Cheap car insurance in NY can feel like a unicorn – mythical and hard to find. But, with the right knowledge and strategies, you can snag some serious savings on your premiums. Forget the stress of sky-high car insurance, because this guide will help you navigate the tricky world of New York’s insurance landscape and uncover the best deals.

New York has its own set of rules when it comes to car insurance. The state requires you to have certain minimum coverage levels, and factors like your driving history, age, and even where you park your car can all impact your premiums. But don’t worry, we’re about to break it all down and give you the tools to find the perfect policy that fits your budget.

Understanding New York’s Car Insurance Landscape

Navigating the world of car insurance in New York can feel like trying to find a parking spot in Manhattan during rush hour – tough, confusing, and maybe a little stressful. But don’t worry, we’re here to break down the key factors that influence car insurance costs in the Empire State and help you make sense of the whole process.

New York’s Unique Car Insurance Landscape

New York’s car insurance landscape is a bit different than other states. It’s a “no-fault” state, meaning drivers are primarily responsible for covering their own medical expenses after an accident, regardless of who caused it. This system aims to reduce litigation and speed up claims processing. However, it also means that New York drivers often pay higher premiums than drivers in other states.

New York State’s Regulations and Requirements for Car Insurance

The New York State Department of Financial Services (DFS) sets the rules of the road for car insurance. Here’s a breakdown of the key regulations and requirements:

* Minimum Coverage Requirements: New York requires all drivers to carry the following minimum coverage:

* Liability Coverage: This covers damage or injuries you cause to other people or their property in an accident. New York’s minimum liability coverage is $25,000 per person, $50,000 per accident for bodily injury, and $10,000 for property damage.

* Personal Injury Protection (PIP): This covers your own medical expenses, lost wages, and other related costs after an accident, regardless of who was at fault. The minimum PIP coverage is $50,000.

* Uninsured Motorist Coverage: This protects you if you’re involved in an accident with an uninsured or hit-and-run driver. New York’s minimum uninsured motorist coverage is the same as your liability coverage.

* No-Fault System: As mentioned earlier, New York operates a no-fault system for car insurance. This means that drivers are primarily responsible for covering their own medical expenses after an accident, regardless of who caused it. This system aims to reduce litigation and speed up claims processing.

* Assigned Risk Plan: If you have a poor driving record or have difficulty finding insurance, you may be assigned to the New York State Assigned Risk Plan. This plan provides insurance to drivers who are considered high-risk. Premiums are typically higher for drivers in the Assigned Risk Plan.

* New York’s “Drive Safe” Program: This program rewards safe drivers with discounts on their car insurance premiums. To qualify, you need to have a clean driving record for at least three years.

Factors That Determine Car Insurance Premiums in New York

Several factors influence how much you pay for car insurance in New York. Here’s a rundown of the key players:

* Driving Record: Your driving record is a major factor in determining your insurance premiums. A clean record with no accidents or violations will typically lead to lower premiums. On the other hand, a record with accidents, speeding tickets, or DUI convictions will likely result in higher premiums.

* Vehicle Type: The type of vehicle you drive also plays a role in your insurance costs. Sports cars, luxury vehicles, and high-performance cars are generally more expensive to insure due to their higher repair costs and potential for higher risk.

* Age and Gender: Your age and gender can also impact your insurance premiums. Younger drivers are often considered higher risk, and insurance companies may charge them higher premiums. Men generally pay higher premiums than women, as they are statistically more likely to be involved in accidents.

* Location: Where you live in New York can also influence your insurance premiums. Cities with higher rates of traffic congestion and accidents may have higher insurance rates.

* Credit Score: In some states, including New York, insurance companies may use your credit score to determine your insurance premiums. A good credit score can lead to lower premiums, while a poor credit score may result in higher premiums.

Note: The factors that determine your car insurance premiums can vary depending on the insurance company. It’s important to shop around and compare quotes from different insurers to find the best rate for your needs.

Finding Affordable Car Insurance Options

Navigating the world of car insurance in New York can feel like trying to find a parking spot in Manhattan during rush hour – a real challenge. But fear not, because we’re about to break down the different types of car insurance, the factors that affect your premium, and some sweet tips to help you score some serious savings.

Types of Car Insurance

Understanding the different types of car insurance available in New York is key to finding the right coverage for your needs. New York State requires all drivers to have at least the following:

- Liability Coverage: This protects you financially if you’re responsible for an accident that causes injury or damage to others. It covers the other driver’s medical bills, lost wages, and property damage.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses, lost wages, and other related costs, regardless of who was at fault in the accident. It’s mandatory in New York, even if you’re not at fault.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This protection comes in handy if you’re hit by a driver without insurance or with insufficient coverage. It helps pay for your medical bills and other expenses.

While these are the required coverages, you can choose to add more comprehensive protection, such as:

- Collision Coverage: This covers damage to your car if you’re involved in an accident, even if you’re at fault.

- Comprehensive Coverage: This protects your car against damage from events like theft, vandalism, or natural disasters.

Factors Affecting Car Insurance Premiums

Your car insurance premium is based on a variety of factors, including:

- Age: Younger drivers tend to have higher premiums due to their lack of experience. As you age and gain more experience, your premium usually decreases.

- Driving History: A clean driving record with no accidents or traffic violations is a surefire way to keep your premium low. On the other hand, accidents and tickets can significantly increase your rates.

- Vehicle Type: The make, model, and year of your car play a role in your premium. Cars with higher safety ratings, lower repair costs, and anti-theft features may have lower premiums.

- Coverage Levels: The amount of coverage you choose affects your premium. Higher coverage levels generally mean higher premiums.

- Location: Your location impacts your premium due to factors like traffic density, accident rates, and the cost of repairs.

Discounts on Car Insurance

Now for the good news! There are several ways to save on your car insurance in New York:

- Safe Driving Courses: Completing a defensive driving course can often earn you a discount, showing that you’re committed to safe driving practices.

- Bundling Policies: Combining your car insurance with other policies, such as home or renters insurance, can lead to significant savings.

- Loyalty Programs: Staying with the same insurance company for a long time can often earn you a discount for your loyalty.

- Good Student Discount: If you’re a high-achieving student, some insurers offer discounts to reward your academic success.

- Payment Options: Paying your premium in full or setting up automatic payments can sometimes earn you a discount.

Exploring Online Car Insurance Quotes: Cheap Car Insurance In Ny

Finding the best car insurance deal in New York can feel like navigating a maze, but thankfully, the internet has made the process a whole lot easier. With online car insurance quotes, you can compare prices and coverage options from multiple insurers without leaving your couch. Think of it as a digital car insurance shopping spree!

Getting Online Car Insurance Quotes, Cheap car insurance in ny

Before you dive into the digital world of car insurance quotes, you’ll need to gather some basic information. This includes your driving history, vehicle information, and your desired coverage levels. Once you’ve got your ducks in a row, you can start getting quotes. Here’s a step-by-step guide:

- Visit a Car Insurance Comparison Website: These websites act as middlemen, connecting you with multiple insurance companies. They’re like your personal shopping assistants for car insurance. Just input your information, and they’ll do the legwork of finding quotes for you.

- Provide Your Information: Be prepared to share details like your name, address, driving history, and vehicle information. The more information you provide, the more accurate your quotes will be.

- Compare Quotes: Once you’ve received your quotes, it’s time to compare apples to apples. Pay attention to the coverage options, deductibles, and premiums offered by each insurer. You might be surprised at the differences in pricing and coverage.

- Read Reviews and Ratings: Before you commit to an insurer, take a peek at their reviews and ratings. These can give you a good sense of their customer service, claims handling, and overall reputation. Think of it as checking the Yelp reviews before you eat at a new restaurant.

- Get a Quote Directly from the Insurer: While comparison websites are a great starting point, it’s always a good idea to get a quote directly from the insurer you’re interested in. This allows you to ask specific questions and ensure you’re getting the best deal.

Popular Car Insurance Providers in New York

Here’s a table comparing some of the most popular car insurance providers in New York:

| Insurer | Features | Benefits |

|---|---|---|

| Geico | – 24/7 customer service – Mobile app for managing policies – Discounts for good drivers, safety features, and bundling policies |

– Known for its competitive rates – Easy-to-use online platform – Wide range of coverage options |

| Progressive | – Name Your Price tool for finding affordable coverage – Snapshot device for tracking driving habits – Discounts for safe drivers and bundling policies |

– Customizable coverage options – Personalized pricing based on driving behavior – Strong customer service reputation |

| State Farm | – Comprehensive coverage options – Strong financial stability – Discounts for good drivers, safe vehicles, and bundling policies |

– Trusted brand with a long history – Excellent customer service – Wide network of agents |

| Allstate | – Drive Safe & Save program for rewarding safe driving – Mobile app for managing policies and filing claims – Discounts for good drivers, bundling policies, and safe vehicles |

– Comprehensive coverage options – Competitive rates – Excellent customer service |

Reputable Online Car Insurance Comparison Websites

- Insurify: This website compares quotes from over 20 major insurance companies, helping you find the best deal for your needs. They also provide personalized recommendations based on your driving history and vehicle information.

- Policygenius: Policygenius offers a comprehensive comparison platform that allows you to compare quotes from multiple insurance companies in one place. They also offer a helpful guide to understanding car insurance terms and coverage options.

- The Zebra: The Zebra is a popular car insurance comparison website that uses a simple and user-friendly interface. They offer a wide range of coverage options and provide personalized recommendations based on your needs.

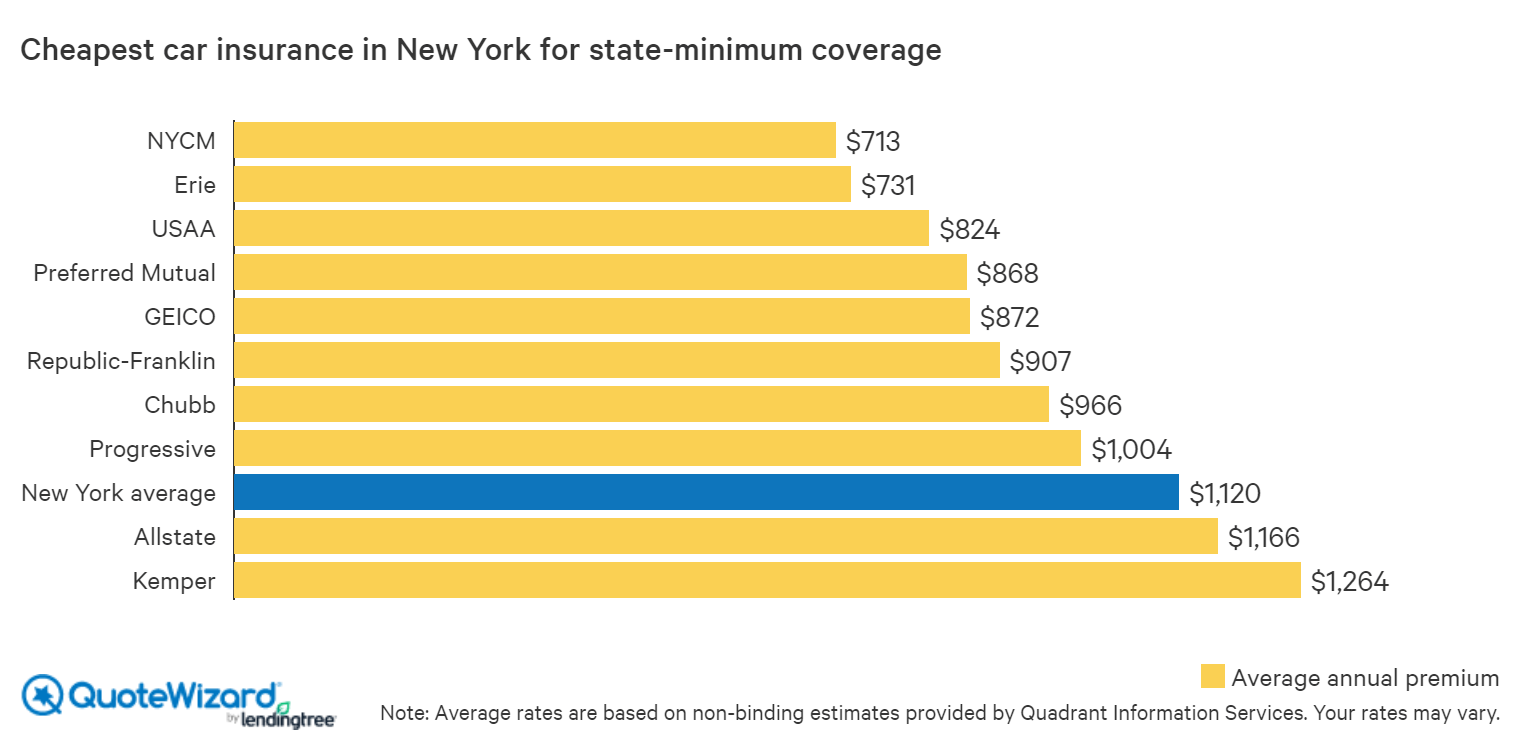

- QuoteWizard: QuoteWizard allows you to compare quotes from over 100 insurance companies. They also offer a variety of tools and resources to help you understand car insurance and make informed decisions.

Considerations for Choosing a Car Insurance Policy

Choosing the right car insurance policy is crucial for protecting yourself financially in the event of an accident or other covered incident. Understanding the different types of coverage, their limits, and deductibles is essential for making an informed decision.

Coverage Limits and Deductibles

It’s important to understand the coverage limits and deductibles offered by different car insurance policies. Coverage limits determine the maximum amount the insurance company will pay for a covered claim, while deductibles represent the amount you’ll pay out of pocket before your insurance kicks in.

- Liability Coverage: This coverage protects you financially if you’re at fault in an accident that causes injury or damage to others. It covers medical expenses, property damage, and legal defense costs. The limits for liability coverage are typically expressed as a combination of numbers, such as 25/50/10, which means $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $10,000 for property damage. Choosing a higher liability limit is crucial to avoid potential financial ruin if you’re involved in a serious accident.

- Collision Coverage: This coverage pays for repairs or replacement of your car if it’s damaged in an accident, regardless of who’s at fault. The deductible is the amount you’ll pay before your insurance kicks in. If you have an older car with a lower value, you might consider dropping collision coverage to save on premiums.

- Comprehensive Coverage: This coverage protects your car from damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. Like collision coverage, it has a deductible. If you have a newer car with a higher value, comprehensive coverage is typically recommended.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has inadequate coverage. It covers your medical expenses, property damage, and lost wages. It’s crucial to have this coverage, especially in densely populated areas where the risk of encountering uninsured drivers is higher.

Consequences of Inadequate Coverage

Choosing inadequate coverage can have serious financial consequences if you’re involved in an accident. For example, if you have low liability limits and are found at fault in a serious accident, you could be held personally liable for damages exceeding your coverage limits. This could result in significant financial hardship, including debt, lawsuits, and even bankruptcy.

Choosing a Car Insurance Provider

When choosing a car insurance provider, consider factors such as customer service, claims handling process, and financial stability.

- Customer Service: Look for a provider with a reputation for excellent customer service, including responsive agents, helpful claims adjusters, and easy-to-use online platforms.

- Claims Handling Process: Consider the provider’s track record for prompt and fair claims handling. Research their average claim processing time and customer satisfaction ratings related to claims.

- Financial Stability: It’s important to choose a provider with a strong financial rating, as this indicates their ability to pay claims in the event of a major disaster or economic downturn. You can check a provider’s financial stability by reviewing ratings from organizations like A.M. Best.

Tips for Saving Money on Car Insurance

In the concrete jungle of New York City, where parking can be a nightmare and traffic a constant headache, saving money on car insurance is a priority for many drivers. Don’t worry, though, you don’t have to be a master negotiator or have a spotless driving record to get a great deal. With a few simple tips and strategies, you can significantly reduce your premiums and keep more cash in your pocket.

Maintaining a Good Driving Record

A clean driving record is like gold in the world of car insurance. It shows insurers that you’re a responsible driver, reducing their risk and, in turn, your premiums. Avoid speeding tickets, reckless driving, and accidents like the plague. Every incident on your record can bump up your rates, so stay safe and keep that record pristine.

Parking Your Car in a Garage

In the Big Apple, where car theft is a reality, parking your car in a garage can make a huge difference. Garaged cars are less likely to be stolen or damaged, which means lower insurance premiums for you. Think of it as a safe haven for your car, protecting it from the elements and potential mishaps.

Installing Anti-Theft Devices

Adding anti-theft devices like alarms, immobilizers, or GPS trackers to your car can be a game-changer. Insurers love to see these features, as they significantly reduce the risk of theft. By making your car less appealing to thieves, you’ll get a discount on your premiums. It’s a win-win situation – you get peace of mind, and your wallet gets a little lighter.

Comparing Quotes from Multiple Providers

Don’t settle for the first insurance quote you get. Shop around! Compare quotes from different providers to find the best rates and coverage options. This can save you hundreds, if not thousands, of dollars annually. Think of it like comparing prices for a new pair of sneakers – you wouldn’t buy the first pair you see, would you?

Negotiating with Insurers

Once you’ve found a few good options, don’t be afraid to negotiate with insurers. Explain your situation, highlight your good driving record, and see if they’re willing to offer you a better rate. You might be surprised at how much you can save by simply asking. Remember, the worst they can say is no, and the best they can say is “yes” – which means more dough for you.

Using a Car Insurance Broker

A car insurance broker can be your secret weapon in the world of insurance. They act as your personal representative, comparing quotes from multiple insurers and finding you the best deals. Think of them as your insurance matchmaker, connecting you with the perfect policy.

Last Word

Finding cheap car insurance in NY doesn’t have to be a headache. With a little research, some smart strategies, and a sprinkle of determination, you can secure a policy that protects you and your wallet. Remember, it’s all about comparing, negotiating, and knowing your options. So buckle up, and get ready to save some serious cash on your car insurance!

FAQ Overview

What are the minimum car insurance requirements in New York?

New York requires you to have liability coverage, which protects you financially if you cause an accident. The minimum limits are $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $10,000 for property damage.

How can I get a discount on my car insurance?

There are tons of discounts available! Ask your insurer about safe driver discounts, good student discounts, multi-car discounts, and bundling discounts (combining home and auto insurance). You might also be eligible for discounts for anti-theft devices, parking your car in a garage, or taking a defensive driving course.

What is a car insurance broker, and how can they help me?

A car insurance broker acts as a middleman, comparing quotes from different insurance companies and finding the best deals for you. They can save you time and effort, especially if you’re overwhelmed by all the options.