- Forex Back Test: Master the Art of Predicting Future Trades

-

FAQ about Forex Back Test

- What is forex back testing?

- Why should I back test my forex strategies?

- How can I back test a forex strategy?

- What data should I use for back testing?

- How do I optimize my back testing results?

- How can I avoid overfitting in back testing?

- What are the limitations of back testing?

- What is forward testing?

- How can I improve my back testing skills?

- What resources are available for forex back testing?

Forex Back Test: Master the Art of Predicting Future Trades

Introduction

Hey readers,

Welcome to the ultimate guide to forex back testing, a powerful technique that can take your trading game to new heights. In this article, we’ll dive deep into the world of back testing, exploring its ins and outs and empowering you with the knowledge to make informed trading decisions.

What is Forex Back Testing?

Simply put, forex back testing is a simulation of historical trading data. It involves running a trading strategy on past price movements to assess its hypothetical performance. By analyzing the results, you can identify potential strengths and weaknesses, optimize your strategy, and ultimately increase your chances of profitability.

Benefits of Forex Back Testing

- Identify Winning Strategies: Back testing allows you to evaluate different trading strategies and select the ones that have performed well under various market conditions.

- Optimize Parameters: Adjust and refine the parameters of your trading strategy to find the optimal combination for maximum efficiency.

- Manage Risk: Identify potential risks and areas of improvement in your strategy, minimizing losses and maximizing profits.

- Build Confidence: Gain confidence in your trading strategy before risking real capital by testing it on historical data.

Steps Involved in Forex Back Testing

1. Gather Historical Data: Collect historical price data for the currency pair or asset you’re interested in testing.

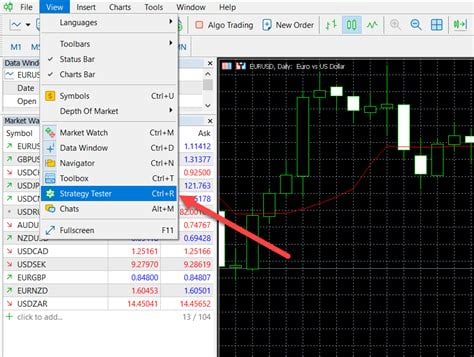

2. Choose a Trading Platform: Select a trading platform that supports back testing, such as MetaTrader 4 or 5.

3. Develop a Trading Strategy: Define your trading strategy, including entry and exit signals, risk management parameters, and position sizing.

4. Run the Backtest: Import the historical data into the trading platform and execute your trading strategy.

5. Analyze the Results: Evaluate the performance of your strategy by analyzing key metrics such as profitability, win rate, and risk-reward ratio.

Parameters for Forex Back Testing

– Time Period: Choose a relevant historical period to back test your strategy. Consider market conditions and events that may have affected the price action.

– Start Capital: Determine the initial capital you would have used if you were trading live.

– Trading Frequency: Specify how often you would have entered and exited trades based on your strategy.

– Leverage: Define the amount of leverage you would have used to increase your potential returns.

Common Mistakes in Forex Back Testing

– Overfitting: Avoid creating a strategy that performs exceptionally well on historical data but may not generalize to future market conditions.

– Insufficient Data: Using a limited sample size for back testing can provide misleading results. Ensure you have enough data to draw reliable conclusions.

– Lack of Real-Time Parameters: Forex back testing cannot fully replicate real-time trading conditions, so it’s crucial to consider factors such as slippage and latency.

Conclusion

Readers,

Forex back testing is an indispensable tool for aspiring and experienced traders alike. By understanding its concepts, benefits, and pitfalls, you can unlock the power to improve your trading strategies and enhance your profitability.

Explore our other articles to learn more about forex trading, technical analysis, and advanced trading techniques. Together, let’s conquer the markets.

FAQ about Forex Back Test

What is forex back testing?

Forex back testing is a way to simulate trading strategies on historical data to see how they would have performed.

Why should I back test my forex strategies?

Back testing helps you identify winning strategies, optimize your parameters, and manage your risk.

How can I back test a forex strategy?

There are manual and automated back testing tools available. Manual back testing is done by hand, while automated back testing uses software.

What data should I use for back testing?

High-quality historical data that is reliable and accurate is essential for back testing.

How do I optimize my back testing results?

Optimize your strategy parameters, such as entry and exit points, stop-loss levels, and position sizes, to improve performance.

How can I avoid overfitting in back testing?

Use multiple data sets and avoid optimizing too closely to the original data to prevent overfitting.

What are the limitations of back testing?

Back testing cannot guarantee future performance, as market conditions can change.

What is forward testing?

Forward testing is a live simulation of your strategy using real-time data to confirm its effectiveness.

How can I improve my back testing skills?

Practice regularly, experiment with different strategies, and analyze your results to refine your process.

What resources are available for forex back testing?

There are various online platforms, brokers, and software providers that offer back testing tools and resources.