- Forex Broker Micro Lots: A Beginner’s Guide to Trading Smaller Amounts

- Understanding Forex Broker Micro Lots

- Choosing a Forex Broker with Micro Lots

- Trading Strategies for Micro Lots

- Forex Broker Micro Lots Comparison Table

- Conclusion

-

FAQ About Forex Broker Micro Lots

- What is a micro lot?

- What is the advantage of trading micro lots?

- What is the minimum deposit required to trade micro lots?

- How do I calculate the value of a micro lot?

- What is the spread on a micro lot?

- What is the commission on a micro lot?

- What is the leverage on a micro lot?

- What is the risk of trading micro lots?

- How can I minimize the risk of trading micro lots?

- Is trading micro lots right for me?

Forex Broker Micro Lots: A Beginner’s Guide to Trading Smaller Amounts

Introduction

Hey there, readers! Are you curious about the world of forex trading but feel overwhelmed by the thought of investing large sums of money? Well, we have good news for you! Forex broker micro lots make it possible to trade with smaller amounts, making forex accessible to traders of all levels. In this comprehensive guide, we’ll delve into the world of forex broker micro lots and unravel everything you need to know to get started.

Forex, short for foreign exchange, involves buying and selling currencies in pairs. Traditionally, forex trading required substantial capital, often making it out of reach for many individuals. However, the introduction of micro lots has revolutionized the industry, allowing traders to participate with more manageable amounts.

Understanding Forex Broker Micro Lots

What Are Micro Lots?

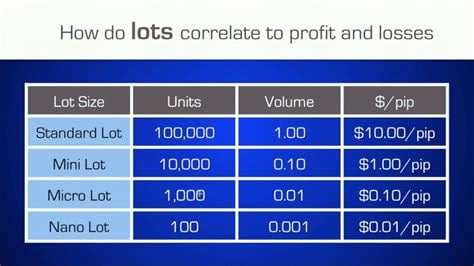

A micro lot, also known as a 0.01 lot, represents the smallest unit of currency tradable in forex. It’s equivalent to 1,000 units of the base currency in a currency pair. So, if you buy one micro lot of EUR/USD, you’re buying 1,000 euros.

Benefits of Micro Lots

- Reduced Capital Requirement: Micro lots allow you to trade with as little as $0.10 per pip, making it accessible to even small investors.

- Controlled Risk: Trading with micro lots limits your potential losses, as smaller trades result in smaller pip values.

- Flexibility: Micro lots offer flexibility to scale your trades based on your risk appetite and account balance.

- Learning Opportunity: For beginners, trading with micro lots provides a valuable opportunity to gain experience without risking significant capital.

Choosing a Forex Broker with Micro Lots

Factors to Consider

- Regulation: Ensure your broker is regulated by a reputable financial authority for added protection.

- Trading Platform: Choose a broker with a user-friendly and reliable trading platform.

- Spreads and Commissions: Consider the spreads and commissions charged by the broker, as they can impact your profitability.

- Customer Support: Opt for a broker with responsive and knowledgeable customer support.

- Minimum Deposit: Check the minimum deposit required to open an account with micro lot trading capabilities.

Trading Strategies for Micro Lots

Scalping

Scalping involves making multiple small trades over a short period, profiting from tiny price fluctuations. Micro lots are ideal for scalping due to their low trading costs.

News Trading

News trading capitalizes on market movements triggered by news events. By trading micro lots, you can react quickly to news and limit your losses if things don’t go as expected.

Counter-Trend Trading

Counter-trend trading involves trading against the prevailing market trend in anticipation of a reversal. Micro lots allow you to enter and exit trades with precision, maximizing your potential profits.

Forex Broker Micro Lots Comparison Table

| Broker | Minimum Deposit | Spreads (EUR/USD) | Commission | Leverage | Platform |

|---|---|---|---|---|---|

| Exness | $10 | 0.6 pips | $0 | Up to 1:2000 | MetaTrader 4/5 |

| OctaFX | $100 | 1.0 pips | $0 | Up to 1:500 | MetaTrader 4/5 |

| Pepperstone | $200 | 1.4 pips | $0 | Up to 1:500 | cTrader |

| Vantage FX | $200 | 1.5 pips | $0 | Up to 1:500 | MetaTrader 4/5 |

| IC Markets | $200 | 0.9 pips | $0 | Up to 1:500 | MetaTrader 4/5 |

Conclusion

Forex broker micro lots have opened up a new world of trading opportunities for individuals who want to participate in the forex market without risking large sums of money. By understanding the benefits and strategies associated with micro lots, you can navigate the forex market with confidence and potentially earn profits. Don’t forget to check out our other articles for more comprehensive insights into forex trading.

FAQ About Forex Broker Micro Lots

What is a micro lot?

A micro lot is a unit of measurement for the trading of foreign currencies. It is one thousandth of a standard lot, which is equal to 100,000 units of the base currency.

What is the advantage of trading micro lots?

The main advantage of trading micro lots is that it allows traders to trade smaller positions with less risk. This is especially beneficial for beginner traders who may not have a large amount of capital to invest.

What is the minimum deposit required to trade micro lots?

The minimum deposit required to trade micro lots will vary depending on the forex broker you choose. However, most brokers will require a deposit of at least $100.

How do I calculate the value of a micro lot?

To calculate the value of a micro lot, you need to multiply the current exchange rate by the number of micro lots you are trading. For example, if the EUR/USD exchange rate is 1.1200 and you are trading one micro lot, the value of the lot would be $1,120.

What is the spread on a micro lot?

The spread on a micro lot is the difference between the bid price and the ask price. The spread is typically expressed in pips, which are the smallest increment of price movement.

What is the commission on a micro lot?

The commission on a micro lot is a fee charged by the forex broker for executing the trade. The commission is typically a small percentage of the trade value.

What is the leverage on a micro lot?

Leverage is a tool that allows traders to trade with more money than they have in their account. The leverage on a micro lot will vary depending on the forex broker you choose. However, most brokers will offer leverage of up to 100:1.

What is the risk of trading micro lots?

The risk of trading micro lots is the same as the risk of trading any other size of lot. The main risk is that you could lose money if the market moves against you.

How can I minimize the risk of trading micro lots?

There are a number of ways to minimize the risk of trading micro lots. These include:

- Using a stop-loss order to limit your losses

- Trading with a small amount of capital

- Only trading when you have a clear understanding of the market

Is trading micro lots right for me?

Whether or not trading micro lots is right for you depends on your individual circumstances. If you are a beginner trader with a limited amount of capital, then trading micro lots may be a good option for you. However, if you are an experienced trader with a large amount of capital, then you may be better off trading larger lots.