- eToro Forex: The Ultimate Guide for Beginners and Advanced Traders

- Account Types

- Trading Instruments

- Fees and Spreads

- Order Types

- Risk Management

- Conclusion

-

FAQ about eToro Forex

- What is eToro Forex?

- What are the benefits of using eToro Forex?

- How do I get started with eToro Forex?

- What is the minimum deposit for eToro Forex?

- What are the trading hours for eToro Forex?

- What currencies can I trade on eToro Forex?

- What is a spread?

- What is social trading?

- How do I copy the trades of other traders?

eToro Forex: The Ultimate Guide for Beginners and Advanced Traders

Introduction

Howdy, readers! Welcome to our in-depth guide on eToro Forex, one of the leading platforms for online currency trading. Whether you’re a seasoned pro or just starting out, this comprehensive guide will provide you with everything you need to know about eToro Forex.

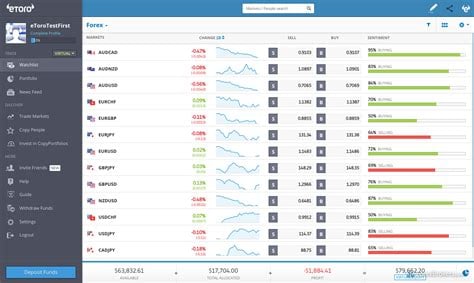

eToro Forex offers a user-friendly platform, a wide range of trading instruments, and a robust social trading community. In this comprehensive guide, we’ll explore the ins and outs of eToro Forex, covering topics such as account types, trading instruments, fees and spreads, order types, and risk management tips. So, buckle up and let’s dive into the exciting world of eToro Forex.

Account Types

eToro Forex offers three account types to cater to traders with different needs and experience levels:

Demo Account

A demo account is a great way to test the eToro Forex platform and practice trading without risking real money. It comes with virtual funds, enabling you to explore market dynamics and develop your trading strategies.

Standard Account

The Standard Account is suitable for beginners and low-volume traders. It requires a minimum deposit of $200 and offers a range of trading instruments, including forex currency pairs, commodities, and indices.

Professional Account

The Professional Account is designed for experienced traders who meet certain eligibility criteria. It offers higher leverage, access to additional trading instruments, and personalized support.

Trading Instruments

eToro Forex offers a diverse range of trading instruments, catering to both short-term and long-term traders.

Forex Currency Pairs

eToro Forex offers over 50 forex currency pairs, including popular ones like EUR/USD, GBP/USD, and USD/JPY. These pairs allow traders to speculate on currency movements and benefit from market volatility.

Commodities

eToro Forex also offers a selection of commodities, such as gold, silver, and oil. Trading commodities can provide diversification and potential hedging opportunities for your portfolio.

Indices

Indices are baskets of stocks that represent the performance of a particular market or sector. eToro Forex offers indices like the S&P 500 and the FTSE 100, enabling traders to gain exposure to broader market trends.

Fees and Spreads

Fees and spreads are an integral part of any trading operation, and it’s essential to understand how eToro Forex structures them.

Fees

eToro Forex charges a fixed spread on all trades, which is the difference between the bid and ask prices. Spreads vary depending on the instrument and market conditions.

Non-Trading Fees

eToro Forex also charges non-trading fees, such as inactivity fees for accounts that have been dormant for a specified period. There are also fees for withdrawals and currency conversions.

Order Types

eToro Forex provides a variety of order types to suit different trading strategies:

Market Orders

Market orders are executed immediately at the best available market price. They are ideal for traders who want to enter or exit a trade quickly.

Limit Orders

Limit orders are executed only when the market price reaches a specified level. They allow traders to control their entry and exit points more precisely.

Stop-Loss Orders

Stop-loss orders are used to protect against potential losses. They automatically trigger an order to sell an instrument when its price falls below a predetermined level.

Risk Management

Risk management is crucial in forex trading, and eToro Forex provides several tools to help traders manage their exposure:

Negative Balance Protection

eToro Forex offers negative balance protection, ensuring that traders cannot lose more than their account balance.

Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders are effective risk management tools that help traders define their exit points and limit potential losses or secure profits.

Leverage

Leverage allows traders to control a larger position with a smaller amount of capital. However, it can also amplify losses, so it’s essential to use leverage wisely.

Table: Currency Pairs, Spreads, and Leverage

| Currency Pair | Spread (Pips) | Leverage |

|---|---|---|

| EUR/USD | 1 | 30:1 |

| GBP/USD | 2 | 20:1 |

| USD/JPY | 0.5 | 10:1 |

Conclusion

eToro Forex is a comprehensive and beginner-friendly platform that offers a wide range of trading instruments, advanced risk management tools, and a supportive social trading community. This guide has provided a thorough overview of eToro Forex, but there’s always more to explore. Be sure to check out our other articles for deeper dives into specific aspects of eToro Forex and online trading in general. Happy trading!

FAQ about eToro Forex

What is eToro Forex?

eToro Forex is a platform that allows users to trade currencies on the foreign exchange (forex) market.

What are the benefits of using eToro Forex?

eToro Forex offers a number of benefits, including:

- Access to a global market: eToro Forex allows users to trade currencies from all over the world.

- Low spreads: eToro Forex offers some of the lowest spreads in the industry.

- Fast execution: eToro Forex executes trades quickly and efficiently.

- Social trading: eToro Forex allows users to copy the trades of other successful traders.

How do I get started with eToro Forex?

Getting started with eToro Forex is easy. Simply create an account and deposit funds. You can then start trading currencies by clicking on the "Trade" tab.

What is the minimum deposit for eToro Forex?

The minimum deposit for eToro Forex is $200.

What are the trading hours for eToro Forex?

eToro Forex is open for trading 24 hours a day, 5 days a week.

What currencies can I trade on eToro Forex?

You can trade all major currency pairs on eToro Forex, as well as a number of minor currency pairs.

What is a spread?

A spread is the difference between the bid price and the ask price of a currency pair.

What is social trading?

Social trading is a way of copying the trades of other successful traders.

How do I copy the trades of other traders?

To copy the trades of other traders, simply click on the "CopyTrader" tab and select the traders you want to copy.