- Inside the Heart of Forex Trading: A Comprehensive Guide to Forex Floors

- Introduction

- Understanding Forex Floors

- The Strategies of Forex Traders

- Life on the Forex Floor

- Comprehensive Table of Forex Floor Statistics

- Conclusion

-

FAQ about Forex Floor

- What is a forex floor?

- Where are forex floors located?

- Who trades on forex floors?

- What is open outcry?

- What is electronic trading?

- What are the advantages of trading on a forex floor?

- What are the disadvantages of trading on a forex floor?

- Are forex floors still relevant in today’s electronic trading era?

- Is it possible to trade forex without visiting a forex floor?

- What is the difference between a forex floor and an over-the-counter (OTC) market?

Inside the Heart of Forex Trading: A Comprehensive Guide to Forex Floors

Introduction

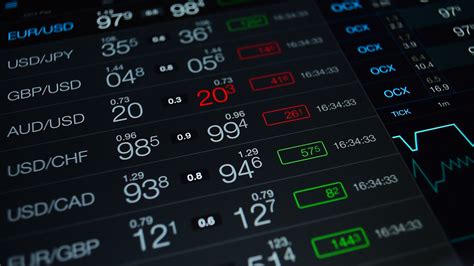

Forex floors, the bustling hubs of the foreign exchange (forex) market, are the epicenter of global currency trading. For traders, the clamor and energy of the forex floor evoke the essence of high-stakes financial battles and the allure of substantial profits. Readers, in this article, we’ll embark on an in-depth exploration of forex floors, unraveling their intricate workings, strategies, and the art of trading currencies in a dynamic environment.

Understanding Forex Floors

Forex floors are physical locations where traders gather to buy and sell currencies. Unlike other financial markets like stock exchanges, forex trading is decentralized, meaning there is no singular venue where all transactions occur. Instead, a global network of forex floors connects traders across the world, facilitating the smooth exchange of currencies.

Types of Forex Floors

Forex floors can be broadly classified into two types:

-

Bank-owned floors: These are operated by major banks and provide a centralized environment for their proprietary traders and institutional clients to execute trades.

-

Independent floors: These are owned and operated by independent companies and are open to a wider range of participants, including brokers, traders, and other financial institutions.

The Strategies of Forex Traders

In the highly competitive forex floors, traders employ a diverse range of strategies to navigate the volatile markets. Some common strategies include:

Scalping

Scalping involves making quick, frequent trades by taking advantage of small price movements. Scalpers aim to profit from the bid-ask spread, the difference between the buying and selling prices of a currency.

News Trading

News trading involves using economic data and political events to predict currency movements. Traders monitor news releases and market sentiment to identify trading opportunities.

Counter-Trend Trading

Counter-trend traders attempt to identify and trade against the prevailing market trend. They believe that markets are cyclical and that pullbacks or reversals present opportunities for profit.

Life on the Forex Floor

The environment on the forex floor is intense and rapidly evolving. Traders work under immense pressure, constantly monitoring multiple screens, analyzing data, and making split-second decisions. Camaraderie and competition coexist, with traders forming alliances and seeking to outmaneuver one another.

Culture of the Forex Floor

Forex floors cultivate a unique culture that fosters both teamwork and individual achievement. Traders share information, support each other, while maintaining a strong competitive drive. The fast-paced nature of the market demands adaptability, resilience, and a keen eye for opportunities.

Common Misconceptions

Despite the allure of forex trading, there are some common misconceptions that should be addressed:

-

Forex is a get-rich-quick scheme: While substantial profits are possible, forex trading is a complex and risky endeavor that requires skill, knowledge, and discipline.

-

Only professionals can succeed: Forex trading is accessible to individuals from all backgrounds. With proper education and training, anyone can navigate the forex market.

Comprehensive Table of Forex Floor Statistics

| Metric | Value |

|---|---|

| Average daily forex trading volume | $6.6 trillion |

| Number of forex floors worldwide | Over 100 |

| Largest forex floors | New York, London, Tokyo |

| Prevalence of bank-owned floors | Over 50% |

| Common trading strategies | Scalping, News Trading, Counter-Trend Trading |

Conclusion

Forex floors are the heart of the foreign exchange market, where traders from around the world gather to execute trades and shape the global currency landscape. The dynamics of the forex floor are complex and ever-changing, requiring a deep understanding of markets, strategies, and risk management. Readers, for further insights, we invite you to explore our other articles on forex trading and financial markets.

FAQ about Forex Floor

What is a forex floor?

- A forex floor is a physical exchange where foreign exchange (forex) traders meet to trade currencies in person, using open outcry and electronic trading systems.

Where are forex floors located?

- The world’s largest forex floors are located in London, New York, Tokyo, Zurich, and Singapore.

Who trades on forex floors?

- Traders from banks, brokerage firms, hedge funds, and other financial institutions.

What is open outcry?

- A traditional method of trading where traders use verbal and hand signals to make offers and accept bids.

What is electronic trading?

- A system that uses computers and networks to facilitate trading.

What are the advantages of trading on a forex floor?

- Access to a large number of traders and liquidity, and the ability to react quickly to market changes.

What are the disadvantages of trading on a forex floor?

- Can be noisy and chaotic, and subject to human error.

Are forex floors still relevant in today’s electronic trading era?

- Yes, they remain important for certain types of trades, such as large or complex orders, or when traders want to build relationships with other traders.

Is it possible to trade forex without visiting a forex floor?

- Yes, through online platforms and brokers that offer electronic trading.

What is the difference between a forex floor and an over-the-counter (OTC) market?

- Forex floors are physical exchanges, while OTC markets are decentralized and trades are executed directly between participants.