- The Quest for the Best Forex Markets: A Comprehensive Guide

-

FAQ about Best Forex Markets

- 1. What are the best forex markets?

- 2. How do I choose the best forex market for me?

- 3. What makes a forex market liquid?

- 4. What are competitive spreads?

- 5. What currency pairs are available in the forex market?

- 6. When are the best trading hours for forex?

- 7. How do I compare different forex markets?

- 8. What regulatory bodies oversee forex markets?

- 9. How do I access forex markets?

- 10. What are some tips for trading in forex markets?

The Quest for the Best Forex Markets: A Comprehensive Guide

Introduction

Greetings, dear readers! Welcome to our in-depth exploration of the best forex markets. Forex, short for foreign exchange, is the global marketplace where currencies are traded. With its vast liquidity and potential for profitability, the forex market has attracted traders from all walks of life. However, navigating this complex landscape can be daunting, especially for beginners. This guide will provide you with the knowledge and insights you need to identify and leverage the best forex markets.

Understanding Different Forex Market Structures

Spot Market: The spot market is where currencies are traded for immediate delivery. It’s the most liquid forex market and offers real-time pricing.

Forward Market: In the forward market, currencies are traded at a predetermined price and delivery date. Forward contracts allow traders to lock in exchange rates and manage currency risk in the future.

Swap Market: The swap market involves the simultaneous exchange of two currencies for different value dates. Swaps are typically used for longer-term hedging and speculation.

Evaluating Forex Market Liquidity and Volatility

Liquidity: Liquidity refers to the ease with which currencies can be bought and sold without significantly affecting their price. High liquidity ensures smooth trading and minimizes slippage.

Volatility: Volatility measures the fluctuations in currency prices over a given period. High volatility can lead to both profits and losses, depending on the direction of the trend.

Choosing the Best Forex Market for Your Needs

For Beginners:

High Liquidity and Low Volatility: Look for markets with high liquidity, such as the EUR/USD or GBP/USD, which offer tight spreads and minimize the impact of market fluctuations.

Established Market History: Favor markets with a long and stable trading history, as they provide valuable insights into currency behavior and trends.

For Experienced Traders:

Higher Volatility and Profit Potential: Explore markets with higher volatility, such as the AUD/JPY or USD/SEK, which offer the potential for greater rewards but also carry higher risk.

Emerging Market Opportunities: Consider emerging markets with promising economic prospects and currency appreciation potential, but be aware of the associated risks.

Key Considerations for Forex Market Selection

| Factor | Considerations |

|---|---|

| Regulation: Ensure the market is regulated by reputable authorities to protect traders and maintain transparency. | |

| Transaction Costs: Consider the spread, commissions, and any other fees associated with trading in a particular market. | |

| Trading Tools: Look for markets that offer advanced trading platforms and tools to enhance your analysis and execution. | |

| Customer Support: Choose markets with responsive customer support to assist you with any issues or inquiries. |

Conclusion

Choosing the best forex markets is crucial for successful trading. By understanding the different market structures, evaluating liquidity and volatility, and considering your own needs, you can identify the markets that align with your risk tolerance and profit goals. Remember to stay informed about market conditions, seek guidance from experienced traders, and always trade with caution.

If you enjoyed this article, be sure to check out our other insights on forex trading, technical analysis, and market strategies. Stay tuned for more valuable content that will help you navigate the forex landscape with confidence!

FAQ about Best Forex Markets

1. What are the best forex markets?

- Forex markets with high liquidity, competitive spreads, and access to a wide range of currency pairs are considered best. Major markets include the London Forex Market, New York Forex Market, and Tokyo Forex Market.

2. How do I choose the best forex market for me?

- Consider factors such as liquidity, spreads, currency pairs offered, trading hours, and regulation to select a market that aligns with your trading style and needs.

3. What makes a forex market liquid?

- High liquidity means there is a large volume of orders in the market, resulting in faster execution and narrower spreads. Major forex markets are highly liquid due to the participation of financial institutions and individual traders.

4. What are competitive spreads?

- Spreads refer to the difference between the bid and ask prices of a currency pair. Competitive spreads imply lower transaction costs and increased profitability.

5. What currency pairs are available in the forex market?

- Major currency pairs (e.g., EUR/USD, GBP/USD, USD/JPY) are widely traded and have the highest liquidity. Minor currency pairs (e.g., AUD/CAD, GBP/JPY) have lower liquidity and wider spreads.

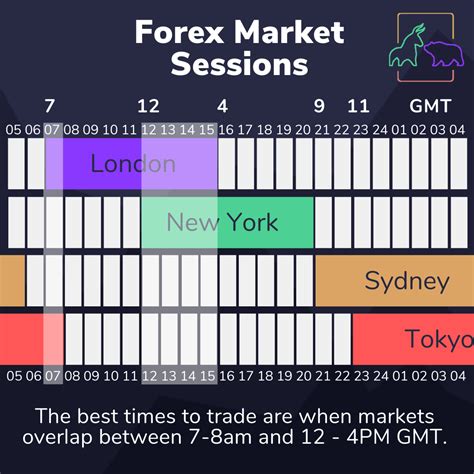

6. When are the best trading hours for forex?

- The overlap between the London and New York Forex Markets (8 AM to 4 PM EST) offers the highest liquidity and volatility, making it a popular trading period.

7. How do I compare different forex markets?

- Use brokers’ websites, online reviews, and industry sources to compare liquidity, spreads, currency pairs, trading hours, and regulation of potential markets.

8. What regulatory bodies oversee forex markets?

- Forex markets are regulated by various government agencies in different countries, such as the Financial Conduct Authority (FCA) in the UK, the Commodity Futures Trading Commission (CFTC) in the US, and the Australian Securities and Investments Commission (ASIC) in Australia.

9. How do I access forex markets?

- To trade forex, you need to open an account with a reputable brokerage firm that provides access to a trading platform and currency pairs.

10. What are some tips for trading in forex markets?

- Educate yourself about the market, start with a demo account, manage risk effectively, and develop a trading strategy that aligns with your goals and risk tolerance.