-

Forex Brokers Demo Account: A Comprehensive Guide

- Introduction

- Section 1: Understanding Forex Demo Accounts

- What is a Forex Demo Account?

- Benefits of Using a Demo Account

- Section 2: Finding the Right Forex Broker for a Demo Account

- Choosing a Reliable Broker

- Perks to Look Out For

- Section 3: Using a Forex Demo Account Effectively

- Practice and Experiment

- Monitor and Analyze

- Risk Management

- Section 4: Demo Account vs. Real Account

- Key Differences

- When to Transition to a Real Account

- Section 5: Table of Forex Brokers Offering Demo Accounts

- Conclusion

-

FAQ about Forex Brokers Demo Account

- What is a forex brokers demo account?

- Why should I use a demo account?

- How do I open a demo account?

- What instruments can I trade on a demo account?

- How much virtual money do I get on a demo account?

- What is the difference between a demo account and a live account?

- Can I withdraw profits made on a demo account?

- How long does a demo account last?

- Are demo accounts suitable for beginners?

- Can I switch between demo and live accounts?

Forex Brokers Demo Account: A Comprehensive Guide

Introduction

Greetings, readers! Are you ready to embark on an educational journey into the realm of forex brokers and demo accounts? In this comprehensive guide, we will delve into every aspect of this topic, empowering you with the knowledge to make informed decisions.

Section 1: Understanding Forex Demo Accounts

What is a Forex Demo Account?

A forex demo account is a virtual trading environment that mimics the real forex market without any financial risk. It allows traders to practice their strategies, learn about different currency pairs, and hone their trading skills without risking their hard-earned funds.

Benefits of Using a Demo Account

- Risk-free trading: Traders can test their trading strategies without the fear of losing real money.

- Educational tool: Demo accounts provide a safe space to practice and improve trading skills.

- Market analysis: Traders can use demo accounts to analyze market behavior and gather data before making real-world trades.

Section 2: Finding the Right Forex Broker for a Demo Account

Choosing a Reliable Broker

Selecting a reputable and regulated forex broker is crucial for ensuring a secure and positive trading experience. Consider factors such as:

- Regulation: Look for brokers licensed by respected regulatory bodies.

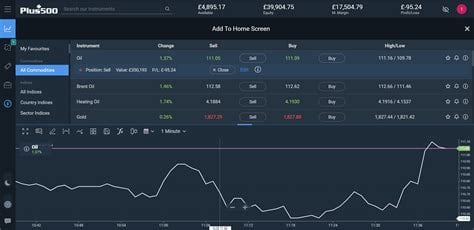

- Trading platform: Choose a platform that is user-friendly, responsive, and offers the features you need.

- Customer support: Responsive and knowledgeable customer support is essential for troubleshooting and resolving queries.

Perks to Look Out For

- Free demo accounts: Some brokers offer demo accounts with no time limits or fund restrictions.

- Advanced features: Demo accounts may offer advanced features such as technical analysis tools and one-click trading.

- Bonus incentives: Brokers may offer bonus promotions to attract new traders.

Section 3: Using a Forex Demo Account Effectively

Practice and Experiment

The primary purpose of a demo account is to practice and experiment with different trading strategies. Try out different currency pairs, trade at different times, and experiment with various order types.

Monitor and Analyze

Keep track of your results and analyze your performance in the demo account. This will help you identify areas for improvement and refine your trading approach.

Risk Management

Even though there is no real financial risk in a demo account, it’s important to practice risk management principles. Set stop-loss orders and manage your position size wisely.

Section 4: Demo Account vs. Real Account

Key Differences

- Financial risk: Demo accounts involve no financial risk, while real accounts carry the potential for both profits and losses.

- Emotional impact: Trading with real money can evoke different emotions and psychological challenges compared to using a demo account.

- Live market conditions: While demo accounts simulate real market conditions, they may not fully replicate the volatility and liquidity of the live market.

When to Transition to a Real Account

Traders should transition to a real account when they:

- Have a solid trading strategy and risk management plan.

- Are confident in their trading abilities and have consistently performed well in the demo account.

- Are comfortable with the potential financial risks involved in real trading.

Section 5: Table of Forex Brokers Offering Demo Accounts

| Broker | Demo Account | Time Limit | Fund Limit | Advanced Features |

|---|---|---|---|---|

| eToro | Yes | Unlimited | $100,000 | Social trading, copy trading |

| XM | Yes | 30 days | $100,000 | MT4, MT5 platforms, trading tools |

| IC Markets | Yes | 30 days | $200,000 | Raw spreads, institutional-grade platforms |

| AvaTrade | Yes | Unlimited | $100,000 | Autochartist, Trading Central |

| Forex.com | Yes | 30 days | $50,000 | MetaTrader 4, proprietary trading platform |

Conclusion

"Forex brokers demo account" is an invaluable tool for aspiring forex traders. By leveraging the benefits of demo accounts, you can practice trading, refine your strategies, and gain confidence before venturing into the real market.

We invite you to explore our other articles on forex trading, market analysis, and broker reviews to further enhance your knowledge. Remember, the path to successful trading is paved with continuous learning and practice.

FAQ about Forex Brokers Demo Account

What is a forex brokers demo account?

A demo account is a simulated trading platform provided by forex brokers that allow traders to practice trading without risking real money.

Why should I use a demo account?

Using a demo account offers several benefits, including:

- Practice trading strategies without financial risk.

- Test and evaluate different trading platforms.

- Gain experience in the forex market before trading with real funds.

How do I open a demo account?

To open a demo account, you typically need to:

- Visit the website of a forex broker and navigate to the account opening page.

- Provide personal and contact information.

- Choose a trading platform and select a demo account option.

What instruments can I trade on a demo account?

Demo accounts usually offer a wide range of instruments to trade, such as валютные пары, commodities, indices, and stocks.

How much virtual money do I get on a demo account?

The amount of virtual money provided varies among brokers, but it is typically a substantial amount to allow for ample practice.

What is the difference between a demo account and a live account?

The main difference is that demo accounts use virtual money while live accounts involve real funds. Demo accounts are for practice and learning, while live accounts are for actual trading.

Can I withdraw profits made on a demo account?

No, profits made on a demo account are not withdrawable as they are not real funds.

How long does a demo account last?

The duration of a demo account varies among brokers, but many offer unlimited access or a long period (e.g., 30 days or more).

Are demo accounts suitable for beginners?

Yes, demo accounts are highly recommended for beginners as they provide a safe environment to learn and develop trading skills.

Can I switch between demo and live accounts?

Yes, most brokers allow you to switch between demo and live accounts at any time, but it’s important to check with the specific broker’s policies.