-

Forex Broker Micro Accounts: A Beginner’s Guide to Trading with Small Capital

- Understanding Forex Broker Micro Accounts

- Advantages of Using a Forex Broker Micro Account

- Disadvantages of Using a Forex Broker Micro Account

- How to Choose the Right Forex Broker for Micro Accounts

- Tips for Trading with a Forex Broker Micro Account

- Forex Broker Micro Account vs. Standard Account

- Conclusion

-

FAQ about Forex Broker Micro Account

- What is a Forex Broker Micro Account?

- What are the benefits of using a Forex Broker Micro Account?

- What is the minimum deposit for a Forex Broker Micro Account?

- How do I open a Forex Broker Micro Account?

- Can I withdraw profits from a Forex Broker Micro Account?

- What are the trading conditions on a Forex Broker Micro Account?

- Can I use a Forex Broker Micro Account for scalping?

- Are Forex Broker Micro Accounts suitable for beginners?

- What is the best Forex Broker for Micro Accounts?

- Can I make money with a Forex Broker Micro Account?

Forex Broker Micro Accounts: A Beginner’s Guide to Trading with Small Capital

Greetings, readers! Are you interested in exploring the world of forex trading but hesitant due to limited capital? Well, the forex broker micro account is here to alleviate that concern. Designed specifically for beginners and traders with smaller budgets, micro accounts offer a low-risk entry point into the forex market.

As a newbie, starting with a micro account can be an excellent way to hone your skills, learn the ropes, and gain confidence without putting your entire financial future on the line. In this comprehensive guide, we’ll delve into the intricacies of forex broker micro accounts, empowering you with the knowledge you need to succeed.

Understanding Forex Broker Micro Accounts

Forex broker micro accounts are specialized trading accounts offered by forex brokers that allow traders to trade with small amounts of money. These accounts typically have the lowest minimum deposit requirements, often ranging from $10 to $100. With such low barriers to entry, micro accounts make forex trading accessible to even the smallest investors.

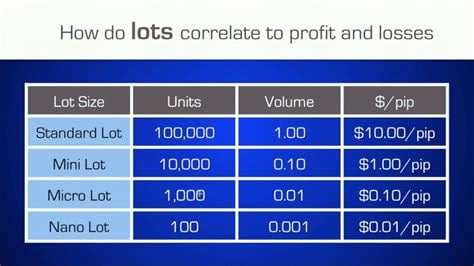

Besides low minimum deposits, micro accounts also offer small contract sizes. Instead of trading standard lots (100,000 units of currency), micro accounts allow you to trade micro lots (1,000 units of currency). This feature enables traders to control their risk exposure by limiting the amount of money they can potentially lose on any given trade.

Advantages of Using a Forex Broker Micro Account

-

Low capital requirement: Micro accounts are designed for traders with limited capital, making it an ideal starting point for beginners.

-

Reduced risk exposure: Small contract sizes limit potential losses, allowing traders to manage risk more effectively.

-

Testing strategies without significant financial risk: Micro accounts provide a safe environment for testing trading strategies before risking larger sums of money.

Disadvantages of Using a Forex Broker Micro Account

-

Higher trading costs: Micro accounts often have higher spreads and commissions compared to standard accounts.

-

Limited trading volume: Micro accounts may impose restrictions on the maximum trading volume, which can be a limitation for experienced traders.

-

Not suitable for large-scale trading: Micro accounts are not designed for traders looking to engage in large-scale forex trading.

How to Choose the Right Forex Broker for Micro Accounts

Selecting the right forex broker is crucial for your trading success. Consider these key factors when making your choice:

-

Minimum deposit: Look for brokers with low minimum deposit requirements to suit your budget.

-

Contract size: Ensure that the broker offers micro lot trading, which is essential for beginners and traders with limited capital.

-

Trading costs: Compare spreads and commissions to minimize trading expenses.

-

Reputation and regulation: Choose brokers with a solid reputation and those regulated by respected financial authorities.

-

Customer support: Opt for brokers that provide reliable and responsive customer support to assist you on your trading journey.

Tips for Trading with a Forex Broker Micro Account

-

Start with a demo account: Practice trading with a demo account before risking real money to enhance your skills and confidence.

-

Set realistic expectations: Don’t expect to make millions overnight. Forex trading involves risks, and it’s essential to approach it with a realistic mindset.

-

Manage your risk effectively: Use stop-loss orders and limit your leverage to minimize potential losses.

-

Don’t overtrade: Avoid taking on more trades than you can handle. Remember, quality is more important than quantity.

-

Learn from your mistakes: Analyze your trades to identify areas for improvement. Mistakes are inevitable, but learning from them is invaluable.

Forex Broker Micro Account vs. Standard Account

| Feature | Micro Account | Standard Account |

|---|---|---|

| Minimum deposit | $10-$100 | $1,000-$5,000 |

| Contract size | 1,000 units of currency | 100,000 units of currency |

| Spreads and commissions | Higher | Lower |

| Risk exposure | Lower | Higher |

| Suitability | Beginners, traders with limited capital | Experienced traders |

Conclusion

Forex broker micro accounts provide a valuable entry point into the forex market for those with limited capital. They offer a low-risk environment to learn and practice trading, allowing you to build your skills and confidence before committing larger sums of money. However, it’s important to remember that forex trading involves risks, and it’s essential to approach it with a realistic mindset and effective risk management strategies. If you’re a novice trader or have a limited budget, a forex broker micro account could be an excellent option for you.

To further your forex knowledge, we encourage you to explore our other articles on forex trading strategies, technical analysis, and market trends. Stay informed, stay adaptable, and let us guide you on your forex trading journey.

FAQ about Forex Broker Micro Account

What is a Forex Broker Micro Account?

A Forex broker micro account is a trading account that allows traders to trade with smaller amounts of money, typically starting from $10 or less.

What are the benefits of using a Forex Broker Micro Account?

- Lower risk: With a smaller account balance, traders can limit their potential losses.

- Easier to learn: Micro accounts allow traders to practice trading with real money without risking large amounts.

- Greater flexibility: Micro accounts offer greater flexibility in terms of trading strategies and risk management.

What is the minimum deposit for a Forex Broker Micro Account?

The minimum deposit for a micro account can vary depending on the broker, but it typically ranges from $10 to $50.

How do I open a Forex Broker Micro Account?

Opening a micro account is a straightforward process. Simply visit the broker’s website, register for an account, and make a deposit.

Can I withdraw profits from a Forex Broker Micro Account?

Yes, you can withdraw profits from a micro account, just like any other trading account.

What are the trading conditions on a Forex Broker Micro Account?

Trading conditions on micro accounts are generally similar to those on standard accounts, but there may be some differences in terms of spreads, commissions, and leverage.

Can I use a Forex Broker Micro Account for scalping?

Yes, you can use a micro account for scalping, which is a short-term trading strategy involving frequent trades.

Are Forex Broker Micro Accounts suitable for beginners?

Yes, micro accounts are ideal for beginners who want to start trading with a small amount of money and learn the basics.

What is the best Forex Broker for Micro Accounts?

The best broker for micro accounts depends on your individual needs. Consider factors such as trading conditions, customer support, and regulation when choosing a broker.

Can I make money with a Forex Broker Micro Account?

Yes, you can make money with a micro account, but it requires skill, knowledge, and a sound trading strategy.