- The Ultimate Guide to Forex Brokers with 1000 Leverage for Traders

-

FAQ about Forex Brokers with 1000 Leverage

- What is a forex broker with 1000 leverage?

- Is it safe to trade forex with 1000 leverage?

- What are the benefits of using 1000 leverage?

- What are the risks of using 1000 leverage?

- Who should use a forex broker with 1000 leverage?

- What should I look for when choosing a forex broker with 1000 leverage?

- How much money do I need to start trading forex with 1000 leverage?

- What is the best way to learn how to trade forex with 1000 leverage?

- Is it possible to make a lot of money trading forex with 1000 leverage?

- What are the risks of trading forex with 1000 leverage?

The Ultimate Guide to Forex Brokers with 1000 Leverage for Traders

Greetings, Fellow Traders!

Welcome to our in-depth exploration of the world of forex brokers offering a breathtaking 1000:1 leverage. In this comprehensive guide, we’ll delve into every aspect you need to know about unlocking the unparalleled trading potential with these esteemed brokerages.

1000 Leverage: The Power and the Pitfalls

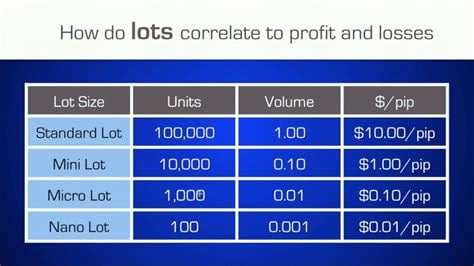

When it comes to forex trading, leverage acts as a magnifying glass, allowing traders to amplify their returns. With 1000 leverage, you can trade up to $1,000,000 worth of currency for every $1,000 in your account. While this magnification can lead to substantial gains, it’s crucial to exercise caution and understand the inherent risks.

Choosing the Right Forex Broker with 1000 Leverage

Selecting a reputable forex broker with 1000 leverage is paramount. Look for brokers with a proven track record, solid financial standing, and a comprehensive offering of trading tools and resources. Consider factors such as trading platforms, spreads, commissions, and customer support to find the best match for your trading style and goals.

Maximizing Your Leverage: Strategies and Tips

Leverage is a double-edged sword that requires prudent management. To maximize its potential while mitigating risks, adhere to these strategies:

- Use Stop-Loss Orders: Set predetermined exit points to limit potential losses in case of adverse market movements.

- Manage Your Risk: Determine your risk tolerance and allocate funds accordingly. Avoid risking more than you can afford to lose.

- Educate Yourself: Thoroughly understand the forex market, trading strategies, and risk management techniques.

Comprehensive Table of Forex Brokers with 1000 Leverage

To assist you in your search, we’ve compiled a detailed table showcasing leading forex brokers offering 1000 leverage:

| Broker | Platform | Spread | Commission | Minimum Deposit |

|---|---|---|---|---|

| FXTM | MetaTrader 4, 5 | From 0.1 pips | Variable | $50 |

| IC Markets | cTrader, MetaTrader 4, 5 | From 0.5 pips | Raw spread | $200 |

| Pepperstone | MetaTrader 4, 5 | From 0.6 pips | Variable | $200 |

| XM | MetaTrader 4, 5 | From 0.6 pips | None | $5 |

| Exness | MetaTrader 4, 5 | From 0.5 pips | Variable | $1 |

Conclusion

Navigating the world of forex brokers with 1000 leverage demands thorough research and a prudent approach. By carefully considering the factors discussed in this guide, you can enhance your trading potential and achieve success in the dynamic forex market.

If you’re eager to expand your knowledge and discover more trading strategies, check out our other articles on our website. We’re committed to providing valuable insights and empowering traders of all levels to make informed trading decisions.

FAQ about Forex Brokers with 1000 Leverage

What is a forex broker with 1000 leverage?

A forex broker with 1000 leverage allows you to trade with a ratio of 1:1000. This means that for every $1 of your own money, you can control up to $1,000 worth of currency pairs.

Is it safe to trade forex with 1000 leverage?

Trading forex with 1000 leverage is not advisable for most traders. It can amplify your profits, but it can also magnify your losses. Only experienced traders who are willing to take significant risks should consider using this level of leverage.

What are the benefits of using 1000 leverage?

The main benefit of using 1000 leverage is that it can increase your potential profits. By controlling a larger amount of capital, you have the opportunity to generate larger returns on your investment.

What are the risks of using 1000 leverage?

The main risk of using 1000 leverage is that it can lead to large losses. If the market moves against you, you could lose your entire investment very quickly.

Who should use a forex broker with 1000 leverage?

Forex brokers with 1000 leverage are best suited for experienced traders who are willing to take on significant risk in order to achieve higher returns. Beginner traders should avoid using this level of leverage.

What should I look for when choosing a forex broker with 1000 leverage?

When choosing a forex broker with 1000 leverage, you should consider the following factors:

- Reputation and regulation

- Trading platform and tools

- Spreads and commissions

- Customer support

How much money do I need to start trading forex with 1000 leverage?

The amount of money you need to start trading forex with 1000 leverage will depend on the broker you choose and the amount of risk you are willing to take. Some brokers may require a minimum deposit of as little as $100, while others may require more.

What is the best way to learn how to trade forex with 1000 leverage?

The best way to learn how to trade forex with 1000 leverage is to open a demo account with a reputable broker. This will allow you to practice trading without risking any real money.

Is it possible to make a lot of money trading forex with 1000 leverage?

It is possible to make a lot of money trading forex with 1000 leverage, but it is not easy. You need to have a strong understanding of the market and be willing to take on a lot of risk.

What are the risks of trading forex with 1000 leverage?

The risks of trading forex with 1000 leverage are significant. You could lose your entire investment very quickly if the market moves against you.