- Forex Acount: A Comprehensive Guide for Beginners

- Types of Forex Acounts

- Features of Forex Acounts

- Understanding Forex Acount Details

- Choosing the Right Forex Acount

- Conclusion

-

FAQ about Forex Accounts

- What is a Forex account?

- What are the different types of Forex accounts?

- What is the minimum deposit required to open a Forex account?

- What are the different currencies that can be traded on a Forex account?

- What is leverage?

- What are the risks of trading Forex?

- What is a Forex broker?

- How do I choose a Forex broker?

- What is a Forex trading platform?

- How do I open a Forex account?

Forex Acount: A Comprehensive Guide for Beginners

Introduction

Readers, let’s embark on a comprehensive exploration of the world of forex acounts. As we delve into this topic, we’ll unravel the intricacies of this exciting financial instrument and empower you to navigate the forex markets with confidence.

Forex acounts, also known as foreign exchange accounts, provide a gateway to trade currencies globally. Whether you’re a seasoned trader or just starting out, understanding the nuances of forex acounts is crucial for success in this dynamic market.

Types of Forex Acounts

Retail Forex Acounts

Retail forex acounts are designed for individual traders and typically offer lower minimum deposits and trading volumes. They provide access to a wide range of currency pairs and trading platforms.

Institutional Forex Acounts

Institutional forex acounts cater to banks, hedge funds, and other large entities with high trading volumes. These acounts offer specialized services, such as tailored risk management solutions and advanced trading technologies.

Broker-Dealer Forex Acounts

Broker-dealer forex acounts are offered by broker-dealers who act as intermediaries between traders and the foreign exchange market. They provide execution services, liquidity, and access to various trading platforms.

Features of Forex Acounts

Leverage

Leverage is a key feature of forex acounts, allowing traders to control a larger position relative to their account balance. This can enhance potential profits but also carries the risk of significant losses.

Spreads and Commissions

Spreads and commissions are fees charged by brokers for executing trades. Brokers offer different types of pricing models, including fixed spreads, variable spreads, and commission-based pricing.

Trading Platforms

Forex brokers provide a range of trading platforms, each offering unique features and functionalities. Platforms vary in terms of user-friendliness, trading tools, and technical indicators.

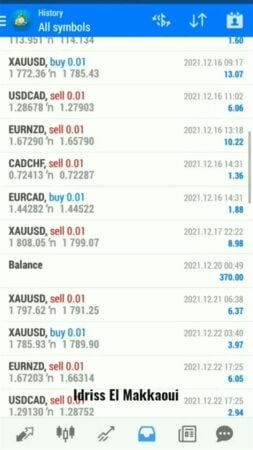

Understanding Forex Acount Details

| Term | Description |

|---|---|

| Account Number | Unique identifier for your forex acount |

| Balance | Current funds available in your acount |

| Equity | Total value of your acount, including realized and unrealized profits/losses |

| Margin | Amount of funds required to cover potential losses on open positions |

| Free Margin | Surplus funds in your acount that are available for trading |

| Leverage | Ratio of your position size to your account balance |

| Position Size | Total value of your open trades |

| Profit/Loss | Unrealized gains or losses on your open positions |

Choosing the Right Forex Acount

Selecting the right forex acount is crucial for your trading success. Consider the following factors:

Regulation

Choose brokers regulated by reputable financial authorities to ensure the safety and security of your funds.

Trading Costs

Compare spreads, commissions, and other fees to find a broker that aligns with your trading strategy.

Trading Platform

Ensure the broker offers a trading platform that meets your needs in terms of functionality, user-friendliness, and technical tools.

Customer Support

Choose brokers with reliable customer support to assist you with any queries or technical issues.

Conclusion

Readers, we hope this comprehensive guide has provided you with a solid understanding of forex acounts. By carefully considering the factors discussed above, you can choose the right acount and embark on your forex trading journey with confidence. Be sure to explore other articles on our website for further insights and trading strategies.

FAQ about Forex Accounts

What is a Forex account?

A Forex account is a trading account that allows you to buy and sell foreign currencies.

What are the different types of Forex accounts?

There are two main types of Forex accounts: retail accounts and institutional accounts. Retail accounts are designed for individual traders, while institutional accounts are designed for large organizations, such as banks and hedge funds.

What is the minimum deposit required to open a Forex account?

The minimum deposit required to open a Forex account varies depending on the broker. Some brokers require a minimum deposit of $100, while others require a minimum deposit of $500 or more.

What are the different currencies that can be traded on a Forex account?

The most commonly traded currencies on Forex accounts are the US dollar, euro, Japanese yen, British pound, and Swiss franc. However, there are many other currencies that can be traded on Forex accounts, such as the Australian dollar, Canadian dollar, and New Zealand dollar.

What is leverage?

Leverage is a tool that allows traders to trade with more money than they have in their account. For example, if you have a Forex account with $1,000 and you use a leverage of 100:1, you can trade with up to $100,000.

What are the risks of trading Forex?

There are a number of risks associated with trading Forex, including:

- Currency risk: The value of currencies can fluctuate, which can result in losses for traders.

- Leverage risk: Leverage can magnify both profits and losses.

- Execution risk: There is always the risk that orders will not be executed at the desired price.

What is a Forex broker?

A Forex broker is a company that provides traders with access to the Forex market. Forex brokers offer a variety of services, such as:

- Execution services: Forex brokers execute orders for traders.

- Currency conversion services: Forex brokers convert currencies for traders.

- Leverage: Forex brokers offer leverage to traders.

How do I choose a Forex broker?

When choosing a Forex broker, you should consider a number of factors, such as:

- Regulation: Make sure that the Forex broker is regulated by a reputable authority.

- Fees: Compare the fees charged by different Forex brokers.

- Customer service: Make sure that the Forex broker has a good customer service reputation.

What is a Forex trading platform?

A Forex trading platform is a software program that allows traders to trade Forex. Forex trading platforms offer a variety of features, such as:

- Charting tools: Forex trading platforms allow traders to chart currency prices.

- Technical analysis tools: Forex trading platforms offer a variety of technical analysis tools that can help traders make trading decisions.

- News and analysis: Forex trading platforms provide traders with access to news and analysis that can help them make trading decisions.

How do I open a Forex account?

To open a Forex account, you need to provide the Forex broker with some basic information, such as your name, address, and phone number. You will also need to deposit funds into your account.