- Forex Best Time to Trade: A Comprehensive Guide for Maximizing Profits

- Introduction

- Section 1: Factors Influencing Forex Trading Time

- Section 2: Best Times to Trade Forex

- Section 3: Strategies for Choosing the Best Time to Trade

- Table: Best Times to Trade Forex Based on Currency Pair

- Conclusion

-

FAQ about Forex Best Time to Trade

- 1. What is the best time to trade forex?

- 2. Is there a best day of the week to trade forex?

- 3. What time zone is best for forex trading?

- 4. How does market volatility affect the best time to trade?

- 5. Can I trade forex 24/7?

- 6. Should I trade during major news releases?

- 7. How can I determine the best trading hours for my strategy?

- 8. Is it better to trade during the Asian, European, or American session?

- 9. Can I trade forex during the night?

- 10. Is there a specific time when the forex market is closed?

Forex Best Time to Trade: A Comprehensive Guide for Maximizing Profits

Introduction

Readers, are you curious about the optimal time to trade forex and unlock greater profits? In this extensive guide, we’ll delve into the intricacies of the forex market, exploring the best hours and days to buy and sell currencies for maximum returns. Whether you’re a seasoned trader or a novice looking to venture into the financial realm, this article will provide invaluable insights.

Section 1: Factors Influencing Forex Trading Time

Market Liquidity

Liquidity refers to the ease with which a currency pair can be bought or sold. The higher the liquidity, the narrower the bid-ask spread, resulting in lower trading costs. Major currency pairs, such as EUR/USD and GBP/USD, are typically the most liquid and offer the best conditions for trading.

Market Volatility

Volatility measures the rate of price fluctuations in a currency pair. Higher volatility can lead to greater profits but also increased risk. Understanding the cyclical patterns of volatility can help traders determine the optimal time to enter and exit the market.

Economic News and Events

Economic news and events, such as central bank meetings, interest rate announcements, and GDP reports, can significantly impact currency prices. By staying abreast of upcoming events and analyzing their potential outcomes, traders can anticipate market movements and make informed decisions.

Section 2: Best Times to Trade Forex

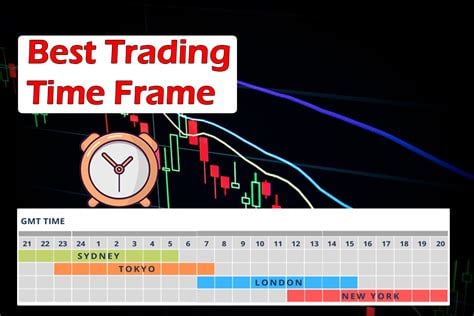

Trading Hours

The forex market operates 24/5, with different trading sessions corresponding to different geographical regions. The most active trading hours are during the overlap of two or more major sessions, typically:

- London Session (08:00 – 17:00 GMT): Significant liquidity and volatility due to the overlap with the European and Asian sessions.

- New York Session (13:00 – 22:00 GMT): The most active session, with high liquidity and volatility driven by major economic news and events.

- Tokyo Session (00:00 – 09:00 GMT): Less liquidity and volatility compared to the London and New York sessions, but still offers opportunities for trading during the Asian business day.

Trading Days

In general, the forex market tends to be more active and volatile during the weekdays compared to weekends. This is because most economic news and events are released during the week, influencing currency prices and driving market movements.

Section 3: Strategies for Choosing the Best Time to Trade

Risk Tolerance

Traders with a high risk tolerance may prefer to trade during volatile market conditions, as it offers greater potential for profits. Conversely, traders with a lower risk tolerance may prefer to trade during less volatile periods, when price movements are more predictable.

Trading Style

Scalpers, who enter and exit trades quickly, may prefer to trade during high-liquidity periods, such as the overlap of major trading sessions. Swing traders, who hold trades for longer periods, may prefer to trade during less volatile periods, when trends are more likely to form.

Currency Pair Selection

Different currency pairs have varying degrees of liquidity and volatility. Traders should choose currency pairs that align with their risk tolerance, trading style, and understanding of the underlying market factors.

Table: Best Times to Trade Forex Based on Currency Pair

| Currency Pair | Best Time to Trade |

|---|---|

| EUR/USD | London and New York Sessions |

| GBP/USD | London and New York Sessions |

| USD/JPY | Tokyo and New York Sessions |

| USD/CHF | London and New York Sessions |

| AUD/USD | Tokyo and New York Sessions |

| NZD/USD | Tokyo and New York Sessions |

Conclusion

Choosing the optimal time to trade forex is crucial for maximizing profits and minimizing risk. By understanding the factors influencing the market, identifying the best trading hours and days, and employing appropriate strategies, traders can increase their chances of success in the ever-evolving forex arena. Readers, we encourage you to explore our other articles for further insights into the intricacies of forex trading and enhance your financial acumen.

FAQ about Forex Best Time to Trade

1. What is the best time to trade forex?

- The best time to trade forex depends on factors such as your trading strategy, market volatility, and your availability. In general, high-volume trading hours, such as when major financial markets overlap (London, New York, and Tokyo), offer higher liquidity and volatility.

2. Is there a best day of the week to trade forex?

- No specific day of the week is consistently better for forex trading. Market activity can vary depending on economic events, news announcements, and other factors.

3. What time zone is best for forex trading?

- Major forex trading centers operate in different time zones, so the best time zone for you will depend on your location and trading hours. Popular time zones for forex trading include GMT+0 (London), GMT-5 (New York), and GMT+9 (Tokyo).

4. How does market volatility affect the best time to trade?

- High volatility, often occurring during news announcements or economic events, can provide more trading opportunities. However, it also increases risk, so traders may prefer to trade during calmer periods.

5. Can I trade forex 24/7?

- Yes, the forex market is open 24 hours a day, five days a week, excluding weekends. However, liquidity and volatility can vary significantly depending on the time of day and week.

6. Should I trade during major news releases?

- Major news releases can create significant market volatility, providing both opportunities and risks. Traders should carefully assess the potential impact of news events before making trading decisions.

7. How can I determine the best trading hours for my strategy?

- Experiment with different trading hours to determine which ones suit your strategy and risk tolerance. Consider your market analysis, entry and exit points, and your available time.

8. Is it better to trade during the Asian, European, or American session?

- Different trading sessions have varying levels of activity and volatility. The Asian session is typically quieter, while the European and American sessions tend to be more active.

9. Can I trade forex during the night?

- Yes, you can trade forex at night, but liquidity and volatility may be lower. Overnight trading can also carry higher risk due to the potential for overnight gaps and news events.

10. Is there a specific time when the forex market is closed?

- The forex market closes on weekends, typically from Friday evening to Sunday evening (depending on the broker and time zone).