- Understanding State Employment Laws

- Common Employment Law Issues Faced by State Employers

- The Role of an Employment Law Attorney

- Strategies for Compliance with State Employment Laws

- Preventing Employment Law Disputes

- Navigating Employment Law Disputes

- Conclusion: Employment Law Attorney Dealing With State Employer

- FAQ Section

Employment law attorney dealing with state employer concerns is a critical aspect of navigating the complex legal landscape surrounding workplace practices. State employers, unlike their federal counterparts, face a unique set of regulations and legal challenges, often requiring specialized legal guidance to ensure compliance and avoid costly disputes.

This article delves into the intricacies of state employment law, exploring the specific challenges faced by state employers, and highlighting the crucial role of an employment law attorney in providing strategic legal support. From understanding the nuances of state-specific laws to navigating complex legal issues like discrimination, harassment, and wage and hour disputes, this guide provides valuable insights for state employers seeking to maintain a compliant and ethical workplace.

Understanding State Employment Laws

Navigating the complexities of employment law can be challenging, especially for employers operating in multiple states. While federal laws provide a baseline, state employment laws often introduce unique requirements and nuances. This guide delves into the key differences between federal and state employment laws and explores major state employment laws relevant to employers, focusing on their implications for hiring, firing, and employee rights.

Key Differences Between Federal and State Employment Laws

Federal employment laws establish minimum standards for workplace practices, protecting employees from discrimination, ensuring fair wages and working conditions, and regulating workplace safety. However, state laws can expand upon these federal protections, offering more robust employee rights and imposing additional obligations on employers.

For instance, federal law prohibits discrimination based on race, religion, national origin, sex, and disability. However, many states have expanded these protections to include additional categories like sexual orientation, gender identity, and marital status. Similarly, while federal law mandates a minimum wage, many states have set higher minimum wages, reflecting the cost of living in different regions.

Major State Employment Laws

State employment laws vary widely across the country, covering a range of topics, including:

- Minimum Wage and Overtime: Many states have established minimum wages exceeding the federal minimum wage. Additionally, some states have unique overtime regulations, requiring employers to pay overtime for work exceeding a specific threshold, which may differ from the federal Fair Labor Standards Act (FLSA) requirements.

- Paid Time Off: Several states have mandated paid time off (PTO) benefits, including sick leave, vacation time, and family leave. These laws typically specify the amount of PTO employees are entitled to and the circumstances under which they can use it. For example, some states require employers to provide paid sick leave for employees who are ill or caring for a sick family member.

- Discrimination and Harassment: States often have their own anti-discrimination and harassment laws, prohibiting discrimination based on a broader range of protected characteristics than federal law. These laws may also specify specific requirements for employer training and reporting procedures.

- Employee Privacy: State laws can govern employee privacy, regulating employers’ access to and use of employee information, including personal data, communications, and social media activity. For example, some states require employers to obtain employee consent before accessing their personal emails or social media accounts.

- Wage and Hour Laws: State wage and hour laws may require employers to pay employees for all hours worked, including breaks and meal periods. These laws may also regulate the use of independent contractors and the classification of employees as exempt or non-exempt from overtime pay.

- Workplace Safety: State laws may have specific requirements for workplace safety beyond the federal Occupational Safety and Health Administration (OSHA) standards. For example, some states require employers to provide additional safety training or implement stricter safety protocols in certain industries.

- Unemployment Insurance: States administer unemployment insurance programs, providing benefits to eligible workers who lose their jobs through no fault of their own. Each state has its own eligibility criteria and benefit levels, which can vary significantly.

Implications of State-Specific Laws on Hiring, Firing, and Employee Rights

State-specific employment laws have significant implications for employers in all aspects of the employment relationship, from hiring to firing and everything in between. Understanding these laws is crucial to ensure compliance and avoid potential legal liabilities.

Hiring

State laws can influence the hiring process by imposing restrictions on:

- Background Checks: Many states regulate the use of background checks, requiring employers to obtain employee consent and limiting the types of information they can collect.

- Drug Testing: State laws may limit employers’ ability to conduct drug tests, specifying permissible testing scenarios and requiring employee consent.

- Pre-Employment Inquiries: Some states restrict the types of questions employers can ask during the hiring process, prohibiting inquiries about protected characteristics such as marital status, religion, or sexual orientation.

Firing

State laws can also impact termination practices, requiring employers to follow specific procedures when terminating employees. For example, some states require employers to provide notice of termination, offer severance pay, or provide specific reasons for termination.

Employee Rights

State employment laws often expand employee rights beyond those provided by federal law. For example, some states have laws that protect employees’ right to organize and join unions, provide protections against retaliation for whistleblowing, or require employers to provide reasonable accommodations for employees with disabilities.

Common Employment Law Issues Faced by State Employers

State employers face a wide range of employment law issues, often navigating complex regulations that vary significantly from state to state. Understanding these legal complexities is crucial for compliance and minimizing legal risks.

Employee Classification

The classification of workers as employees or independent contractors has significant legal implications. Misclassification can lead to significant penalties and lawsuits.

- Employee: Employees are subject to federal and state employment laws, including minimum wage, overtime, and unemployment insurance. Employers are responsible for withholding taxes and providing benefits.

- Independent Contractor: Independent contractors are typically not subject to the same employment laws as employees. Employers are not required to withhold taxes or provide benefits.

The distinction between employees and independent contractors hinges on several factors, including:

- Control: The extent to which the employer controls the worker’s work.

- Financial Investment: The worker’s investment in equipment, tools, and other resources.

- Opportunity for Profit: The worker’s potential to profit or lose money based on their work.

- Integration: The extent to which the worker’s work is integrated into the employer’s business.

Misclassifying an employee as an independent contractor can lead to significant legal consequences, including:

- Back Taxes: The employer may be required to pay back taxes and penalties for unpaid Social Security, Medicare, and unemployment taxes.

- Wage and Hour Lawsuits: Employees misclassified as independent contractors may be entitled to back pay and overtime compensation.

- Department of Labor Investigations: The Department of Labor may investigate the employer’s classification practices and impose penalties.

“The ‘economic realities’ test, as applied by the Supreme Court in *United States v. Silk*, 331 U.S. 704 (1947), is a primary tool in distinguishing employees from independent contractors.”

Wage and Hour Laws

State wage and hour laws often set minimum wage, overtime pay, and other requirements for employers.

- Minimum Wage: Most states have minimum wage laws that set the minimum hourly wage employers must pay.

- Overtime Pay: Federal law requires employers to pay overtime pay at 1.5 times the regular rate for hours worked over 40 in a workweek. Many states have their own overtime laws, which may provide more generous overtime pay.

- Meal and Rest Breaks: Some states require employers to provide employees with meal and rest breaks.

- Recordkeeping: Employers must keep accurate records of employee hours worked, wages paid, and other information related to wages and hours.

Employers must comply with both federal and state wage and hour laws.

- Example: In 2018, the U.S. Department of Labor recovered over $290 million in back wages for workers who were denied overtime pay.

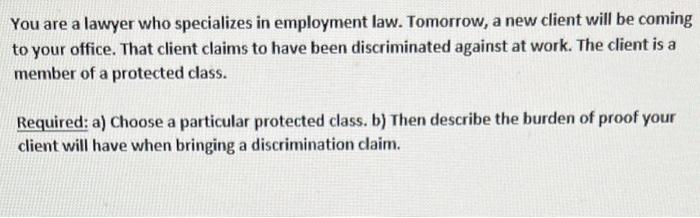

Discrimination and Harassment

State and federal laws prohibit discrimination and harassment in the workplace based on protected characteristics such as race, religion, gender, national origin, disability, and sexual orientation.

- Discrimination: Discrimination occurs when an employer treats an employee differently based on a protected characteristic.

- Harassment: Harassment occurs when an employee is subjected to unwelcome conduct based on a protected characteristic.

Employers must take steps to prevent and address discrimination and harassment in the workplace.

- Example: In 2019, the Equal Employment Opportunity Commission (EEOC) filed a lawsuit against a state agency alleging that it had discriminated against a female employee based on her gender.

The Role of an Employment Law Attorney

Navigating the complex landscape of state employment law can be daunting for even the most experienced state employer. This is where the expertise of an employment law attorney becomes invaluable. An employment law attorney possesses a deep understanding of state and federal employment laws, regulations, and case law, allowing them to provide comprehensive legal guidance and support to state employers.

Key Services Provided by Employment Law Attorneys

An employment law attorney provides a range of essential services to state employers, ensuring compliance with employment laws and mitigating potential legal risks.

- Legal Advice: Employment law attorneys provide guidance on a wide array of employment-related matters, including hiring, firing, discipline, compensation, benefits, workplace safety, discrimination, harassment, and leave policies. They help state employers understand their legal obligations and make informed decisions that comply with applicable laws.

- Contract Review: Employment law attorneys review and draft employment contracts, employee handbooks, non-disclosure agreements, and other employment-related documents to ensure compliance with state and federal laws and protect the interests of the state employer. They can also identify potential legal risks and suggest revisions to minimize liability.

- Litigation Support: Employment law attorneys represent state employers in employment-related lawsuits, administrative hearings, and other legal proceedings. They have the experience and expertise to effectively argue cases and protect the interests of their clients. This includes gathering evidence, preparing legal briefs, conducting depositions, and representing clients in court.

- Training and Education: Employment law attorneys can provide training and education to state employees on a variety of employment law topics, such as harassment prevention, discrimination awareness, and wage and hour compliance. This helps state employers create a culture of compliance and minimize the risk of legal issues.

Comparing Employment Law Attorneys with Other Legal Professionals

While HR consultants can provide valuable advice on employment matters, they lack the legal expertise of an employment law attorney. HR consultants typically focus on practical HR issues, such as employee relations, performance management, and policy development. They may not have the in-depth knowledge of employment laws and regulations that an employment law attorney possesses.

Strategies for Compliance with State Employment Laws

Navigating the complex landscape of state employment laws can be challenging for employers. Failure to comply with these regulations can lead to significant legal and financial consequences. Therefore, it is crucial for employers to proactively implement strategies to ensure compliance and mitigate potential risks.

Best Practices for Compliance with State Employment Laws

- Develop a Comprehensive Employee Handbook: A well-written employee handbook serves as a vital tool for communicating company policies and procedures. It should include clear and concise information about topics such as hiring practices, compensation, benefits, workplace safety, harassment, discrimination, and disciplinary actions. This handbook should be reviewed and updated regularly to reflect any changes in state laws or company policies.

- Conduct Regular Training for Managers and Employees: Providing training on state employment laws is essential to ensure that managers and employees understand their rights and responsibilities. Training programs should cover topics such as discrimination and harassment prevention, wage and hour laws, and safety regulations. Regular refresher training is also recommended to keep employees informed about any changes in the law or company policies.

- Establish Clear Hiring Practices: Employers must ensure that their hiring practices comply with all applicable state laws. This includes avoiding discriminatory practices in the recruitment, selection, and hiring process. It is important to have a consistent and documented process for screening candidates, conducting background checks, and making hiring decisions.

- Maintain Accurate Records: Maintaining accurate records is crucial for demonstrating compliance with state employment laws. Employers should keep detailed records of employee information, including payroll, timekeeping, benefits, disciplinary actions, and training. These records should be organized and readily accessible to ensure that they can be produced upon request.

- Stay Informed of Legal Updates: State employment laws are constantly evolving, so it is essential for employers to stay informed about any changes. This can be done by subscribing to legal updates, attending industry conferences, and consulting with an employment law attorney. Staying up-to-date on legal developments allows employers to proactively adapt their practices to ensure ongoing compliance.

Implementing Effective Policies and Procedures

Employers should implement a step-by-step approach to develop and implement effective policies and procedures related to hiring, compensation, and workplace safety. This process should involve the following steps:

- Identify Applicable State Laws: The first step is to identify all state employment laws that apply to the employer’s business. This includes laws related to wages and hours, discrimination, harassment, leave, and safety. This can be done by consulting with an employment law attorney or reviewing resources provided by the state labor department.

- Develop Clear and Concise Policies: Once the applicable state laws have been identified, employers should develop clear and concise policies that comply with these laws. These policies should be written in plain language and easily understood by all employees. They should also be reviewed and updated regularly to reflect any changes in the law or company practices.

- Communicate Policies to Employees: It is crucial to communicate company policies to all employees. This can be done through employee handbooks, training programs, and regular updates. Employees should be made aware of their rights and responsibilities under these policies and encouraged to ask questions if they have any concerns.

- Implement Procedures for Compliance: Once policies have been developed and communicated, employers should implement procedures to ensure that these policies are followed in practice. This includes establishing procedures for handling complaints, conducting investigations, and taking disciplinary action. These procedures should be documented and readily available to all employees.

- Monitor Compliance and Make Adjustments: Employers should regularly monitor their compliance with state employment laws and make adjustments to their policies and procedures as needed. This includes reviewing employee complaints, conducting internal audits, and staying informed about any changes in the law. By proactively monitoring compliance, employers can identify and address any potential issues before they escalate.

Key Legal Requirements for Employers in Different States

| State | Specific Laws | Regulations | Reporting Obligations |

|---|---|---|---|

| California | California Fair Employment and Housing Act (FEHA), California Labor Code, California Family Rights Act (CFRA) | California Department of Fair Employment and Housing (DFEH) regulations, California Division of Labor Standards Enforcement (DLSE) regulations | Report discrimination, harassment, and wage and hour violations to the DFEH and DLSE |

| New York | New York State Human Rights Law (NYSHRL), New York Labor Law, New York Family Leave Act (NYFLA) | New York State Division of Human Rights (DHR) regulations, New York Department of Labor (DOL) regulations | Report discrimination, harassment, and wage and hour violations to the DHR and DOL |

| Texas | Texas Commission on Human Rights Act (TCHRA), Texas Labor Code, Texas Family and Medical Leave Act (TFMLA) | Texas Workforce Commission (TWC) regulations, Texas Department of Insurance (TDI) regulations | Report discrimination, harassment, and wage and hour violations to the TWC and TDI |

Preventing Employment Law Disputes

Proactive measures are crucial for employers to minimize the risk of employment law disputes. By implementing preventive strategies, employers can create a workplace environment that fosters compliance, reduces legal risks, and promotes a positive and productive workforce.

Establishing a Strong Workplace Culture

A positive workplace culture is essential for preventing employment law disputes. A culture that emphasizes diversity, inclusion, and respect can help to minimize the risk of discrimination, harassment, and retaliation. This culture should be embedded in the organization’s values, policies, and practices.

- Promote Diversity and Inclusion: Employers should actively promote diversity and inclusion in all aspects of the workplace, from hiring and promotion practices to employee development programs. This includes creating a welcoming environment for employees from all backgrounds and ensuring that all employees feel valued and respected.

- Establish Clear Anti-Discrimination and Anti-Harassment Policies: Employers should have clear and comprehensive anti-discrimination and anti-harassment policies that are communicated to all employees. These policies should Artikel prohibited conduct, reporting procedures, and disciplinary actions for violations. Regular training programs should be conducted to reinforce these policies and educate employees on their responsibilities.

- Foster Open Communication and Feedback: Encourage open communication between employees and management. This includes providing mechanisms for employees to voice concerns, report issues, and seek clarification on policies and procedures. Regular employee surveys and feedback sessions can provide valuable insights into the workplace culture and identify potential areas for improvement.

Employee Training Programs, Employment law attorney dealing with state employer

Employee training programs play a vital role in preventing employment law disputes. Comprehensive training programs can educate employees on their rights and responsibilities, minimize misunderstandings, and promote a culture of compliance.

- Compliance Training: Employers should provide regular compliance training to all employees, covering topics such as anti-discrimination, anti-harassment, wage and hour laws, and other relevant employment laws. This training should be interactive and engaging, incorporating real-life scenarios and case studies to reinforce key concepts.

- Supervisory Training: Supervisors play a critical role in creating a positive workplace environment. They should receive specialized training on managing employees effectively, handling employee complaints, and ensuring compliance with employment laws. This training should emphasize the importance of fair treatment, respectful communication, and appropriate decision-making.

- Diversity and Inclusion Training: Employers should offer diversity and inclusion training to promote understanding and respect among employees. This training can address unconscious bias, cultural sensitivity, and effective communication skills. It can also provide employees with tools and strategies for creating an inclusive workplace environment.

Navigating Employment Law Disputes

Employment law disputes can arise in various forms, from disagreements over compensation to allegations of discrimination. When faced with such challenges, understanding the legal procedures involved in resolving these disputes is crucial for both employers and employees.

Resolving Employment Law Disputes

There are several legal procedures available to resolve employment law disputes, each with its own advantages and disadvantages. These include:

- Mediation: A non-binding process where a neutral third party facilitates communication between the parties and helps them reach a mutually agreeable resolution. Mediation can be a cost-effective and efficient way to resolve disputes, particularly when the parties are willing to compromise.

- Arbitration: A binding process where a neutral third party (the arbitrator) hears evidence and arguments from both sides and issues a decision that is legally binding. Arbitration can be more formal than mediation and may be required by contract.

- Litigation: A formal legal process that involves filing a lawsuit in court. Litigation can be expensive and time-consuming, but it is necessary when the parties cannot reach a settlement through other means.

Key Considerations for Employers Facing a Potential Lawsuit or Complaint

When an employer is faced with a potential lawsuit or complaint, there are several key considerations:

- Preserve Evidence: Employers should immediately take steps to preserve relevant evidence, such as employee files, emails, and other documentation. This can be critical in defending against a claim.

- Consult with Legal Counsel: It is essential for employers to seek legal advice from an experienced employment law attorney as soon as possible. An attorney can provide guidance on the legal issues involved, help develop a strategy for responding to the claim, and represent the employer in any legal proceedings.

- Communicate with Employees: Employers should communicate with employees about the situation in a clear and concise manner, but they should avoid making any admissions of liability or discussing the specifics of the case.

Successful Strategies for Defending Against Employment Law Claims

Defending against employment law claims requires a strategic approach that focuses on:

- Thorough Investigation: Conducting a thorough investigation into the allegations is crucial to understand the facts of the case and identify any potential defenses.

- Strong Documentation: Maintaining accurate and complete documentation of employment practices, policies, and procedures can provide strong evidence to support the employer’s defense.

- Effective Legal Representation: Having an experienced employment law attorney who understands the applicable laws and procedures is essential for effectively defending against claims.

- Prompt and Professional Response: Responding to claims promptly and professionally can demonstrate the employer’s commitment to resolving the issue and mitigating potential damages.

Conclusion: Employment Law Attorney Dealing With State Employer

Navigating the intricacies of state employment law can be daunting for employers, but with the right legal guidance, navigating these complexities becomes achievable. By understanding the nuances of state-specific regulations, seeking expert legal counsel, and proactively implementing preventive measures, state employers can foster a compliant and ethical workplace, minimizing the risk of costly disputes and ensuring a smooth and productive work environment.

FAQ Section

What are the key differences between federal and state employment laws?

Federal employment laws provide a baseline of protection for workers, while state laws often expand upon these protections, offering additional rights and benefits. States may have their own specific laws regarding minimum wage, overtime, leave, and discrimination, which employers must comply with.

What are some common employment law issues faced by state employers?

Common issues include wage and hour disputes, discrimination and harassment claims, wrongful termination lawsuits, and employee classification concerns (e.g., independent contractor vs. employee). Each state has its own specific laws and regulations regarding these issues.

How can an employment law attorney help state employers?

An employment law attorney provides expert legal guidance, ensuring compliance with state employment laws, reviewing employment contracts, developing HR policies, and representing employers in legal disputes.

What are some preventive measures employers can take to minimize employment law disputes?

Employers can implement strong HR policies, provide comprehensive employee training, establish a positive and inclusive workplace culture, and maintain clear and consistent documentation of employment decisions.

What are the legal procedures involved in resolving employment law disputes?

Disputes can be resolved through various methods, including mediation, arbitration, and litigation. The specific procedures and options will vary depending on the nature of the dispute and the applicable state laws.