- Forex Buy or Sell: A Comprehensive Guide for Making Informed Decisions

- Section 1: Understanding Forex Trading

- Section 2: Factors Influencing Currency Value

- Section 3: Strategies for Determining Buy or Sell Decisions

- Table: Considerations for Buying or Selling Forex

- Conclusion

-

FAQ about Forex Buy or Sell

- What is forex buy or sell?

- How do I know when to buy or sell forex?

- What are the risks of buying or selling forex?

- Do I need to be an expert to buy or sell forex?

- How do I open a forex trading account?

- What is the minimum deposit required to open a forex trading account?

- What are the different types of forex trading orders?

- What is a pip in forex trading?

- What is leverage in forex trading?

- How do I calculate my profit or loss on a forex trade?

Forex Buy or Sell: A Comprehensive Guide for Making Informed Decisions

Introduction

Hello, readers! Welcome to our in-depth exploration of "forex buy or sell." In this article, we’ll guide you through the intricacies of this fundamental decision in foreign exchange trading, providing you with a clear understanding of the factors that influence whether to buy or sell a currency pair.

We’ll cover everything you need to know, from the basics of forex trading to advanced strategies for determining the most profitable trades. Whether you’re a seasoned trader or just starting out, this comprehensive guide has something for everyone.

Section 1: Understanding Forex Trading

What is Forex?

Forex, short for "foreign exchange," is the global market where currencies are traded. It’s the world’s largest and most liquid financial market, with a daily transaction volume exceeding $5 trillion. In forex trading, you exchange one currency for another, hoping to profit from fluctuations in exchange rates.

Types of Forex Orders

When trading forex, you can place two main types of orders: buy and sell orders.

-

Buy Order: A buy order indicates your intention to buy a particular currency pair, expecting its value to increase against the other currency.

-

Sell Order: A sell order indicates your intention to sell a particular currency pair, expecting its value to decrease against the other currency.

Section 2: Factors Influencing Currency Value

Economic Indicators

Economic indicators provide valuable insights into the health of a country’s economy and can significantly impact currency values. Key indicators to monitor include gross domestic product (GDP), inflation, interest rates, and unemployment.

Political Stability

Political events can have a significant impact on currency value. For example, political unrest or government instability in a country can cause investors to lose confidence in its currency, leading to a decline in its value.

Market Sentiment

Market sentiment refers to the overall mood and attitude of traders towards a particular currency pair. It’s influenced by various factors, including news events, technical analysis, and economic indicators. When market sentiment is positive, it tends to drive up currency value, and when it’s negative, it tends to drive it down.

Section 3: Strategies for Determining Buy or Sell Decisions

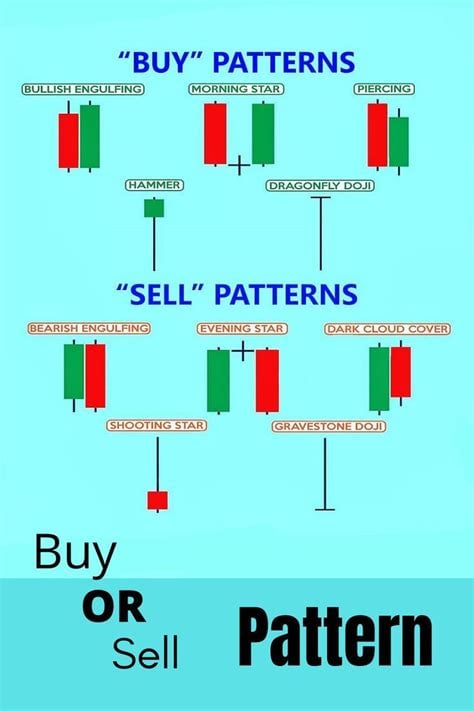

Technical Analysis

Technical analysis involves using historical price data and technical indicators to identify trends, patterns, and potential trading opportunities. By analyzing price charts, traders can identify support and resistance levels, moving averages, and other technical indicators that can help them make informed decisions about when to buy or sell.

Fundamental Analysis

Fundamental analysis involves evaluating economic data, political events, and other factors to understand the underlying value of a currency. By researching a country’s economic fundamentals, traders can assess the long-term outlook for its currency and make more informed decisions about whether to buy or sell.

Risk Management

Risk management is essential for successful forex trading. It involves using various strategies, such as stop-loss orders and position sizing, to minimize potential losses and protect your capital. Effective risk management allows you to trade with confidence, knowing that you’re controlling your risk exposure.

Table: Considerations for Buying or Selling Forex

| Buying Currency | Selling Currency | Factors to Consider |

|---|---|---|

| Strong economy and political stability | Weak economy or political instability | Interest rates, inflation |

| Positive market sentiment | Negative market sentiment | Technical analysis, fundamentals |

| Expecting currency appreciation | Expecting currency depreciation | Economic indicators, news events |

| Bullish trend | Bearish trend | Moving averages, support/resistance levels |

| High demand | Low demand | Supply and demand |

Conclusion

Making informed "forex buy or sell" decisions requires a comprehensive understanding of the factors that influence currency value and the various strategies for determining the most profitable trades. By considering economic indicators, political stability, market sentiment, technical analysis, fundamental analysis, and risk management, you can increase your chances of success in the forex market.

If you’d like to delve deeper into the world of forex trading, we encourage you to check out our other articles on technical analysis, fundamental analysis, and risk management strategies.

FAQ about Forex Buy or Sell

What is forex buy or sell?

- Forex buy or sell refers to the action of purchasing or selling a currency pair in the foreign exchange market.

How do I know when to buy or sell forex?

- There are many factors to consider when deciding when to buy or sell forex, including technical analysis, fundamental analysis, and market sentiment.

What are the risks of buying or selling forex?

- Forex trading involves risk, including the potential for losses. It’s important to understand the risks involved before trading forex.

Do I need to be an expert to buy or sell forex?

- While it’s beneficial to have some knowledge of the forex market, you don’t need to be an expert to trade forex.

How do I open a forex trading account?

- You can open a forex trading account with a forex broker.

What is the minimum deposit required to open a forex trading account?

- The minimum deposit required varies depending on the forex broker.

What are the different types of forex trading orders?

- There are various types of forex trading orders, including market orders, limit orders, and stop-loss orders.

What is a pip in forex trading?

- A pip is the smallest price change that can occur in a currency pair.

What is leverage in forex trading?

- Leverage allows traders to trade with more capital than their account balance.

How do I calculate my profit or loss on a forex trade?

- Your profit or loss on a forex trade is calculated based on the difference between the opening and closing prices of the currency pair.