- Introduction

- Benefits of Forex Back Test Software

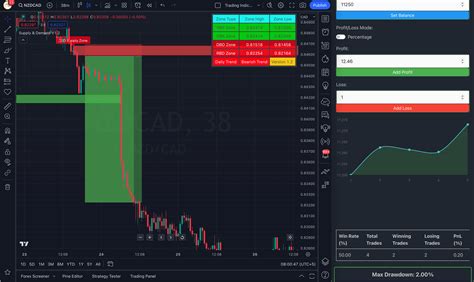

- Features of Forex Back Test Software

- Table: Forex Back Test Software Comparison

- How to Choose the Right Forex Back Test Software

- Conclusion

-

FAQ about Forex Back Test Software

- What is forex back test software?

- What are the benefits of using forex back test software?

- How does forex back test software work?

- What are the different types of forex back test software?

- What are the factors to consider when choosing forex back test software?

- How much does forex back test software cost?

- Is forex back test software reliable?

- What are the limitations of forex back test software?

- How can I learn more about forex back test software?

Introduction

Readers, welcome to the realm of forex back testing, where the ability to predict the future is within your grasp. Forex back test software empowers traders like you with the tools to navigate the ever-changing currency markets with confidence and precision.

As you delve into this comprehensive guide, you’ll discover why back testing software is an indispensable ally for forex traders. We’ll explore its benefits, features, and intricacies, leaving you fully equipped to harness its power.

Benefits of Forex Back Test Software

Enhanced Trading Strategies

Forex back test software allows you to test and refine your trading strategies rigorously. By simulating historical market data and executing your strategies, you can identify flaws, optimize entry and exit points, and ultimately fine-tune your approach to maximize profits.

Increased Confidence in Trading Decisions

Back testing eliminates the guesswork from trading. By providing a concrete evaluation of your strategies’ performance, it instills confidence in your decision-making process. No longer will you be reliant on hunches or market intuition alone.

Reduced Risk and Losses

Forex back test software acts as a safety net, allowing you to test high-risk strategies without putting real capital at stake. This invaluable feature empowers you to experiment with different techniques and identify potential pitfalls before implementing them in live trading.

Features of Forex Back Test Software

Historical Data Import

The foundation of any back testing software is its ability to import historical forex data. Ensure that the software you choose provides comprehensive data from multiple sources to capture market nuances and variations.

Strategy Optimization

Look for software that offers robust strategy optimization tools. These features enable you to refine your strategies by automatically adjusting parameters such as entry triggers, stop-loss levels, and profit targets.

Performance Metrics and Reports

Forex back test software should provide detailed performance metrics and reports. This information allows you to evaluate your strategies’ profitability, risk-reward ratios, and drawdown levels. Thorough analysis enables you to identify the strengths and weaknesses of your approach.

Table: Forex Back Test Software Comparison

| Software | Features | Benefits |

|---|---|---|

| MetaTrader 4 | Comprehensive historical data, advanced strategy optimization, detailed performance reports | Industry-standard platform with a vast user community and support |

| Sierra Chart | High-precision data, customizable indicators, real-time strategy testing | Sophisticated platform for experienced traders seeking advanced charting capabilities |

| NinjaTrader | User-friendly interface, flexible data import options, integrated market analysis tools | Ideal for beginners and intermediate traders with a focus on ease of use and visualization |

How to Choose the Right Forex Back Test Software

Choosing the right forex back test software is essential for your trading success. Consider the following factors:

Your Trading Style

Different software caters to various trading styles. If you prefer technical analysis, look for software with advanced charting features. For automated trading, opt for software with strong strategy optimization capabilities.

Data Quality and Coverage

Historical data quality is paramount for accurate back testing. Verify that the software provides high-quality data from reliable sources and covers extended periods to capture market trends and fluctuations.

User Interface and Support

Choose software with a user-friendly interface that aligns with your technical level. Consider the availability of support and documentation to assist you in getting started and troubleshooting issues.

Conclusion

Forex back test software is an essential tool for ambitious traders seeking to maximize their profits and minimize risks. By harnessing its power, you can optimize your strategies, boost your confidence, and navigate the forex markets with greater precision.

Readers, we invite you to explore our other articles on advanced forex trading techniques and market analysis. By expanding your knowledge base, you empower yourself to become a successful and profitable trader.

FAQ about Forex Back Test Software

What is forex back test software?

Forex back test software is a tool that allows traders to test their trading strategies on historical data. This software can help traders to identify profitable strategies and to avoid making costly mistakes.

What are the benefits of using forex back test software?

Forex back test software can provide traders with several benefits, including:

- The ability to test trading strategies on historical data

- The ability to identify profitable strategies

- The ability to avoid making costly mistakes

- The ability to improve trading skills

How does forex back test software work?

Forex back test software works by simulating the execution of a trading strategy on historical data. The software takes into account the entry and exit points of the strategy, as well as the risk and reward parameters. The software then calculates the profitability of the strategy.

What are the different types of forex back test software?

There are two main types of forex back test software:

- Manual back testing: This type of software requires the trader to manually enter the entry and exit points of the strategy.

- Automated back testing: This type of software automatically executes the strategy on historical data.

What are the factors to consider when choosing forex back test software?

When choosing forex back test software, traders should consider the following factors:

- The type of back testing software

- The features of the software

- The price of the software

- The reputation of the software provider

How much does forex back test software cost?

The cost of forex back test software can vary depending on the type of software and the features that it offers. Some software is free to use, while other software can cost hundreds or even thousands of dollars.

Is forex back test software reliable?

Forex back test software can be reliable, but it is important to use the software correctly. Traders should always test their strategies on a demo account before trading them live.

What are the limitations of forex back test software?

Forex back test software has several limitations, including:

- The software cannot account for all of the factors that can affect the profitability of a trading strategy.

- The software cannot guarantee that a strategy will be profitable in the future.

- The software can be complex and difficult to use.

How can I learn more about forex back test software?

There are several resources available to help traders learn more about forex back test software. These resources include:

- Online articles and tutorials

- Books

- Webinars

- Courses