- Forex Broker Websites: Your Gateway to Currency Trading

-

FAQ about Forex Broker Websites

- What is a forex broker?

- How do I choose a forex broker?

- What are the different types of forex broker accounts?

- What is a forex trading platform?

- How do I open a forex account with a broker?

- What is leverage in forex trading?

- What is a spread in forex trading?

- What are the benefits of using a forex broker?

- What are the risks of forex trading?

- How do I avoid scams when choosing a forex broker?

Forex Broker Websites: Your Gateway to Currency Trading

Greetings, readers! In the vast expanse of the internet, forex broker websites serve as pivotal gateways to the world of currency trading. Whether you’re a seasoned veteran or a curious novice, choosing the right forex broker website is paramount to your trading success.

Section 1: Navigating the Forex Trading Landscape

- Step 1: Explore the Broker’s Credentials – Reputable forex broker websites proudly display their regulatory licenses and affiliations. These entities ensure that the broker operates in compliance with industry standards, protecting your funds and promoting fair trading practices.

- Step 2: Research the Trading Platform – The forex trading platform is your virtual battlefield. Choose a broker website that offers a platform that aligns with your trading style and preferences. Whether you prefer advanced charting tools or automated trading capabilities, there’s a platform out there for you.

Section 2: The Essentials of Choosing a Forex Broker Website

- Key Factor 1: Leverage and Margin – Leverage allows you to amplify your trading potential by borrowing capital. However, it’s crucial to understand the risks associated with leverage and use it judiciously. Margin, on the other hand, acts as a buffer against market fluctuations, protecting your funds from excessive losses.

- Key Factor 2: Market Analysis and Research – Top forex broker websites empower traders with in-depth market analysis, real-time news, and educational resources. These tools provide valuable insights into market trends and help you make informed trading decisions.

Section 3: Advanced Features for Discerning Traders

- Sophisticated Tools: Many forex broker websites offer advanced tools such as VPS (virtual private server) hosting, allowing you to automate your trades and execute them remotely.

- Social Trading: Connect with fellow traders, share insights, and learn from their experiences. Social trading platforms foster a sense of community and provide opportunities for collaboration.

Table: Comparing Forex Broker Websites

| Feature | Broker A | Broker B | Broker C |

|---|---|---|---|

| Regulatory Compliance | FCA, ASIC | CySEC, CFTC | BaFin, NFA |

| Trading Platform | MetaTrader 4 | cTrader | ActTrader |

| Leverage | Up to 1:500 | Up to 1:200 | Up to 1:100 |

| Market Analysis | In-house analysis team | Third-party research providers | Daily market updates |

| Advanced Tools | VPS hosting | Social trading | Autochartist integration |

Conclusion

Choosing the right forex broker website is a journey that requires careful consideration and research. By following the guidance outlined in this article, you can navigate the forex trading landscape with confidence and select a broker website that empowers you to achieve your trading goals. Remember to explore our other articles for further insights into the world of currency trading.

FAQ about Forex Broker Websites

What is a forex broker?

A forex broker is a financial institution that provides traders with access to the foreign exchange (forex) market. They offer trading platforms, execution services, and other tools to facilitate currency exchange and trading.

How do I choose a forex broker?

When choosing a forex broker, consider factors such as regulation, trading conditions (e.g., spreads, fees), platform features, customer support, and reputation. Research and compare multiple brokers to find the best fit for your needs.

What are the different types of forex broker accounts?

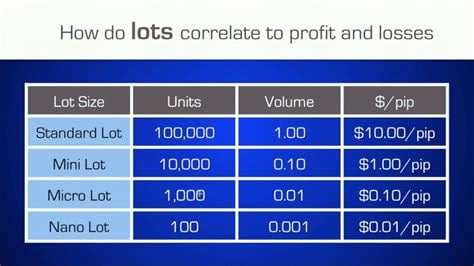

Common forex broker account types include Standard Accounts (basic trading), Micro Accounts (small lot sizes), ECN Accounts (direct market access), and Demo Accounts (practice trading). Each type offers varying features and trading conditions.

What is a forex trading platform?

A forex trading platform is a software or web-based application provided by brokers that allows traders to place orders, manage their positions, and access market data and analysis tools.

How do I open a forex account with a broker?

To open an account, visit the broker’s website and complete the registration form. Provide necessary identity and financial information, and deposit funds to start trading.

What is leverage in forex trading?

Leverage is a tool that allows traders to control a larger position size with a smaller margin deposit. It can amplify profits but also increase losses, so use it wisely.

What is a spread in forex trading?

A spread is the difference between the bid and ask prices of a currency pair. It represents the broker’s commission on each trade. Look for brokers with competitive spreads to minimize trading costs.

What are the benefits of using a forex broker?

Brokers provide access to the forex market, offer trading platforms, execute trades, provide leverage, and may offer educational resources or customer support to assist traders.

What are the risks of forex trading?

Forex trading involves risk of loss due to market volatility, leverage, limited stop-loss protection, and other factors. Only trade with funds you can afford to lose.

How do I avoid scams when choosing a forex broker?

Be wary of unlicensed or unregulated brokers, unrealistic profit promises, high-pressure sales tactics, or requests for sensitive financial information without proper verification.