- Forex Exposures: A Comprehensive Guide for Navigating Currency Risk

-

FAQ about Forex Exposures

- What is forex exposure?

- Why is it important to manage forex exposure?

- What are the types of forex exposure?

- How can businesses hedge against forex exposure?

- What is a forward contract?

- What are options?

- What is a currency swap?

- What are money market instruments?

- What are the risks of unmanaged forex exposure?

- How can individuals manage forex exposure?

Forex Exposures: A Comprehensive Guide for Navigating Currency Risk

Introduction

Hey readers,

Welcome to our in-depth exploration of Forex exposures. In this comprehensive guide, we’ll dive deep into the complexities of currency risk and provide you with a comprehensive understanding of how to navigate these exposures effectively. Whether you’re a seasoned Forex trader or just starting your journey, this article will empower you with the knowledge you need to succeed in the dynamic Forex markets.

Types of Forex Exposures

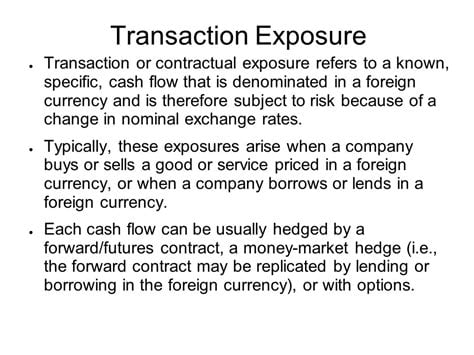

1. Transaction Exposure

Transaction exposure arises when you have a financial obligation denominated in a foreign currency. It occurs when you buy or sell goods or services from another country, or when you borrow or lend money in a foreign currency. For example, if you’re a U.S. company importing goods from Japan, the value of your purchase will be affected by fluctuations in the USD/JPY exchange rate.

2. Translation Exposure

Translation exposure occurs when a company has subsidiaries or operations in multiple countries, and each entity reports its financial statements in a different currency. The parent company’s consolidated financial statements must be translated into the parent company’s home currency, which can introduce currency exchange gains or losses.

3. Economic Exposure

Economic exposure measures the impact of currency fluctuations on a company’s overall financial performance. It considers factors such as changes in demand, costs, and profitability due to currency exchange rate movements. For instance, if a U.S. company has a factory in Europe, the exchange rate between the euro and the U.S. dollar will affect the cost of producing goods and the profitability of the factory.

Managing Forex Exposures

1. Currency Forwards and Futures

Currency forwards and futures are derivative contracts that allow you to fix the exchange rate for a future transaction. By entering into these contracts, you can lock in a favorable rate and mitigate transaction exposure. For example, if you have a large purchase to make in euros in the future, you can buy a euro forward contract to secure today’s exchange rate.

2. Options

Currency options give you the right, but not the obligation, to buy or sell a currency at a fixed exchange rate on a specific date. You can use options to hedge against potential currency losses or to speculate on future exchange rate movements. For instance, if you’re concerned about the euro strengthening against the dollar, you can buy a euro call option to give yourself the option to buy euros at a favorable rate in the future.

3. Natural Hedging

Natural hedging involves using the cash flows of your business to offset currency exposures. For example, if you’re exporting goods to a foreign country, you can invoice your customers in the local currency and use the proceeds from those sales to cover local expenses. This strategy can help reduce transaction exposure and translation exposure.

Measuring Forex Exposures

1. Value at Risk (VaR)

VaR is a statistical measure that estimates the maximum loss that can occur in a given investment or trading position with a specified probability over a specific time period. VaR can be used to quantify transaction exposure and economic exposure.

2. Sensitivity Analysis

Sensitivity analysis involves examining the impact of changes in the exchange rate on a company’s financial performance. By analyzing the sensitivity of key financial ratios to exchange rate fluctuations, companies can identify and manage economic exposure.

Table: Hedging Strategies for Forex Exposures

| Exposure Type | Hedging Strategy | Description |

|---|---|---|

| Transaction Exposure | Currency Forwards/Futures | Lock in exchange rate for future transactions |

| Translation Exposure | Natural Hedging | Use cash flows in local currency to offset exposures |

| Economic Exposure | Options | Purchase rights to buy or sell currencies at specified rates |

Conclusion

Understanding and managing Forex exposures are essential for businesses operating in the global economy. By leveraging the strategies discussed in this article, you can mitigate currency risk and protect your financial performance from adverse exchange rate movements. Remember to stay informed about currency market developments and regularly review your Forex exposures to ensure that you’re proactively managing these risks.

For more insights into Forex trading and risk management, check out our other articles:

FAQ about Forex Exposures

What is forex exposure?

Forex exposure refers to the financial risk that an individual or business faces due to fluctuations in foreign exchange rates. It occurs when the value of assets or liabilities denominated in foreign currencies changes relative to the home currency.

Why is it important to manage forex exposure?

Managing forex exposure is crucial to mitigate the potential losses that can result from currency fluctuations. Unmanaged exposure can significantly impact a company’s profitability, cash flow, and overall financial stability.

What are the types of forex exposure?

There are two main types of forex exposure:

- Transaction exposure: Arises from outstanding or future financial transactions denominated in foreign currencies, such as import/export contracts or loans.

- Translation exposure: Related to the consolidation of foreign subsidiary financial statements into the parent company’s accounts, resulting from the conversion of foreign currency balances into the home currency.

How can businesses hedge against forex exposure?

Businesses can use various hedging techniques to manage forex exposure, including forward contracts, options, currency swaps, and money market instruments.

What is a forward contract?

A forward contract is an agreement to buy or sell a specified amount of foreign currency at a predetermined exchange rate on a future date.

What are options?

Options give the holder the right, but not the obligation, to buy or sell a specific amount of foreign currency at a predetermined exchange rate on a future date.

What is a currency swap?

A currency swap is a derivative contract that involves exchanging principal and interest payments denominated in different currencies over a specified period.

What are money market instruments?

Money market instruments are short-term debt securities, such as commercial paper and treasury bills, that can be used to hedge against forex exposure by adjusting the currency composition of an investment portfolio.

What are the risks of unmanaged forex exposure?

Unmanaged forex exposure can lead to significant financial losses, reduced profitability, and increased operational costs for businesses.

How can individuals manage forex exposure?

Individuals can manage forex exposure through diversification of foreign currency investments, currency hedging strategies, and consultation with financial professionals.