- Introduction

- Selecting a US-Friendly Forex Broker

- Forex Brokers Accepting US Clients

- Account Types and Features

- Table: Forex Brokers Accepting US Clients

- Conclusion

-

FAQ about Forex Brokers Accept US Clients

- What does "US clients" mean?

- Why do some brokers not accept US clients?

- What are the key regulations for US forex brokers?

- How can I find forex brokers that accept US clients?

- Are all forex brokers accepting US clients regulated?

- What are the risks of dealing with an unregulated broker?

- What should I consider when choosing a US-accepting broker?

- How do I verify a broker’s regulatory status?

- What trading instruments are typically available with US-accepting brokers?

- Are there any limitations or restrictions for US forex traders?

Introduction

Howdy readers! Welcome to your ultimate guide to forex brokers that accept US clients. As you embark on your forex trading journey, it’s crucial to find a broker that meets your specific needs and complies with US regulatory frameworks. Let’s dive right into this comprehensive exploration.

What is Forex Trading?

Forex trading involves buying and selling currencies from around the world. It’s the most traded market globally, with daily trading volumes exceeding trillions of dollars. By understanding currency movements and market dynamics, traders can potentially profit from these fluctuations.

Selecting a US-Friendly Forex Broker

Licensing and Regulation

When choosing a forex broker that accepts US clients, it’s essential to ensure they are licensed and regulated by reputable authorities, such as the National Futures Association (NFA) or the Commodity Futures Trading Commission (CFTC). This guarantees compliance with strict regulations and protects traders’ funds.

Trading Platforms and Tools

A user-friendly trading platform is a must-have. Look for brokers that provide advanced charting tools, technical indicators, and risk management features. Consider the platform’s compatibility with your preferred devices and trading style.

Customer Support

Reliable customer support is vital. Ensure the broker offers 24/7 support via various channels, such as live chat, email, and phone. Professional and responsive support can provide valuable assistance, especially during market volatility.

Forex Brokers Accepting US Clients

Interactive Brokers

- Global brokerage offering a wide range of trading instruments, including forex.

- Regulated by the NFA and other top-tier authorities.

- User-friendly Trader Workstation platform with advanced trading capabilities.

TD Ameritrade

- One of the largest online brokers, catering to US-based traders.

- Offers a user-friendly platform with extensive research tools and trading education.

- Provides excellent customer support and account management services.

Oanda

- A leading global broker specializing in forex and CFDs.

- Regulated by multiple jurisdictions, including the CFTC.

- Delivers superior charting and analysis tools, tailored to forex traders.

Account Types and Features

Demo Accounts

Most forex brokers offer demo accounts, which allow you to practice trading without risking real funds. This is a great way to test different platforms and strategies before committing to a live account.

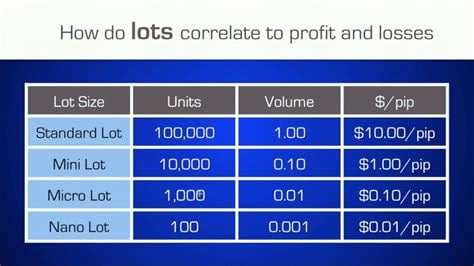

Leverage and Margin

Leverage amplifies your trading potential but also increases risk. US-friendly brokers typically offer leverage limits in line with CFTC regulations. Understanding margin requirements and risk management is essential.

Spreads and Commissions

Forex brokers charge spreads (the difference between the buying and selling prices) or commissions. Compare these costs across brokers to find the most competitive rates for your trading style.

Table: Forex Brokers Accepting US Clients

| Broker | Regulation | Platform | Leverage | Spreads |

|---|---|---|---|---|

| Interactive Brokers | NFA, SEC | Trader Workstation | Up to 50:1 | Variable |

| TD Ameritrade | FINRA, SEC | thinkorswim | Up to 200:1 | Commission-based |

| Oanda | CFTC, FCA | Oanda Platform | Up to 50:1 | Fixed and variable |

| Forex.com | CFTC, FCA | MetaTrader 4, NinjaTrader | Up to 50:1 | Variable |

| Gain Capital | CFTC, FCA | MetaTrader 4, TradingView | Up to 100:1 | Commission-based |

Conclusion

Finding a forex broker that accepts US clients requires careful consideration of licensing, trading platforms, customer support, and account features. By utilizing the information provided in this guide, you can make an informed decision and embark on your forex trading journey with confidence. Be sure to check out our other articles for more insights and trading strategies.

FAQ about Forex Brokers Accept US Clients

What does "US clients" mean?

- US clients generally refer to individuals residing in the United States.

Why do some brokers not accept US clients?

- Due to strict regulations set by the Commodity Futures Trading Commission (CFTC).

What are the key regulations for US forex brokers?

- Leverage limits, reporting requirements, and segregated client accounts.

How can I find forex brokers that accept US clients?

- Check online reviews, visit broker websites, or consult regulatory agencies.

Are all forex brokers accepting US clients regulated?

- No, not all brokers accepting US clients are regulated. Verify their status with the CFTC or NFA.

What are the risks of dealing with an unregulated broker?

- Higher risk of fraud, limited protection, and potential legal issues.

What should I consider when choosing a US-accepting broker?

- Regulation, trading conditions (spreads, commissions), customer support, and reputation.

How do I verify a broker’s regulatory status?

- Check their website for licenses or contact regulatory agencies like the CFTC.

What trading instruments are typically available with US-accepting brokers?

- Major currency pairs, precious metals, and some stock indices.

Are there any limitations or restrictions for US forex traders?

- Yes, such as leverage limits, withdrawal restrictions, and reporting requirements.