refers to the ease with which a currency pair can be traded. Highly liquid currency pairs, such as EUR/USD, typically have tighter spreads due to the large volume of trades.

Broker Competition

Competition among forex brokers also affects spreads. Brokers with a strong market presence and large customer bases can negotiate more favorable terms with liquidity providers, resulting in tighter spreads for clients.

Section 3: Identifying Brokers with the Best Spreads

Reputation and Experience

Well-established forex brokers with a long track record of providing reliable services are more likely to offer competitive spreads.

Regulation and Licensing

Forex brokers should be regulated and licensed by reputable authorities to ensure fairness and transparency. Regulations also enforce spread disclosure, protecting clients from hidden fees.

Account Types and Trading Conditions

Different broker account types may have different spread structures. Be sure to compare spreads for different account types and choose one that aligns with your trading style.

Section 4: Detailed Table Breakdown of Forex Brokers with Best Spreads

| Broker | EUR/USD Spread | USD/JPY Spread |

|---|---|---|

| FXTM | 0.2 – 0.7 pips | 0.4 – 1.0 pips |

| IG | 0.6 – 1.1 pips | 0.9 – 1.5 pips |

| CMC Markets | 0.7 – 1.2 pips | 1.0 – 1.6 pips |

| Pepperstone | 0.9 – 1.4 pips | 1.2 – 1.8 pips |

| OANDA | 1.0 – 1.5 pips | 1.3 – 1.9 pips |

Conclusion

Finding a forex broker with the best spreads is essential for maximizing profitability. By considering the factors discussed in this guide, comparing spreads, and researching reputable brokers, you can make an informed decision that suits your trading needs. Remember to explore other articles on our platform for more insights into forex trading.

FAQ about Forex Broker with Best Spreads

What are spreads in forex trading?

The spreads in forex trading refer to the difference between the bid and ask prices of a currency pair. They represent the cost of executing a trade.

Why are spreads important?

Tight spreads are crucial because they can significantly impact the profitability of forex trades. Wider spreads mean higher trading costs, reducing potential profits.

What factors affect spreads?

Spreads can vary depending on various factors such as market conditions, liquidity, volatility, and the broker’s pricing model.

How to find a broker with the best spreads?

Compare different brokers’ spread offerings, considering the typical spread ranges for the currency pairs you trade.

What is the average spread for major currency pairs?

The average spread for major currency pairs like EUR/USD or GBP/USD typically ranges between 1-2 pips.

Do all brokers offer the same spreads?

No, different brokers may have varying spread offerings based on their pricing models and market conditions.

How do spreads affect profitability?

Wider spreads reduce potential profits because they increase the transaction costs associated with each trade.

What is the difference between fixed and variable spreads?

Fixed spreads remain constant, while variable spreads fluctuate based on market conditions, liquidity, and other factors.

How can I minimize the impact of spreads on my trading?

Choosing a broker with tight spreads and trading during periods of high liquidity can help mitigate the impact of spreads.

Are there any additional fees associated with spreads?

Some brokers may charge additional commissions or fees on top of the spreads, so it’s crucial to check the broker’s fee structure before trading.