-

Best Forex Trading Time: When to Trade for Maximum Profit

- Introduction

- Section 1: Market Open and Close Times

- Understanding Trading Sessions

- Impact on Liquidity and Volatility

- Section 2: Best Trading Times for Currency Pairs

- EUR/USD Pair

- GBP/USD Pair

- USD/JPY Pair

- Section 3: Trading Time vs. Your Style

- Scalping vs. Day Trading

- Long-Term Trading vs. Swing Trading

- Section 4: Detailed Table Breakdown

- Conclusion

-

FAQ about Best Forex Trading Time

- When is the best time to trade forex?

- What are the best trading hours for different currency pairs?

- What is the overlap time for different trading sessions?

- What is the impact of news and economic events on trading times?

- Is it better to trade during the week or weekend?

- Does trading time matter for scalping?

- What are the best times to trade for beginners?

- How can I determine the best trading time for my strategy?

- What should I avoid when choosing a trading time?

Best Forex Trading Time: When to Trade for Maximum Profit

Introduction

Greetings, readers! Are you eager to unlock the secrets of the forex market and discover the optimal time to trade for maximum gains? You’ve come to the right place. In this comprehensive guide, we’ll delve into the intricacies of forex trading hours and explore the best times to execute your trades based on market conditions, currency pairs, and your own trading style.

Section 1: Market Open and Close Times

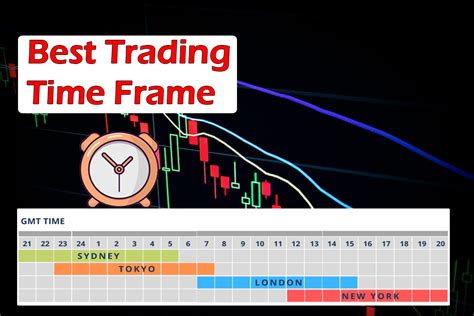

Understanding Trading Sessions

The forex market is a decentralized global network that operates 24 hours a day, 5 days a week. However, this vast market is divided into four major trading sessions that correspond to the opening and closing times of major financial centers around the world:

- Sydney Session: 10 pm UTC to 6 am UTC

- Tokyo Session: 12 am UTC to 8 am UTC

- London Session: 8 am UTC to 4 pm UTC

- New York Session: 1 pm UTC to 9 pm UTC

Impact on Liquidity and Volatility

The overlap between trading sessions plays a crucial role in liquidity and volatility. When multiple sessions overlap, market activity increases, leading to greater liquidity and potentially higher volatility. Conversely, when only one or two sessions are active, liquidity tends to be lower, which can result in slower execution times and potentially wider spreads.

Section 2: Best Trading Times for Currency Pairs

EUR/USD Pair

The EUR/USD pair, also known as the "Euro," is the most widely traded currency pair in the forex market. The best time to trade EUR/USD is during the London and New York sessions when there is increased liquidity and volatility. The overlap between these sessions provides ample trading opportunities due to the significant presence of European and American banks and financial institutions.

GBP/USD Pair

The GBP/USD pair, also known as the "Cable," is the second most traded currency pair in the market. The best time to trade GBP/USD is during the London session, when the currency pair experiences the highest liquidity and volatility. This is because the United Kingdom is the primary financial hub for the British pound.

USD/JPY Pair

The USD/JPY pair, also known as the "Ninja," is the third most traded currency pair in the market. The best time to trade USD/JPY is during the Tokyo and London sessions. The overlap between these sessions provides opportunities for both Asian and European traders to participate in the market.

Section 3: Trading Time vs. Your Style

Scalping vs. Day Trading

Scalping is a short-term trading strategy that involves entering and exiting positions within minutes or seconds. Scalpers typically trade during the most volatile market hours, such as the overlap between the London and New York sessions.

Day trading, on the other hand, involves holding positions for longer durations, typically within a single trading day. Day traders can benefit from trading during periods of increased volatility, but they may also consider trading during less volatile hours to manage risk more effectively.

Long-Term Trading vs. Swing Trading

Long-term traders hold positions for weeks, months, or even years. The best time for long-term traders to enter and exit the market is based on long-term fundamental analysis and technical indicators.

Swing traders hold positions for several days or weeks, capturing price swings in the market. The best time for swing trading is during periods of moderate volatility, as excessive volatility can lead to premature exits or missed opportunities.

Section 4: Detailed Table Breakdown

| Currency Pair | Best Trading Time |

|---|---|

| EUR/USD | London and New York sessions overlap |

| GBP/USD | London session |

| USD/JPY | Tokyo and London sessions overlap |

| AUD/USD | Sydney and Tokyo sessions overlap |

| EUR/GBP | London session |

| USD/CAD | New York session |

Conclusion

Readers, we hope this guide has provided you with valuable insights into the best forex trading time. By understanding market open and close times, the impact of trading sessions on liquidity and volatility, and the relationship between trading time and your trading style, you can optimize your trading strategies for maximum profitability.

To further enhance your knowledge, we invite you to explore our other articles on forex trading psychology, risk management, and technical analysis. Stay tuned for more actionable tips and strategies to help you navigate the complex world of forex trading.

FAQ about Best Forex Trading Time

When is the best time to trade forex?

The best time to trade forex is during active trading hours, typically from 7 am to 4 pm Eastern Time (ET). This is when the market is most liquid and offers the most trading opportunities.

What are the best trading hours for different currency pairs?

- EUR/USD: 7 am to 1 pm ET

- USD/JPY: 7 pm to 3 am ET

- GBP/USD: 8 am to 2 pm ET

What is the overlap time for different trading sessions?

The overlap time between the Tokyo, London, and New York trading sessions (6 am to 12 pm ET) offers high volatility and liquidity, making it an ideal time for trading.

What is the impact of news and economic events on trading times?

News and economic events can significantly affect currency prices. It’s wise to follow economic calendars and trade around major news releases to capitalize on market volatility.

Is it better to trade during the week or weekend?

The forex market is open 24 hours a day, 5 days a week. However, there is generally lower liquidity on weekends, making it less ideal for trading.

Does trading time matter for scalping?

Yes, for scalpers who execute several trades within short periods, choosing active trading hours with high liquidity is crucial to minimize slippage and maximize profits.

What are the best times to trade for beginners?

Beginners should consider trading during the overlap hours (6 am to 12 pm ET) when volatility is moderate and spreads are generally tighter.

How can I determine the best trading time for my strategy?

Backtest your strategy on historical data during different trading hours to identify the times that align best with your trading style and objectives.

What should I avoid when choosing a trading time?

Avoid quiet hours (3 am to 7 am ET) when liquidity is low and spreads are wider. Also, be mindful of holidays and geopolitical events that can impact trading conditions.